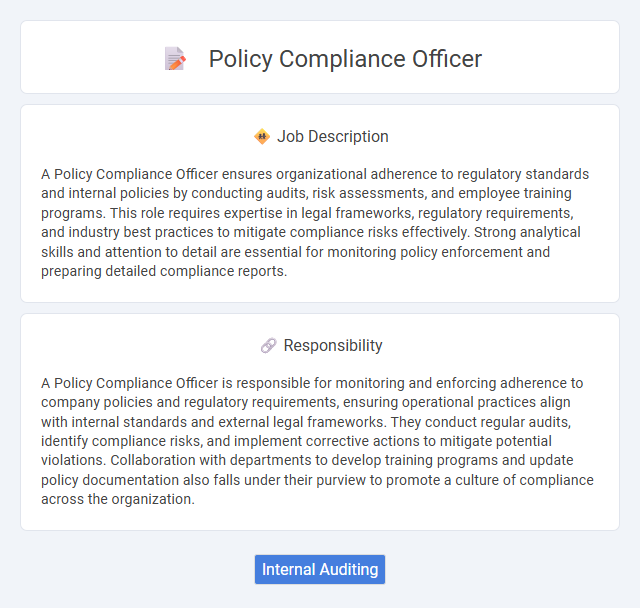

A Policy Compliance Officer ensures organizational adherence to regulatory standards and internal policies by conducting audits, risk assessments, and employee training programs. This role requires expertise in legal frameworks, regulatory requirements, and industry best practices to mitigate compliance risks effectively. Strong analytical skills and attention to detail are essential for monitoring policy enforcement and preparing detailed compliance reports.

Individuals with strong attention to detail and a keen sense of ethics are likely to be well-suited for a Policy Compliance Officer role. Those who thrive in structured environments and can navigate complex regulations may have a higher probability of success in ensuring organizational adherence to policies. Conversely, people who struggle with ambiguity or lack analytical skills might find this position challenging.

Qualification

A Policy Compliance Officer requires a strong background in regulatory frameworks, risk assessment, and corporate governance, often supported by a bachelor's degree in law, finance, or business administration. Certifications such as Certified Regulatory Compliance Manager (CRCM) or Certified Compliance and Ethics Professional (CCEP) enhance credibility and expertise in compliance standards. Proficiency in interpreting legal documents, conducting audits, and implementing policy controls is essential for effectively monitoring organizational adherence to industry regulations.

Responsibility

A Policy Compliance Officer is responsible for monitoring and enforcing adherence to company policies and regulatory requirements, ensuring operational practices align with internal standards and external legal frameworks. They conduct regular audits, identify compliance risks, and implement corrective actions to mitigate potential violations. Collaboration with departments to develop training programs and update policy documentation also falls under their purview to promote a culture of compliance across the organization.

Benefit

Policy Compliance Officer roles likely offer benefits including enhanced job security due to regulatory demand and opportunities for professional growth in risk management. These positions probably provide a chance to influence organizational governance positively, fostering ethical standards and reducing legal risks. Financial incentives and comprehensive benefits packages may also accompany the responsibility of ensuring corporate adherence to laws and policies.

Challenge

The role of a Policy Compliance Officer likely involves navigating complex regulatory environments, which can pose significant challenges due to constantly evolving laws and standards. Ensuring organizational adherence may require meticulous attention to detail and the ability to interpret ambiguous guidelines. There is probably a need for balancing enforcement with collaboration across departments to effectively mitigate risks.

Career Advancement

Policy Compliance Officers play a crucial role in ensuring organizations adhere to regulatory standards and internal policies, creating a solid foundation for career progression. Mastery in regulatory knowledge, risk assessment, and audit processes significantly enhances opportunities for advancement into senior compliance roles or leadership positions such as Compliance Manager or Chief Compliance Officer. Continuous professional development, including certifications like Certified Compliance & Ethics Professional (CCEP), accelerates career growth within the compliance and governance sector.

Key Terms

Internal Auditing

Policy Compliance Officers specializing in internal auditing ensure organizational adherence to regulatory standards and internal policies through systematic risk assessments and detailed audit reports. They develop audit programs, monitor compliance controls, and recommend corrective actions to mitigate operational risks and enhance governance frameworks. Expertise in regulatory requirements such as SOX, HIPAA, or GDPR is crucial for identifying discrepancies and maintaining corporate accountability.

kuljobs.com

kuljobs.com