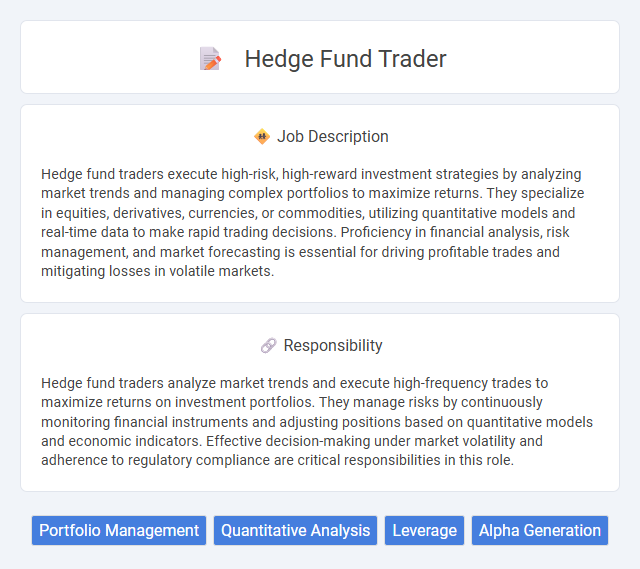

Hedge fund traders execute high-risk, high-reward investment strategies by analyzing market trends and managing complex portfolios to maximize returns. They specialize in equities, derivatives, currencies, or commodities, utilizing quantitative models and real-time data to make rapid trading decisions. Proficiency in financial analysis, risk management, and market forecasting is essential for driving profitable trades and mitigating losses in volatile markets.

Individuals with strong analytical skills and a high tolerance for risk are likely to thrive as hedge fund traders, given the fast-paced and high-pressure environment. People who can make quick decisions under uncertainty and remain emotionally resilient may find this role suitable. Those who struggle with stress or require a predictable routine might face challenges adapting to the demands of this job.

Qualification

A hedge fund trader typically requires a strong background in finance, economics, or mathematics, with a bachelor's or master's degree being highly preferred. Proficiency in quantitative analysis, risk management, and familiarity with financial instruments such as derivatives, equities, and fixed income is essential. Certifications like CFA (Chartered Financial Analyst) or FRM (Financial Risk Manager) enhance credibility and career prospects in hedge fund trading.

Responsibility

Hedge fund traders analyze market trends and execute high-frequency trades to maximize returns on investment portfolios. They manage risks by continuously monitoring financial instruments and adjusting positions based on quantitative models and economic indicators. Effective decision-making under market volatility and adherence to regulatory compliance are critical responsibilities in this role.

Benefit

A hedge fund trader's job likely offers substantial financial rewards, including performance-based bonuses and profit sharing, significantly boosting overall income. Access to sophisticated trading tools and advanced market data may enhance decision-making and trading efficiency. The role probably provides valuable experience in fast-paced, high-stakes environments, which can accelerate career advancement opportunities in the finance industry.

Challenge

Hedge fund traders likely face high-pressure environments requiring rapid decision-making to capitalize on market fluctuations. The complexity of diverse financial instruments may pose continuous intellectual challenges demanding advanced analytical skills. Navigating unpredictable market conditions probably tests adaptability and risk management strategies on a daily basis.

Career Advancement

Hedge fund traders advance their careers by mastering complex financial instruments and consistently delivering high returns on investment portfolios. Developing expertise in quantitative analysis, risk management, and market trends positions them for senior roles such as portfolio manager or chief investment officer. Networking within the finance industry and obtaining certifications like the CFA further enhance career growth opportunities.

Key Terms

Portfolio Management

A hedge fund trader specializing in portfolio management analyzes market trends, asset allocations, and risk factors to optimize investment returns. They employ advanced quantitative models and real-time data analytics to adjust portfolios dynamically and capitalize on market inefficiencies. Effective portfolio management in hedge funds involves balancing diversification, liquidity, and leverage to achieve consistent alpha generation.

Quantitative Analysis

Hedge fund traders specializing in quantitative analysis use mathematical models, statistical techniques, and algorithmic strategies to identify market inefficiencies and generate alpha. They analyze large datasets, implement complex trading algorithms, and constantly refine predictive models to optimize portfolio performance. Strong proficiency in programming languages like Python, R, and MATLAB, as well as expertise in machine learning and financial econometrics, are critical for success in this role.

Leverage

Hedge fund traders utilize leverage to amplify potential returns by borrowing capital to increase their investment exposure beyond available equity. Effective risk management techniques are essential to control the heightened volatility and potential losses associated with leveraged positions. Mastery of market analysis, financial modeling, and rapid decision-making is critical for optimizing leveraged trades in dynamic market conditions.

Alpha Generation

A hedge fund trader specializes in alpha generation by identifying undervalued assets and exploiting market inefficiencies through advanced quantitative models and proprietary trading strategies. They analyze vast datasets, monitor real-time market movements, and execute high-frequency trades to maximize portfolio returns above benchmark indices. Mastery of risk management techniques and deep understanding of financial instruments drive consistent alpha in highly competitive markets.

kuljobs.com

kuljobs.com