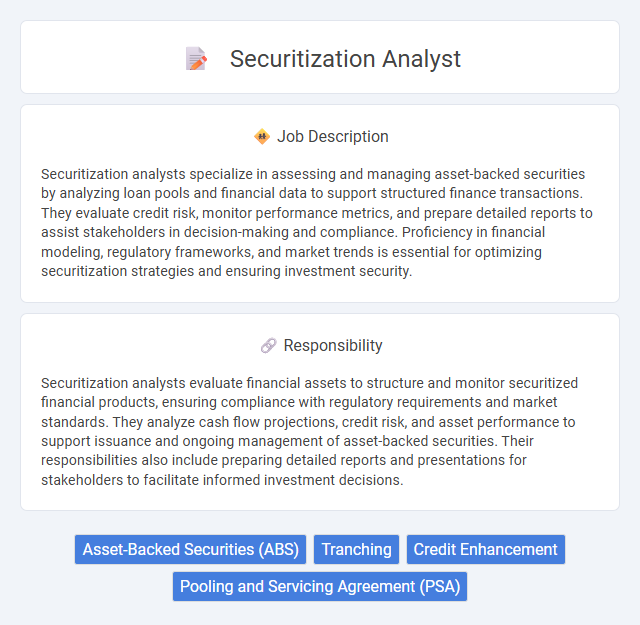

Securitization analysts specialize in assessing and managing asset-backed securities by analyzing loan pools and financial data to support structured finance transactions. They evaluate credit risk, monitor performance metrics, and prepare detailed reports to assist stakeholders in decision-making and compliance. Proficiency in financial modeling, regulatory frameworks, and market trends is essential for optimizing securitization strategies and ensuring investment security.

Individuals with strong analytical skills and a keen attention to detail are likely to thrive as securitization analysts, given the demanding nature of evaluating complex financial instruments. Those comfortable with quantitative data and financial modeling may find this role suitable, while candidates who prefer less structured or interpersonal roles might struggle with the rigorous requirements. The job probably suits self-motivated professionals who can work independently under tight deadlines, as an ability to manage stress effectively could be crucial.

Qualification

A Securitization Analyst typically requires strong analytical skills combined with a bachelor's degree in finance, economics, or a related field, often complemented by advanced certifications such as CFA or CPA. Proficiency in financial modeling, credit risk assessment, and a deep understanding of capital markets are essential to evaluate asset-backed securities and structured finance products. Experience in data analysis tools, regulatory frameworks, and excellent communication skills further enhance a candidate's ability to support securitization transactions effectively.

Responsibility

Securitization analysts evaluate financial assets to structure and monitor securitized financial products, ensuring compliance with regulatory requirements and market standards. They analyze cash flow projections, credit risk, and asset performance to support issuance and ongoing management of asset-backed securities. Their responsibilities also include preparing detailed reports and presentations for stakeholders to facilitate informed investment decisions.

Benefit

Securitization analysts likely enjoy the benefit of gaining deep expertise in financial instruments, enhancing their marketability in the finance sector. They may experience increased earning potential due to the specialized nature of their work analyzing asset-backed securities. Opportunities for career advancement could be higher as firms value their ability to assess and optimize structured financial products.

Challenge

A securitization analyst likely faces the challenge of accurately assessing the risk and value of complex financial assets within structured finance transactions. The role probably demands staying updated on evolving regulations and market conditions to ensure compliance and optimal portfolio performance. Managing large datasets and deriving meaningful insights from them to support investment decisions is also expected to be a significant challenge.

Career Advancement

Securitization analysts play a critical role in structuring and analyzing asset-backed securities, providing essential support for risk assessment and portfolio optimization in financial institutions. Career advancement opportunities often lead to senior analyst positions, portfolio management roles, or specialized fields such as credit risk analysis and investment banking. Mastery of financial modeling, regulatory frameworks, and market trends enhances prospects for promotion and leadership roles within securitization and structured finance teams.

Key Terms

Asset-Backed Securities (ABS)

A Securitization Analyst specializing in Asset-Backed Securities (ABS) evaluates financial assets such as auto loans, credit card receivables, and mortgage pools to structure and price ABS transactions. They analyze cash flow models, assess credit risk, and ensure compliance with regulatory requirements to optimize the securitization process. Proficiency in financial modeling, ABS market trends, and investor demand is essential to support issuance and rating agency presentations.

Tranching

A securitization analyst specializing in tranching evaluates and structures asset-backed securities into different risk layers or tranches, each with distinct credit ratings and payment priorities. This role requires in-depth financial modeling and analysis to optimize tranche performance and investor appeal while ensuring compliance with regulatory standards. Mastery in tranching enhances capital efficiency by allocating risks and returns according to investor preferences and market demand.

Credit Enhancement

A Securitization Analyst specializing in credit enhancement evaluates various mechanisms like overcollateralization, reserve accounts, and guarantees to improve the credit quality of asset-backed securities. They analyze underlying asset performance, structure tranches, and assess risk mitigants to ensure optimal investor protection and higher credit ratings. Mastery of financial modeling, regulatory requirements, and market conditions is essential for effective credit enhancement strategy implementation.

Pooling and Servicing Agreement (PSA)

A Securitization analyst specializing in Pooling and Servicing Agreements (PSA) evaluates the legal and financial frameworks governing asset-backed securities transactions to ensure compliance and risk mitigation. Expertise in PSA provisions allows analysts to assess servicer responsibilities, cash flow waterfalls, and event triggers critical to structuring and managing securitized asset pools. Mastery of PSA details enhances portfolio performance analysis, default risk assessment, and investor reporting within structured finance and securitization markets.

kuljobs.com

kuljobs.com