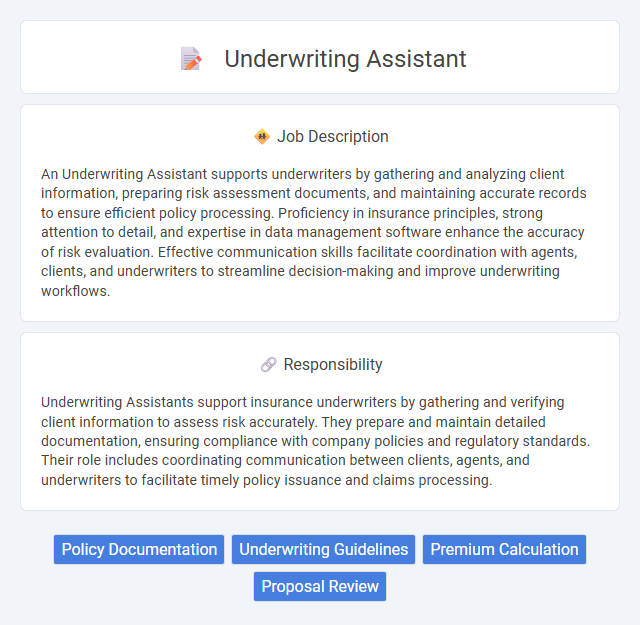

An Underwriting Assistant supports underwriters by gathering and analyzing client information, preparing risk assessment documents, and maintaining accurate records to ensure efficient policy processing. Proficiency in insurance principles, strong attention to detail, and expertise in data management software enhance the accuracy of risk evaluation. Effective communication skills facilitate coordination with agents, clients, and underwriters to streamline decision-making and improve underwriting workflows.

Individuals who possess strong attention to detail and analytical skills are likely to be well-suited for the Underwriting Assistant role, as it requires careful evaluation of financial and insurance documents. Candidates with good communication abilities and a methodical approach to problem-solving may have a higher probability of excelling in this position. Those who struggle with multitasking or have difficulty interpreting data might find the job less compatible with their strengths.

Qualification

Underwriting Assistant roles typically require a bachelor's degree in finance, economics, or a related field, along with strong analytical skills and attention to detail. Proficiency in risk assessment software and knowledge of insurance policies and regulatory compliance are critical qualifications. Effective communication and organizational abilities further enhance performance in managing underwriting documentation and supporting decision-making processes.

Responsibility

Underwriting Assistants support insurance underwriters by gathering and verifying client information to assess risk accurately. They prepare and maintain detailed documentation, ensuring compliance with company policies and regulatory standards. Their role includes coordinating communication between clients, agents, and underwriters to facilitate timely policy issuance and claims processing.

Benefit

An Underwriting Assistant likely supports the underwriting team by preparing and organizing documents, which may increase workflow efficiency and accuracy. This role probably provides valuable exposure to risk assessment processes, offering potential career growth in the insurance or finance sectors. It's possible that working as an Underwriting Assistant improves attention to detail and enhances communication skills, benefiting long-term professional development.

Challenge

The role of an Underwriting Assistant likely involves managing complex risk assessments and navigating detailed financial information, which can present significant challenges. Balancing accuracy and efficiency in processing documentation may often test one's attention to detail and decision-making skills. Adapting to evolving regulatory requirements and technology tools could further complicate daily responsibilities.

Career Advancement

Underwriting Assistants play a crucial role in the insurance industry by supporting underwriters in evaluating risk and processing applications, providing a solid foundation for career advancement into underwriting and risk management roles. Gaining expertise in underwriting software, risk assessment, and regulatory compliance can accelerate progression to senior underwriting positions or specialized areas like commercial or reinsurance underwriting. Continuous professional development and obtaining industry certifications, such as the Chartered Property Casualty Underwriter (CPCU), enhance prospects for leadership roles and higher compensation.

Key Terms

Policy Documentation

Underwriting Assistants play a crucial role in the preparation and review of policy documentation, ensuring accuracy and compliance with company standards and regulatory requirements. They gather and verify information from applicants to support underwriters in assessing risk profiles and facilitating timely policy issuance. Proficiency in managing documentation workflows and maintaining detailed records enhances the efficiency and reliability of underwriting operations.

Underwriting Guidelines

Underwriting Assistants play a crucial role in ensuring compliance with underwriting guidelines by meticulously reviewing applications and verifying documentation against established risk criteria. They facilitate risk assessment processes by organizing data, tracking policy conditions, and maintaining accurate records to support underwriters' decision-making. Expertise in interpreting underwriting guidelines enhances accuracy and efficiency, reducing risks and improving overall portfolio quality.

Premium Calculation

Underwriting Assistants support insurance companies by accurately calculating premiums based on risk assessments, policy details, and client information. They analyze data from applications and guidelines to ensure premium rates comply with company standards and regulatory requirements. Mastery of underwriting software and attention to detail are crucial for efficient premium calculation and error reduction.

Proposal Review

Underwriting Assistants play a critical role in the proposal review process by meticulously examining insurance applications and supporting documents for accuracy and completeness. They ensure compliance with underwriting guidelines and flag discrepancies or missing information to mitigate risks. Proficiency in data analysis and knowledge of insurance policies enhances their ability to support underwriters in making informed decisions.

kuljobs.com

kuljobs.com