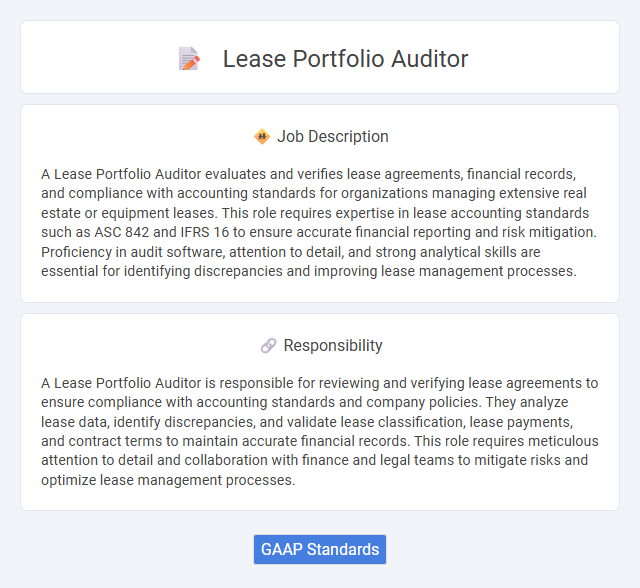

A Lease Portfolio Auditor evaluates and verifies lease agreements, financial records, and compliance with accounting standards for organizations managing extensive real estate or equipment leases. This role requires expertise in lease accounting standards such as ASC 842 and IFRS 16 to ensure accurate financial reporting and risk mitigation. Proficiency in audit software, attention to detail, and strong analytical skills are essential for identifying discrepancies and improving lease management processes.

Individuals with strong attention to detail and analytical skills will likely be suitable for a lease portfolio auditor role, as the job requires careful examination of financial documents and lease agreements. Those who prefer structured, repetitive tasks and have a background in accounting or finance might find this position aligns well with their capabilities. Conversely, candidates who struggle with meticulous work or lack interest in financial data review may find it challenging to excel in this role.

Qualification

A Lease Portfolio Auditor must possess a deep understanding of lease accounting standards such as ASC 842 and IFRS 16, with strong analytical skills to assess complex lease agreements accurately. Proficiency in financial reporting software, advanced Excel capabilities, and experience in auditing lease portfolios within real estate or corporate sectors are essential qualifications. Strong attention to detail, effective communication skills, and the ability to identify compliance risks and reconciliation discrepancies are crucial for ensuring accurate financial disclosures.

Responsibility

A Lease Portfolio Auditor is responsible for reviewing and verifying lease agreements to ensure compliance with accounting standards and company policies. They analyze lease data, identify discrepancies, and validate lease classification, lease payments, and contract terms to maintain accurate financial records. This role requires meticulous attention to detail and collaboration with finance and legal teams to mitigate risks and optimize lease management processes.

Benefit

A lease portfolio auditor likely improves financial accuracy by identifying discrepancies and ensuring lease compliance, which may reduce risk for organizations. They probably enhance the efficiency of lease management processes, potentially leading to cost savings and better asset utilization. Their role might also support strategic decision-making through accurate reporting and lease data analysis.

Challenge

A lease portfolio auditor likely faces the challenge of accurately verifying complex lease agreements across diverse industries, requiring meticulous attention to detail and up-to-date knowledge of accounting standards. The probability of encountering discrepancies or incomplete records is high, demanding strong analytical and problem-solving skills. Navigating varying regulatory requirements and ensuring compliance may also present ongoing difficulties within this role.

Career Advancement

A Lease Portfolio Auditor plays a critical role in assessing lease agreements for compliance and accuracy, offering valuable expertise in real estate finance and accounting. Mastery in lease audit techniques and familiarity with ASC 842 and IFRS 16 standards can accelerate career progression to senior auditor or portfolio manager positions. Continuous skill enhancement and industry experience enable professionals to pursue leadership roles within property management and corporate finance sectors.

Key Terms

GAAP Standards

A Lease Portfolio Auditor ensures compliance with GAAP standards such as ASC 842 by reviewing lease agreements and financial statements for accurate recognition, measurement, and disclosure. They analyze lease terms and financial data to verify proper lease classification and amortization of right-of-use assets and liabilities. Proficiency in GAAP lease accounting principles is essential for identifying discrepancies and supporting corporate financial reporting integrity.

kuljobs.com

kuljobs.com