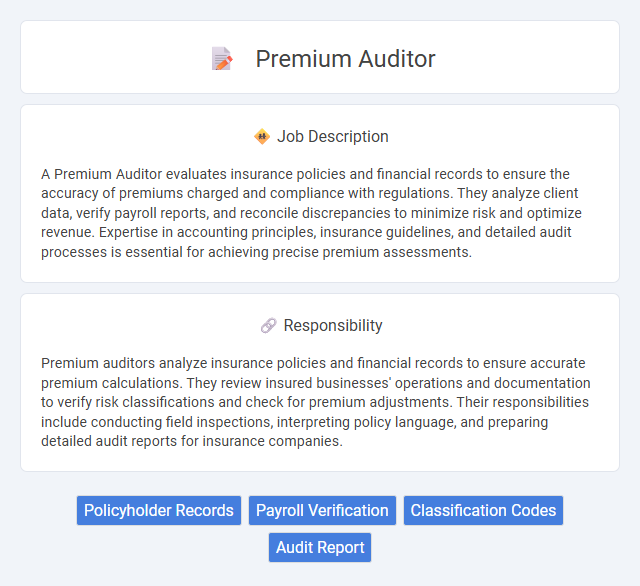

A Premium Auditor evaluates insurance policies and financial records to ensure the accuracy of premiums charged and compliance with regulations. They analyze client data, verify payroll reports, and reconcile discrepancies to minimize risk and optimize revenue. Expertise in accounting principles, insurance guidelines, and detailed audit processes is essential for achieving precise premium assessments.

Individuals with strong analytical skills and attention to detail are likely to find success as Premium Auditors, as the role requires thorough evaluation of insurance premiums and risk assessments. Those comfortable working independently and handling complex data might be well-suited for this position, while candidates who prefer fast-paced, highly interactive environments may find it less compatible. A background in finance, insurance, or accounting could increase the probability of job suitability.

Qualification

A Premium Auditor must possess strong analytical skills and attention to detail to accurately review insurance policies and determine premium adjustments. Proficiency in auditing software, knowledge of insurance principles, and a background in accounting or finance are essential qualifications. Certified Internal Auditor (CIA) or Certified Public Accountant (CPA) designations enhance credibility and career prospects in this role.

Responsibility

Premium auditors analyze insurance policies and financial records to ensure accurate premium calculations. They review insured businesses' operations and documentation to verify risk classifications and check for premium adjustments. Their responsibilities include conducting field inspections, interpreting policy language, and preparing detailed audit reports for insurance companies.

Benefit

A Premium Auditor likely provides significant financial benefits by ensuring accurate premium calculations and minimizing errors in insurance billing. Their role probably enhances revenue recovery and reduces company losses through diligent policy audits. Employers might experience improved compliance and risk management, leading to stronger financial stability.

Challenge

The Premium Auditor role likely involves the challenge of meticulously analyzing complex insurance policies and financial documents to ensure accurate premium calculation. It probably requires strong attention to detail and the ability to identify discrepancies that could impact financial outcomes. Navigating evolving regulations and adapting to diverse client data may also present significant challenges in this position.

Career Advancement

Premium Auditors play a crucial role in the insurance industry by analyzing financial records to ensure accurate premium calculations. Career advancement opportunities include progressing to senior auditor, underwriting manager, or risk analyst roles, leveraging expertise in data analysis and regulatory compliance. Mastery of auditing software, strong analytical skills, and certifications such as CPA or CPCU can significantly enhance promotion prospects in this field.

Key Terms

Policyholder Records

Premium auditors meticulously examine policyholder records to verify accuracy in premium calculations and ensure compliance with insurance policies. They analyze payroll reports, financial statements, and other relevant documents to assess risk and detect discrepancies that influence premium adjustments. Accurate evaluation of policyholder data helps insurance companies manage risk exposure and maintain fair pricing structures.

Payroll Verification

Premium Auditors specializing in payroll verification meticulously analyze employer payroll records to ensure accurate premium calculations for insurance policies. They compare payroll data against policy terms and classifications to identify discrepancies and minimize risk exposure. Expertise in regulatory compliance and data analysis tools enhances precision in verifying wage details and employment classifications.

Classification Codes

Premium auditors play a critical role in ensuring accurate insurance premium calculations by closely examining payroll records and business operations to verify classification codes. These codes categorize different types of work activities and risk levels, directly impacting premium amounts for workers' compensation insurance. Expertise in interpreting and applying classification codes helps identify potential misclassifications that could lead to overpayment or underpayment of premiums.

Audit Report

A Premium Auditor is responsible for analyzing insurance policies and financial records to ensure accurate premium calculations. The Audit Report generated by a Premium Auditor details the findings, highlighting discrepancies, adjustments, and recommendations for premium adjustments. This report serves as a critical document for insurers, ensuring compliance with underwriting guidelines and minimizing financial risk.

kuljobs.com

kuljobs.com