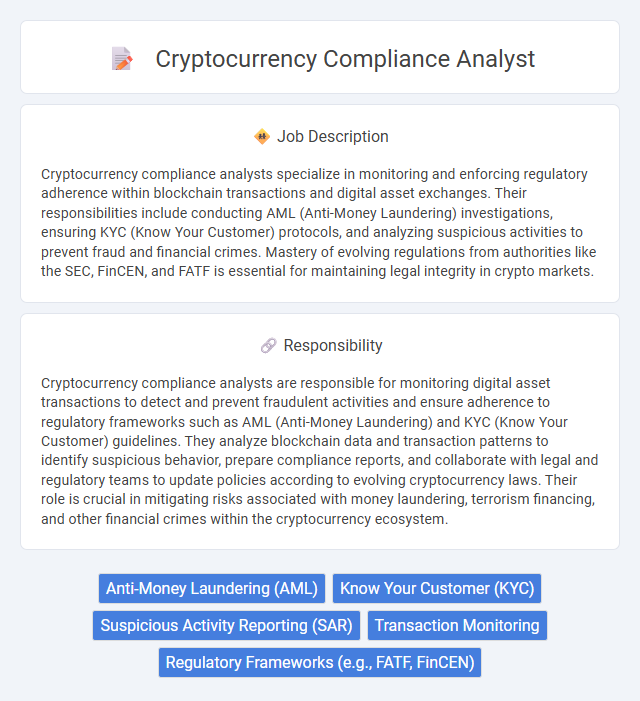

Cryptocurrency compliance analysts specialize in monitoring and enforcing regulatory adherence within blockchain transactions and digital asset exchanges. Their responsibilities include conducting AML (Anti-Money Laundering) investigations, ensuring KYC (Know Your Customer) protocols, and analyzing suspicious activities to prevent fraud and financial crimes. Mastery of evolving regulations from authorities like the SEC, FinCEN, and FATF is essential for maintaining legal integrity in crypto markets.

Individuals with strong analytical skills and attention to detail will likely find a cryptocurrency compliance analyst role suitable. Those comfortable navigating complex regulatory frameworks and staying updated on evolving digital asset laws will probably excel. Candidates lacking interest in legal regulations or struggling with continual learning may face challenges in this position.

Qualification

A Cryptocurrency Compliance Analyst requires expertise in anti-money laundering (AML) regulations, Know Your Customer (KYC) processes, and blockchain technology. Proficiency in regulatory frameworks such as FATF, FinCEN, and EU AML directives is crucial for monitoring and mitigating risks. Strong analytical skills, attention to detail, and experience with compliance software tools enhance effective transaction analysis and regulatory reporting.

Responsibility

Cryptocurrency compliance analysts are responsible for monitoring digital asset transactions to detect and prevent fraudulent activities and ensure adherence to regulatory frameworks such as AML (Anti-Money Laundering) and KYC (Know Your Customer) guidelines. They analyze blockchain data and transaction patterns to identify suspicious behavior, prepare compliance reports, and collaborate with legal and regulatory teams to update policies according to evolving cryptocurrency laws. Their role is crucial in mitigating risks associated with money laundering, terrorism financing, and other financial crimes within the cryptocurrency ecosystem.

Benefit

Cryptocurrency compliance analysts likely benefit from a dynamic work environment where they develop expertise in blockchain technology and evolving regulatory frameworks. They probably experience enhanced career growth opportunities due to the increasing demand for compliance professionals in the crypto industry. High earning potential and exposure to global financial systems may also contribute to the advantages of this role.

Challenge

Cryptocurrency compliance analyst roles likely involve navigating complex and rapidly evolving regulatory landscapes, which can pose significant challenges in maintaining up-to-date policies. The unpredictability of legal frameworks across jurisdictions may require continuous adaptation and vigilance to ensure adherence to anti-money laundering (AML) and counter-terrorism financing (CTF) standards. Balancing risk management with innovative technological developments could also present ongoing difficulties in achieving effective compliance.

Career Advancement

Cryptocurrency compliance analyst roles offer significant career advancement opportunities through the development of expertise in blockchain technology, regulatory frameworks, and anti-money laundering (AML) practices. Mastery of evolving cryptocurrency regulations and data analytics tools enhances promotion prospects to senior compliance officer or risk management positions within fintech firms. Building a strong network with regulatory bodies and gaining certifications like CAMS (Certified Anti-Money Laundering Specialist) accelerates career growth in this expanding sector.

Key Terms

Anti-Money Laundering (AML)

A Cryptocurrency Compliance Analyst specializing in Anti-Money Laundering (AML) monitors and investigates blockchain transactions to identify suspicious activities and ensure adherence to regulatory requirements such as the Bank Secrecy Act (BSA) and Financial Action Task Force (FATF) guidelines. The role involves conducting customer due diligence (CDD), transaction monitoring, and preparing detailed reports for compliance teams and regulatory bodies to mitigate risks associated with money laundering and terrorist financing. Proficiency in AML software tools, blockchain analytics, and knowledge of evolving cryptocurrency regulations are critical for maintaining effective compliance frameworks.

Know Your Customer (KYC)

A Cryptocurrency Compliance Analyst specializing in Know Your Customer (KYC) is responsible for verifying the identity of clients to prevent fraud, money laundering, and terrorist financing within crypto transactions. This role involves conducting thorough background checks, analyzing transaction patterns, and ensuring adherence to regulatory requirements such as AML (Anti-Money Laundering) and CTF (Counter-Terrorism Financing) laws. Proficiency in blockchain analytics tools and understanding evolving regulatory frameworks is essential to maintaining robust compliance in the cryptocurrency industry.

Suspicious Activity Reporting (SAR)

A Cryptocurrency Compliance Analyst specializing in Suspicious Activity Reporting (SAR) monitors blockchain transactions to identify potential money laundering, fraud, or terrorist financing activities. They analyze transaction patterns using advanced analytics tools and ensure compliance with regulatory requirements such as the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) legislation. This role involves preparing detailed SAR filings for submission to authorities like the Financial Crimes Enforcement Network (FinCEN), helping to maintain the integrity and transparency of cryptocurrency markets.

Transaction Monitoring

A Cryptocurrency Compliance Analyst specializing in Transaction Monitoring plays a critical role in detecting and preventing illicit activities such as money laundering and fraud within digital asset transactions. They analyze blockchain data and transaction patterns, utilizing advanced software tools and regulatory frameworks to ensure adherence to KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements. Proficiency in monitoring real-time cryptocurrency transfers and generating detailed compliance reports is essential for maintaining secure and compliant crypto operations.

Regulatory Frameworks (e.g., FATF, FinCEN)

Cryptocurrency compliance analysts ensure that digital asset transactions adhere to key regulatory frameworks such as the Financial Action Task Force (FATF) guidelines and the Financial Crimes Enforcement Network (FinCEN) regulations. They conduct ongoing monitoring and risk assessments to prevent money laundering, fraud, and terrorism financing within blockchain-based platforms. Proficiency in interpreting Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) standards is essential for maintaining robust compliance programs in the evolving crypto landscape.

kuljobs.com

kuljobs.com