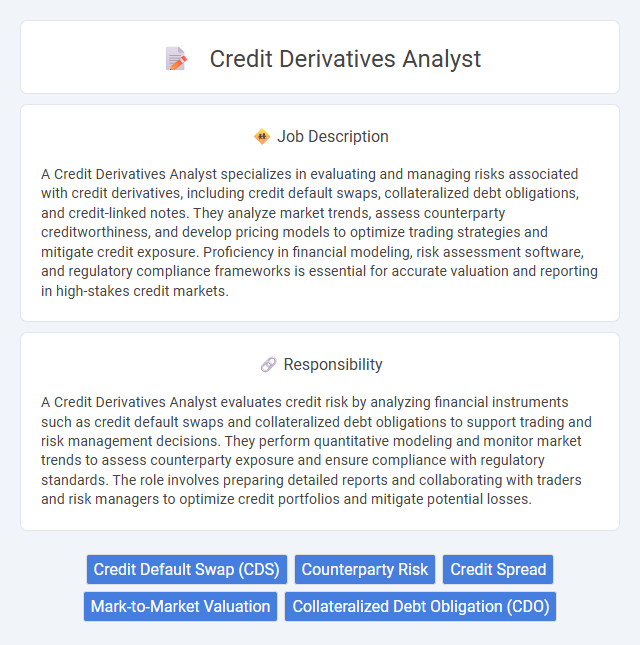

A Credit Derivatives Analyst specializes in evaluating and managing risks associated with credit derivatives, including credit default swaps, collateralized debt obligations, and credit-linked notes. They analyze market trends, assess counterparty creditworthiness, and develop pricing models to optimize trading strategies and mitigate credit exposure. Proficiency in financial modeling, risk assessment software, and regulatory compliance frameworks is essential for accurate valuation and reporting in high-stakes credit markets.

Individuals with strong analytical skills and a solid understanding of financial markets are likely well-suited for a credit derivatives analyst role. Those comfortable working with complex data, assessing credit risk, and under pressure to meet tight deadlines may find the job fitting. People who prefer routine tasks or have limited interest in financial instruments may struggle to succeed in this fast-paced and detail-oriented environment.

Qualification

A Credit Derivatives Analyst requires a strong foundation in finance, often demonstrated by a degree in economics, finance, or a related field, alongside proficiency in financial modeling and risk assessment. Expertise in credit risk analysis, derivatives markets, and regulatory compliance is essential, supported by experience with tools such as Bloomberg, Reuters, or advanced Excel functions. Strong analytical skills, attention to detail, and knowledge of credit default swaps (CDS), collateralized debt obligations (CDOs), and other credit derivative instruments are critical for success in this role.

Responsibility

A Credit Derivatives Analyst evaluates credit risk by analyzing financial instruments such as credit default swaps and collateralized debt obligations to support trading and risk management decisions. They perform quantitative modeling and monitor market trends to assess counterparty exposure and ensure compliance with regulatory standards. The role involves preparing detailed reports and collaborating with traders and risk managers to optimize credit portfolios and mitigate potential losses.

Benefit

A Credit Derivatives Analyst likely enhances portfolio risk management by accurately assessing credit exposure and potential default probabilities. They probably improve decision-making through detailed market analysis and credit event modeling. Their expertise may lead to increased financial stability and optimized investment strategies for the organization.

Challenge

A credit derivatives analyst likely faces the challenge of navigating complex financial instruments with evolving market conditions that require constant analytical precision. The role probably demands interpreting vast datasets to assess credit risk accurately, where errors could significantly impact investment decisions. Adapting to regulatory changes and unpredictable economic factors may also heighten the difficulty of maintaining effective risk management strategies.

Career Advancement

Credit derivatives analysts specializing in structured financial products can advance rapidly by mastering risk assessment models and regulatory compliance frameworks. Gaining expertise in pricing strategies and market trends enhances opportunities for promotion to senior analyst or portfolio manager roles within investment banks and hedge funds. Continuous skill development in quantitative analysis and programming languages like Python further drives career growth and leadership potential.

Key Terms

Credit Default Swap (CDS)

A Credit Derivatives Analyst specializing in Credit Default Swaps (CDS) evaluates market risks associated with default probabilities and credit events. Expertise in CDS pricing models, spread analysis, and counterparty risk assessment enables precise valuation and risk mitigation strategies. Proficiency in analyzing credit curves, basis risk, and default correlations supports informed decision-making for trading and portfolio management.

Counterparty Risk

A Credit Derivatives Analyst specializing in counterparty risk evaluates the potential exposure to losses arising from counterparties failing to meet their financial obligations in derivative contracts. This role involves analyzing creditworthiness, monitoring credit limits, and employing quantitative models to predict default probabilities and mitigate risk. Expertise in market data, credit rating transitions, and regulatory frameworks such as Basel III is essential for accurate risk assessment and reporting.

Credit Spread

A Credit Derivatives Analyst specializes in assessing credit spread movements to evaluate credit risk and price credit derivatives accurately. They analyze market data, including bond yields and CDS spreads, to model credit spread volatility and its impact on portfolios. Expertise in credit spread curves and correlation with default probabilities is essential for optimizing risk management strategies.

Mark-to-Market Valuation

A Credit Derivatives Analyst specializing in Mark-to-Market Valuation assesses the current market value of credit derivative instruments to ensure accurate financial reporting and risk management. This role involves analyzing credit spreads, default probabilities, and counterparty risk factors to update valuations in real-time. Expertise in pricing models such as the Monte Carlo simulation and credit default swap spreads is critical for precise Mark-to-Market assessments.

Collateralized Debt Obligation (CDO)

A Credit Derivatives Analyst specializing in Collateralized Debt Obligations (CDOs) assesses the risk and performance of these structured financial products backed by pools of debt assets. This role involves analyzing tranche-level credit risk, monitoring underlying asset quality, and modeling default probabilities to support investment strategies. Expertise in credit risk modeling, securitization structures, and market dynamics is essential for optimizing portfolio management and pricing accuracy within CDO markets.

kuljobs.com

kuljobs.com