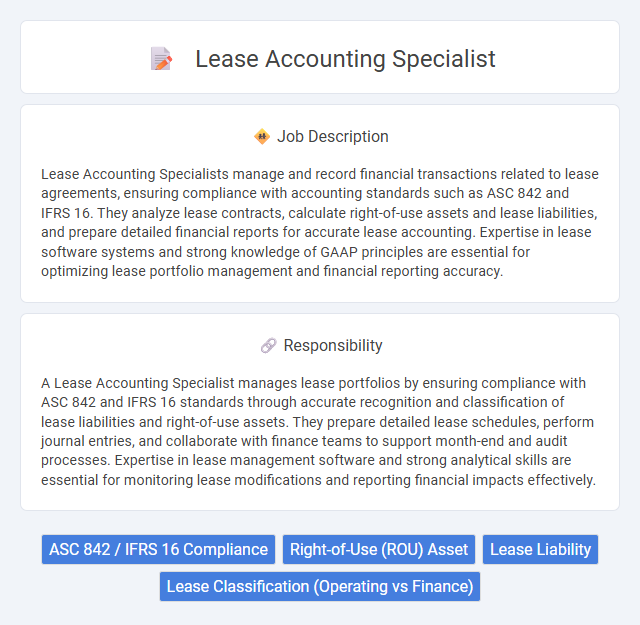

Lease Accounting Specialists manage and record financial transactions related to lease agreements, ensuring compliance with accounting standards such as ASC 842 and IFRS 16. They analyze lease contracts, calculate right-of-use assets and lease liabilities, and prepare detailed financial reports for accurate lease accounting. Expertise in lease software systems and strong knowledge of GAAP principles are essential for optimizing lease portfolio management and financial reporting accuracy.

Individuals with strong analytical skills and attention to detail are likely to thrive as Lease Accounting Specialists due to the precision required in managing lease contracts and financial records. Those comfortable working with complex accounting standards and regulatory compliance probably find this role suitable, as it demands interpreting and applying lease accounting principles accurately. Candidates who prefer structured environments and have proficiency in accounting software are more likely to succeed in this position.

Qualification

A Lease Accounting Specialist requires proficiency in GAAP and ASC 842 lease accounting standards, with strong analytical skills to manage complex lease portfolios. Expertise in lease accounting software such as LeaseQuery or CoStar and advanced Excel capabilities are essential for accurate lease data analysis and reporting. A bachelor's degree in accounting or finance, coupled with relevant certifications like CPA or CMA, enhances a candidate's qualifications and effectiveness in this role.

Responsibility

A Lease Accounting Specialist manages lease portfolios by ensuring compliance with ASC 842 and IFRS 16 standards through accurate recognition and classification of lease liabilities and right-of-use assets. They prepare detailed lease schedules, perform journal entries, and collaborate with finance teams to support month-end and audit processes. Expertise in lease management software and strong analytical skills are essential for monitoring lease modifications and reporting financial impacts effectively.

Benefit

A Lease Accounting Specialist role likely offers the benefit of enhancing expertise in complex lease regulations and financial reporting standards, which could improve career advancement opportunities. This position may provide exposure to diverse leasing contracts, fostering deeper analytical and compliance skills that are valuable in accounting and finance fields. There is also a probability of contributing to efficient lease management processes, potentially leading to cost savings and improved financial accuracy for the organization.

Challenge

Lease Accounting Specialists likely face the challenge of staying current with evolving lease accounting standards such as ASC 842 and IFRS 16, which frequently undergo updates affecting reporting requirements. The complexity of accurately classifying leases, managing lease data across multiple systems, and ensuring compliance may require advanced analytical skills and attention to detail. Managing tight deadlines for financial reporting while coordinating with various departments could further increase the difficulty of maintaining accurate lease accounting records.

Career Advancement

Lease Accounting Specialists play a critical role in managing and analyzing lease agreements, ensuring compliance with accounting standards such as ASC 842 and IFRS 16. Expertise in lease administration, financial reporting, and software tools like SAP or Oracle can accelerate career progression to roles such as Senior Accountant, Finance Manager, or Lease Accounting Manager. Continuous professional development and certification in accounting standards enhance opportunities for leadership positions and specialized financial consultancy.

Key Terms

ASC 842 / IFRS 16 Compliance

Lease Accounting Specialists ensure accurate implementation and compliance with ASC 842 and IFRS 16 standards, facilitating proper lease identification, measurement, and reporting. They manage lease data automation and maintain detailed lease registers to support financial statement transparency and audit readiness. Expertise in lease classification, right-of-use asset calculations, and lease liability assessments is critical to aligning company records with evolving regulatory requirements.

Right-of-Use (ROU) Asset

Lease Accounting Specialists manage and monitor Right-of-Use (ROU) assets to ensure accurate financial reporting in compliance with ASC 842 and IFRS 16 standards. They calculate initial recognition, subsequent measurement, and impairment of ROU assets, optimizing lease capitalization and amortization processes. Expertise in lease software and collaboration with finance teams enhances accuracy in balance sheet presentation and lease liability tracking.

Lease Liability

A Lease Accounting Specialist ensures accurate recognition and measurement of lease liabilities in compliance with ASC 842 and IFRS 16 standards. They manage lease liability calculations, including present value assessments and amortization schedules, to reflect financial obligations correctly. Expertise in lease data analysis, system implementation, and collaboration with finance teams is essential for maintaining accurate lease liability reporting.

Lease Classification (Operating vs Finance)

Lease Accounting Specialists play a critical role in accurately classifying leases as operating or finance based on criteria outlined in ASC 842 and IFRS 16 standards. Their expertise ensures precise recognition of lease assets and liabilities on the balance sheet, directly impacting financial statements and compliance. Mastery in evaluating lease terms, payment structures, and economic benefits is essential to distinguish between operating leases and finance leases effectively.

kuljobs.com

kuljobs.com