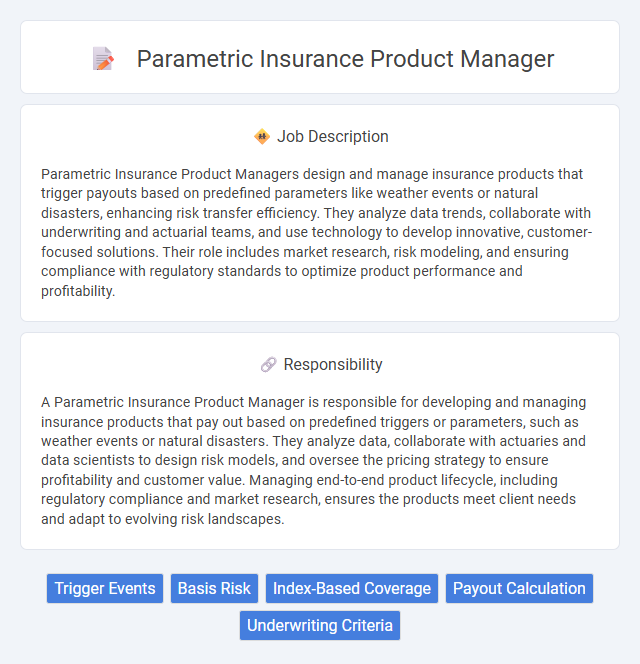

Parametric Insurance Product Managers design and manage insurance products that trigger payouts based on predefined parameters like weather events or natural disasters, enhancing risk transfer efficiency. They analyze data trends, collaborate with underwriting and actuarial teams, and use technology to develop innovative, customer-focused solutions. Their role includes market research, risk modeling, and ensuring compliance with regulatory standards to optimize product performance and profitability.

Individuals with strong analytical skills and a background in finance or insurance are likely suitable for a Parametric Insurance Product Manager role. Those who thrive in data-driven environments and can interpret complex risk models may find this position aligns well with their capabilities. Candidates lacking experience in technology integration or market analysis might face challenges adapting effectively to the demands of this job.

Qualification

A Parametric Insurance Product Manager requires expertise in actuarial science, data analytics, and risk modeling to design and manage parametric insurance solutions effectively. Strong skills in market analysis, product development, and regulatory compliance are essential to tailor products that meet client needs while optimizing profitability. Proficiency in programming languages such as Python or R and experience with catastrophe modeling software further enhance the ability to innovate in this specialized insurance sector.

Responsibility

A Parametric Insurance Product Manager is responsible for developing and managing insurance products that pay out based on predefined triggers or parameters, such as weather events or natural disasters. They analyze data, collaborate with actuaries and data scientists to design risk models, and oversee the pricing strategy to ensure profitability and customer value. Managing end-to-end product lifecycle, including regulatory compliance and market research, ensures the products meet client needs and adapt to evolving risk landscapes.

Benefit

Parametric Insurance Product Managers likely enhance risk transfer efficiency by designing policies that trigger payouts based on predefined parameters, reducing claims processing time. They probably improve customer satisfaction through transparent, objective coverage that minimizes disputes and accelerates recovery. Their role may also optimize underwriting precision and profitability by leveraging data analytics to tailor products to specific risk events.

Challenge

Managing a Parametric Insurance product likely involves navigating the challenge of designing precise triggers that balance accuracy with simplicity. There is probably significant complexity in integrating diverse data sources to ensure timely and reliable payouts. Staying ahead in a competitive market may also require continuous innovation while managing regulatory and operational risks.

Career Advancement

A Parametric Insurance Product Manager drives innovation by developing data-driven insurance products that trigger automatic payouts based on predefined parameters such as weather events or natural disasters. Mastery in risk modeling, data analytics, and technology integration positions professionals for leadership roles in product strategy and portfolio management within the insurtech sector. Advancing in this career path often leads to senior management opportunities, influencing product innovation and shaping market trends in parametric insurance.

Key Terms

Trigger Events

A Parametric Insurance Product Manager specializes in designing insurance products that pay out based on predefined trigger events such as natural disasters, weather conditions, or market indices. These trigger events are quantifiable and enable fast claims processing by automating payouts once the specified parameters are met. Expertise in data analysis, risk modeling, and understanding of event-driven insurance solutions is crucial for optimizing product performance and customer satisfaction.

Basis Risk

Parametric Insurance Product Managers develop and oversee insurance products that pay out based on predefined parameters or indices, minimizing traditional claim assessments. They focus on reducing basis risk, which is the mismatch between the actual loss experienced by the insured and the payout triggered by the parametric index. Effective management of basis risk enhances customer satisfaction and improves the accuracy of risk transfer, driving product success in markets vulnerable to natural disasters.

Index-Based Coverage

Parametric Insurance Product Managers specialize in designing index-based coverage solutions that automatically trigger payouts based on predefined parameters such as weather data, seismic activity, or crop yields. They leverage advanced data analytics and modeling techniques to develop accurate risk indexes that enhance payout efficiency and customer transparency. Their role involves close collaboration with actuarial teams, data scientists, and underwriting to optimize product performance and market competitiveness.

Payout Calculation

A Parametric Insurance Product Manager specializes in designing and managing insurance products where payouts are triggered by predefined events measured by objective parameters, such as weather indices or seismic activity data. They develop algorithms and models to accurately calculate payouts based on real-time data inputs, ensuring rapid and transparent claim settlements. Expertise in data analytics, risk assessment, and coordination with technology teams is critical to optimize payout calculation efficiency and maintain product competitiveness.

Underwriting Criteria

Parametric Insurance Product Managers develop underwriting criteria based on predefined parameters triggering automatic payouts, reducing claims processing time and operational costs. They analyze historical data, risk models, and external factors such as weather patterns or natural disasters to fine-tune policy conditions and loss thresholds. Continuous evaluation of underwriting criteria ensures accuracy in risk assessment and alignment with market demands for parametric insurance products.

kuljobs.com

kuljobs.com