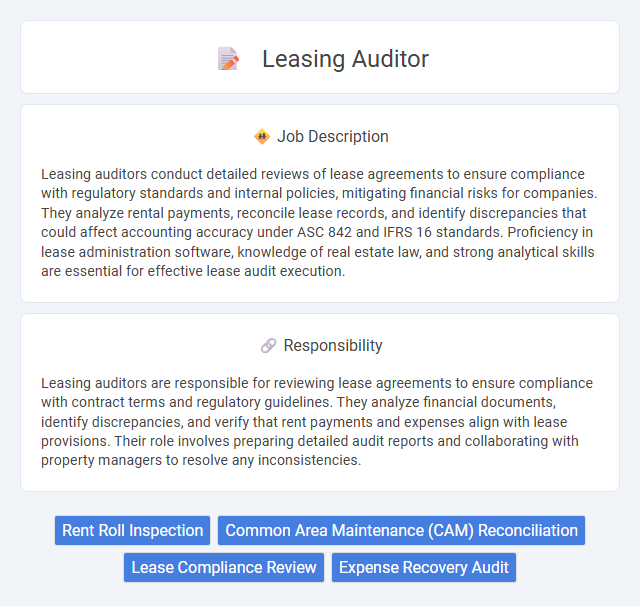

Leasing auditors conduct detailed reviews of lease agreements to ensure compliance with regulatory standards and internal policies, mitigating financial risks for companies. They analyze rental payments, reconcile lease records, and identify discrepancies that could affect accounting accuracy under ASC 842 and IFRS 16 standards. Proficiency in lease administration software, knowledge of real estate law, and strong analytical skills are essential for effective lease audit execution.

Individuals with strong attention to detail and analytical skills are likely suitable for a Leasing Auditor role, as it requires thorough examination of leasing contracts and financial records. People who enjoy working with numbers and have a systematic approach to identifying discrepancies may find this job fitting. Conversely, those who prefer less structured tasks or lack patience for detailed review might struggle in this position.

Qualification

A Leasing Auditor must possess a strong background in accounting or finance, typically requiring a bachelor's degree in these fields. Expertise in lease accounting standards such as ASC 842 or IFRS 16 is essential for accurate financial reporting and compliance. Proficiency in audit software, attention to detail, and analytical skills are critical for evaluating lease agreements and identifying discrepancies.

Responsibility

Leasing auditors are responsible for reviewing lease agreements to ensure compliance with contract terms and regulatory guidelines. They analyze financial documents, identify discrepancies, and verify that rent payments and expenses align with lease provisions. Their role involves preparing detailed audit reports and collaborating with property managers to resolve any inconsistencies.

Benefit

A Leasing Auditor role likely offers benefits such as enhancing financial accuracy and compliance within property management, which can improve operational efficiency. This position may provide the opportunity to develop expertise in lease agreements and financial auditing, increasing career growth potential. It probably includes exposure to diverse real estate portfolios, which can broaden industry knowledge and professional skills.

Challenge

Leasing Auditor positions likely present challenges related to meticulously verifying lease agreements and financial records to ensure compliance and accuracy. The role may demand a strong ability to identify discrepancies and potential fraud within complex lease documentation. It probably requires continuous adaptation to evolving regulations and industry standards, making attention to detail and critical thinking essential.

Career Advancement

Leasing Auditor roles offer significant opportunities for career advancement within real estate finance and compliance sectors. Professionals in this position develop expertise in lease agreement analysis, internal controls, and risk management, paving the way to senior auditing, regulatory compliance, or real estate asset management roles. Mastery of industry-specific software and understanding of commercial lease structures enhance prospects for leadership positions and specialized consultancy.

Key Terms

Rent Roll Inspection

A Leasing Auditor specializing in Rent Roll Inspection meticulously reviews leasing agreements and tenancy data to ensure accuracy and compliance with contractual terms. They analyze rent rolls to verify lease payments, tenant information, and occupancy rates, identifying discrepancies or potential revenue losses. Expertise in rent roll data management and lease auditing software is essential to optimize financial reporting and support property management decisions.

Common Area Maintenance (CAM) Reconciliation

A Leasing Auditor specializing in Common Area Maintenance (CAM) Reconciliation ensures accurate allocation and verification of CAM charges between landlords and tenants. This role involves detailed analysis of CAM expenses, identifying discrepancies in billing statements, and verifying expense eligibility according to lease agreements. Expertise in lease terms, financial auditing, and reconciliation software is essential to maintain transparency and optimize property cost recovery.

Lease Compliance Review

Leasing Auditors conduct detailed lease compliance reviews to ensure adherence to contractual terms and regulatory requirements. They analyze lease agreements for accuracy in rent calculations, expense recoveries, and tenant obligations, identifying discrepancies or potential risks. Their evaluations help maintain financial integrity and minimize legal liabilities in property management operations.

Expense Recovery Audit

Leasing Auditors specializing in Expense Recovery Audit meticulously analyze lease agreements and related financial records to identify overcharges and discrepancies in expense allocations. They ensure accurate recovery of operational costs such as property taxes, insurance, and maintenance fees by verifying charges against lease terms and market benchmarks. Advanced data analysis and auditing software are key tools in optimizing expense recovery and safeguarding tenant and landlord financial interests.

kuljobs.com

kuljobs.com