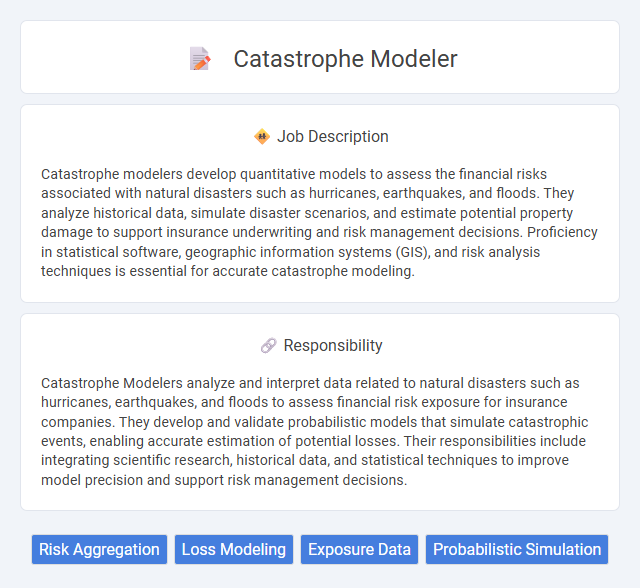

Catastrophe modelers develop quantitative models to assess the financial risks associated with natural disasters such as hurricanes, earthquakes, and floods. They analyze historical data, simulate disaster scenarios, and estimate potential property damage to support insurance underwriting and risk management decisions. Proficiency in statistical software, geographic information systems (GIS), and risk analysis techniques is essential for accurate catastrophe modeling.

Individuals with strong analytical skills, a background in mathematics or statistics, and an interest in risk assessment are likely suitable for a Catastrophe Modeler role. Those uncomfortable with complex data sets or lacking attention to detail may find the job challenging. The position often requires a high level of precision and problem-solving ability, suggesting it may be best suited for candidates who enjoy technical and quantitative work.

Qualification

A Catastrophe Modeler must possess strong quantitative and analytical skills, typically requiring a degree in actuarial science, statistics, mathematics, or a related field. Proficiency in programming languages such as Python, R, or SQL and experience with catastrophe modeling software like RMS or AIR Worldwide are essential. Knowledge of natural disaster risk assessment, statistical modeling, and data analysis techniques is critical for accurately predicting and mitigating catastrophic event impacts.

Responsibility

Catastrophe Modelers analyze and interpret data related to natural disasters such as hurricanes, earthquakes, and floods to assess financial risk exposure for insurance companies. They develop and validate probabilistic models that simulate catastrophic events, enabling accurate estimation of potential losses. Their responsibilities include integrating scientific research, historical data, and statistical techniques to improve model precision and support risk management decisions.

Benefit

A Catastrophe Modeler likely enhances risk assessment precision by applying advanced analytics to forecast potential losses from natural disasters. This role may improve decision-making for insurance companies, enabling more accurate premium pricing and capital allocation. The position could also contribute to disaster preparedness strategies, potentially reducing financial impact and supporting community resilience.

Challenge

Catastrophe Modeler roles likely involve complex data analysis and interpreting diverse risk factors, presenting significant analytical challenges. Navigating uncertain scenarios to accurately predict potential losses may require advanced mathematical and statistical skills. The position probably demands continuous adaptation to evolving models and emerging natural disaster trends, requiring resilience and problem-solving abilities.

Career Advancement

A career as a Catastrophe Modeler offers significant advancement opportunities through expertise in risk assessment, data analysis, and predictive modeling within insurance and reinsurance industries. Professionals can progress from junior analyst roles to senior modeler positions, eventually moving into leadership roles such as risk management director or chief risk officer. Mastery of advanced catastrophe modeling software and a strong understanding of natural disaster impacts elevate career growth and demand in this specialized field.

Key Terms

Risk Aggregation

Catastrophe Modelers specialize in risk aggregation by quantifying and consolidating potential losses from natural and man-made disasters using advanced statistical models and geospatial data analysis. They integrate diverse hazard, exposure, and vulnerability datasets to simulate event scenarios, enabling insurers and reinsurers to evaluate aggregated risk portfolios accurately. Expertise in catastrophe modeling software such as RMS, AIR, and EQECAT is essential for optimizing capital allocation and enhancing risk management strategies.

Loss Modeling

A Catastrophe Modeler specializing in Loss Modeling develops and applies sophisticated algorithms to assess potential financial losses from natural and man-made disasters. This role involves analyzing historical catastrophe data, probabilistic risk models, and exposure databases to estimate probable maximum losses and expected losses for insurance portfolios. Expertise in catastrophe risk analytics, stochastic modeling, and software tools like RMS or AIR is essential to optimize risk management strategies and support underwriting decisions.

Exposure Data

Catastrophe Modeler roles require expertise in analyzing and managing exposure data to assess potential risks from natural hazards like earthquakes, hurricanes, and floods. Accurate exposure data-driven modeling supports insurance and reinsurance companies in predicting loss scenarios and optimizing risk portfolios. Proficiency in GIS, data analytics, and catastrophe modeling software enhances the precision of exposure data interpretation for effective disaster risk management.

Probabilistic Simulation

Catastrophe Modeler roles specialize in developing and implementing probabilistic simulation techniques to assess risk associated with natural and man-made disasters. These simulations integrate historical data, hazard frequencies, and exposure models to estimate potential losses and inform risk management strategies for insurance and reinsurance companies. Proficiency in statistical analysis, coding languages like Python or R, and expertise in geographic information systems (GIS) are critical for optimizing catastrophe risk models.

kuljobs.com

kuljobs.com