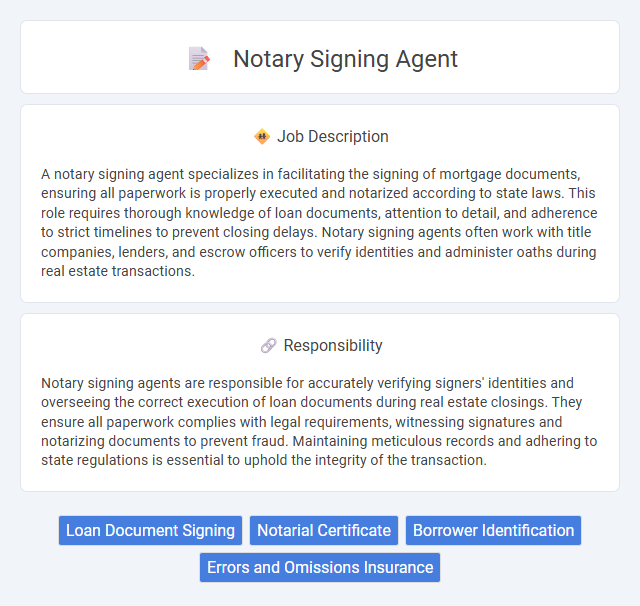

A notary signing agent specializes in facilitating the signing of mortgage documents, ensuring all paperwork is properly executed and notarized according to state laws. This role requires thorough knowledge of loan documents, attention to detail, and adherence to strict timelines to prevent closing delays. Notary signing agents often work with title companies, lenders, and escrow officers to verify identities and administer oaths during real estate transactions.

People who are detail-oriented, organized, and comfortable working independently may be well-suited for a notary signing agent role. Those able to manage time efficiently and handle sensitive documents with confidentiality are more likely to succeed in this position. Individuals who prefer flexible work schedules and enjoy interacting with diverse clients might find this job particularly suitable.

Qualification

A Notary Signing Agent must hold a valid notary public commission and complete specialized training in loan document signings, including knowledge of real estate and mortgage terminology. Certification from reputable organizations such as the National Notary Association enhances credibility and demonstrates proficiency in handling sensitive documents. Attention to detail, strong communication skills, and the ability to maintain confidentiality are essential qualifications for successful signing agents.

Responsibility

Notary signing agents are responsible for accurately verifying signers' identities and overseeing the correct execution of loan documents during real estate closings. They ensure all paperwork complies with legal requirements, witnessing signatures and notarizing documents to prevent fraud. Maintaining meticulous records and adhering to state regulations is essential to uphold the integrity of the transaction.

Benefit

A notary signing agent job likely offers flexible working hours and the opportunity to earn extra income with relatively low startup costs. The role may provide consistent demand due to the steady need for notarizing legal documents like loan signings and real estate transactions. Benefits often include independent work environments and the potential for expanding professional networks within the legal and real estate industries.

Challenge

Handling the role of a notary signing agent often involves meeting tight deadlines and managing complex documents with accuracy, which can be challenging. There is a probability that unforeseen issues, such as discrepancies in paperwork or difficult clients, will arise and require quick problem-solving skills. The ability to adapt and maintain professionalism under pressure is likely crucial for success in this demanding position.

Career Advancement

Notary signing agents can advance their careers by gaining certifications such as the National Notary Association's Certified Signing Agent designation, which enhances credibility and access to higher-value assignments. Specializing in areas like real estate loan signings or legal document notarizations opens opportunities for increased earnings and client trust. Building a robust network with title companies, law firms, and signing services accelerates career growth and referral business.

Key Terms

Loan Document Signing

A Notary Signing Agent specializes in facilitating loan document signing by verifying signer identities and ensuring all paperwork is accurately completed and properly notarized. These professionals play a critical role in mortgage closings, handling documents such as deeds of trust, promissory notes, and closing disclosures. Their expertise helps lenders, title companies, and signing services execute secure and compliant loan transactions efficiently.

Notarial Certificate

A Notary signing agent plays a crucial role in the execution of legal documents by ensuring the accuracy and authenticity of signatures through the notarial certificate. This certificate serves as an official statement confirming the signer's identity and voluntary intent, which is essential for the document's legal validity. Proper completion of the notarial certificate helps prevent fraud and supports the enforceability of contracts, deeds, and loan documents.

Borrower Identification

Notary signing agents play a crucial role in verifying borrower identification to ensure the legitimacy of loan documents during real estate transactions. They carefully examine government-issued IDs, such as driver's licenses or passports, to confirm the borrower's identity matches the loan paperwork. Proper borrower identification reduces the risk of fraud and helps maintain compliance with state and federal regulations.

Errors and Omissions Insurance

Errors and Omissions Insurance is essential for notary signing agents to protect against claims of negligence, errors, or breaches of duty during the notarization process. This insurance covers legal defense costs and potential settlements, ensuring financial security when handling sensitive loan documents or real estate transactions. Maintaining this coverage enhances a notary signing agent's credibility and trustworthiness with lenders, title companies, and clients.

kuljobs.com

kuljobs.com