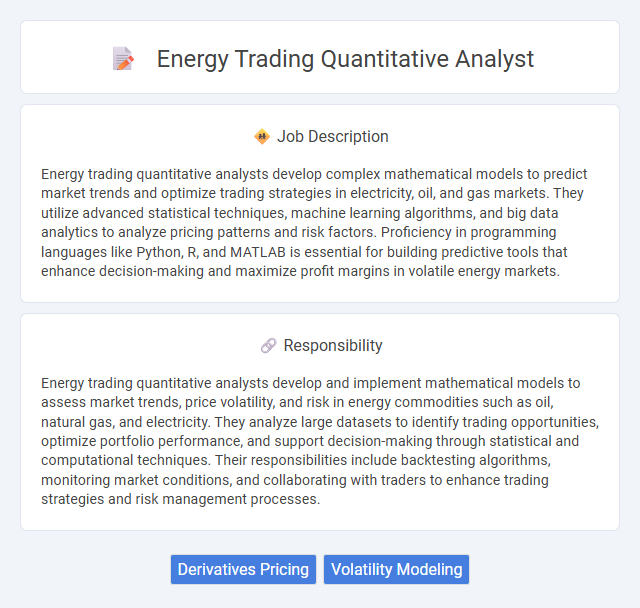

Energy trading quantitative analysts develop complex mathematical models to predict market trends and optimize trading strategies in electricity, oil, and gas markets. They utilize advanced statistical techniques, machine learning algorithms, and big data analytics to analyze pricing patterns and risk factors. Proficiency in programming languages like Python, R, and MATLAB is essential for building predictive tools that enhance decision-making and maximize profit margins in volatile energy markets.

Individuals with strong analytical skills and a passion for energy markets may be well-suited for an energy trading quantitative analyst role. Those comfortable with complex data modeling, statistical analysis, and working in high-pressure environments could find this career rewarding. It seems less likely that people who prefer routine tasks or have limited interest in mathematics and finance would thrive in this position.

Qualification

Energy trading quantitative analyst roles require strong proficiency in advanced statistical methods, mathematical modeling, and programming languages such as Python, R, or MATLAB. Candidates must possess a solid foundation in energy markets, financial instruments, and risk management techniques, often supported by degrees in quantitative disciplines like applied mathematics, physics, engineering, or finance. Expertise in data analysis, machine learning, and the ability to develop pricing algorithms for derivatives or optimization models are critical qualifications for success in this role.

Responsibility

Energy trading quantitative analysts develop and implement mathematical models to assess market trends, price volatility, and risk in energy commodities such as oil, natural gas, and electricity. They analyze large datasets to identify trading opportunities, optimize portfolio performance, and support decision-making through statistical and computational techniques. Their responsibilities include backtesting algorithms, monitoring market conditions, and collaborating with traders to enhance trading strategies and risk management processes.

Benefit

Energy trading quantitative analyst roles likely offer competitive salaries due to the specialized skills in data analysis and modeling required. Benefits may include opportunities for professional growth, exposure to cutting-edge trading strategies, and access to advanced analytical tools that enhance decision-making processes. The job might also provide a dynamic work environment, fostering collaboration with experts in energy markets and finance.

Challenge

Energy trading quantitative analyst roles likely involve complex data modeling and risk assessment challenges due to market volatility and regulatory changes. Candidates may frequently face the difficulty of developing predictive algorithms that accurately price energy derivatives amid fluctuating supply and demand. Navigating large datasets and implementing efficient computational methods could be a consistent part of overcoming these analytical challenges.

Career Advancement

Energy trading quantitative analysts leverage mathematical models and statistical techniques to optimize trading strategies and forecast market trends in the energy sector. Career advancement often involves progressing from junior analyst roles to senior quantitative analyst positions or leading risk management teams, with opportunities to transition into portfolio management or strategic trading roles. Mastery of programming languages, deep understanding of energy markets, and continuous learning in machine learning and data analytics significantly enhance promotion prospects.

Key Terms

Derivatives Pricing

Energy trading quantitative analysts specializing in derivatives pricing develop advanced mathematical models to assess the value and risk of energy derivatives such as futures, options, and swaps. They integrate market data, volatility patterns, and price dynamics into stochastic models to optimize trading strategies and enhance risk management. Proficiency in programming languages like Python and expertise in statistical analysis are essential for implementing real-time pricing algorithms and supporting decision-making in volatile energy markets.

Volatility Modeling

Energy trading quantitative analysts specializing in volatility modeling develop sophisticated statistical models to forecast price fluctuations in energy markets, enhancing risk management and trading strategies. They analyze historical market data using stochastic calculus and machine learning techniques to capture complex volatility patterns in commodities like oil, natural gas, and electricity. Expertise in programming languages such as Python, R, and MATLAB is essential for implementing algorithms that support real-time decision-making and optimize portfolio performance.

kuljobs.com

kuljobs.com