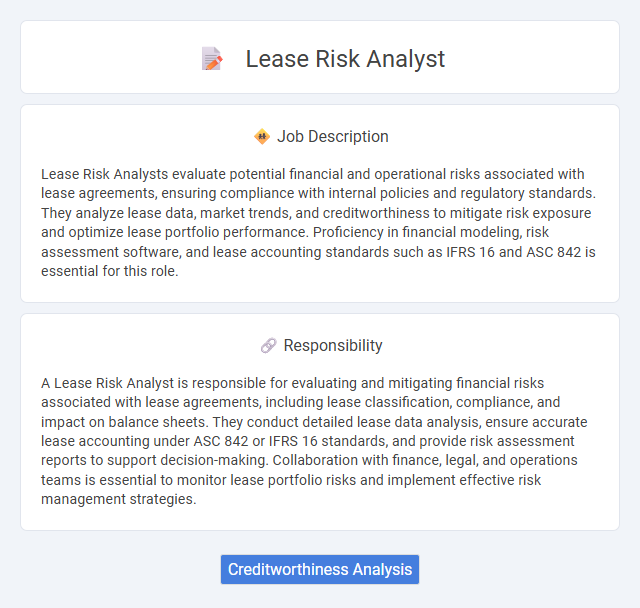

Lease Risk Analysts evaluate potential financial and operational risks associated with lease agreements, ensuring compliance with internal policies and regulatory standards. They analyze lease data, market trends, and creditworthiness to mitigate risk exposure and optimize lease portfolio performance. Proficiency in financial modeling, risk assessment software, and lease accounting standards such as IFRS 16 and ASC 842 is essential for this role.

Individuals with strong analytical skills and attention to detail are likely well-suited for a Lease Risk Analyst role. Those who possess a background in finance or real estate and can effectively assess lease agreements and market conditions may perform effectively. Candidates who demonstrate good judgment, risk assessment capabilities, and the ability to communicate complex information clearly are probably more successful in this position.

Qualification

A Lease Risk Analyst must possess strong analytical skills and expertise in financial modeling, lease accounting standards such as ASC 842 and IFRS 16, and risk assessment methodologies. Proficiency in data analysis tools like Excel, SQL, and lease management software is essential to evaluate lease portfolios and identify potential risks effectively. Advanced knowledge of real estate finance, contract law, and regulatory compliance enhances accuracy in risk identification and mitigation for corporate lease agreements.

Responsibility

A Lease Risk Analyst is responsible for evaluating and mitigating financial risks associated with lease agreements, including lease classification, compliance, and impact on balance sheets. They conduct detailed lease data analysis, ensure accurate lease accounting under ASC 842 or IFRS 16 standards, and provide risk assessment reports to support decision-making. Collaboration with finance, legal, and operations teams is essential to monitor lease portfolio risks and implement effective risk management strategies.

Benefit

A Lease Risk Analyst is likely to benefit from enhanced expertise in assessing and managing financial risks associated with lease agreements, improving a company's ability to minimize potential losses. This role may offer valuable experience in regulatory compliance and market analysis, increasing professional growth opportunities. Developing skills in data interpretation and risk mitigation could lead to higher job security and career advancement in finance-related fields.

Challenge

The role of a Lease Risk Analyst likely involves navigating complex financial data to identify potential risks in lease agreements, requiring strong analytical skills and attention to detail. It may be challenging to accurately assess market fluctuations and legal implications that impact lease terms, demanding continuous learning and adaptation. Managing uncertainties while ensuring compliance could make this position demanding but critical for organizational risk mitigation.

Career Advancement

Lease Risk Analysts specialize in assessing financial risks associated with lease agreements, leveraging advanced data analytics and market trend evaluation to optimize asset management strategies. Mastery in lease accounting standards and risk modeling enhances their value, positioning them for advancement to senior risk management roles or strategic planning positions within finance sectors. Continuous professional development in regulatory compliance and emerging risk mitigation technologies accelerates career growth in corporate finance and real estate investment domains.

Key Terms

Creditworthiness Analysis

A Lease Risk Analyst specializes in assessing the creditworthiness of potential lessees by analyzing financial statements, credit reports, and payment histories. This role involves identifying risks related to lease defaults and recommending mitigation strategies based on predictive data models. Expertise in financial analysis tools and knowledge of leasing regulations are essential to accurately evaluate the lessee's ability to meet lease obligations.

kuljobs.com

kuljobs.com