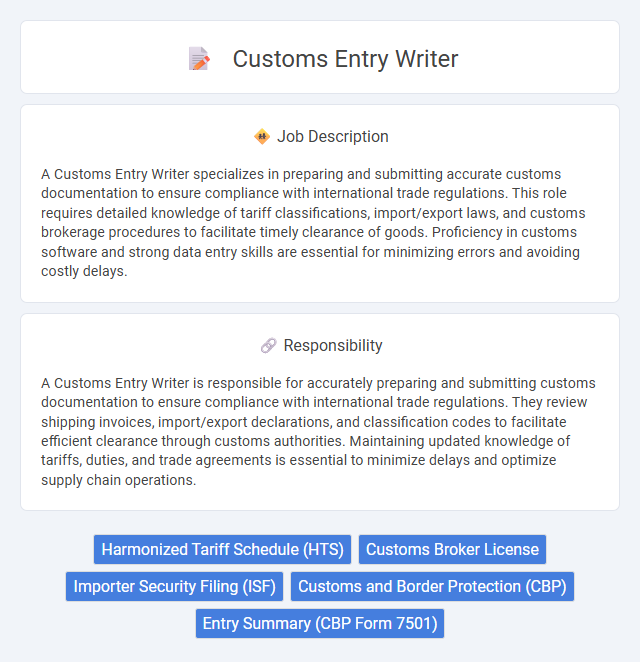

A Customs Entry Writer specializes in preparing and submitting accurate customs documentation to ensure compliance with international trade regulations. This role requires detailed knowledge of tariff classifications, import/export laws, and customs brokerage procedures to facilitate timely clearance of goods. Proficiency in customs software and strong data entry skills are essential for minimizing errors and avoiding costly delays.

Individuals who are detail-oriented and able to manage complex documentation under strict deadlines are likely suitable for a Customs Entry Writer position. Those comfortable working within regulatory frameworks and interpreting trade compliance rules may find this role aligns well with their skills. People who struggle with precision or have difficulty adapting to frequent regulatory changes might face challenges in this job.

Qualification

A Customs Entry Writer typically requires a strong understanding of international trade regulations and customs documentation processes. Proficiency in classification codes, tariff schedules, and compliance standards is essential to ensure accurate and timely customs clearance. Experience with electronic data interchange (EDI) systems and attention to detail in reviewing shipment details are key qualifications for this role.

Responsibility

A Customs Entry Writer is responsible for accurately preparing and submitting customs documentation to ensure compliance with international trade regulations. They review shipping invoices, import/export declarations, and classification codes to facilitate efficient clearance through customs authorities. Maintaining updated knowledge of tariffs, duties, and trade agreements is essential to minimize delays and optimize supply chain operations.

Benefit

A Customs Entry Writer position likely provides the benefit of developing specialized knowledge in international trade regulations and customs documentation processes. This role may enhance career prospects by offering experience in compliance and logistics, which are valuable across global industries. The position probably offers opportunities for skill growth in data accuracy and attention to detail, contributing to operational efficiency.

Challenge

Customs Entry Writers likely face the challenge of accurately interpreting complex international trade regulations and ensuring compliance to avoid costly delays or penalties. Managing frequent updates in customs policies and documentation requirements can increase the probability of errors, demanding meticulous attention to detail. Meeting tight deadlines while coordinating with multiple stakeholders may also pose significant workflow challenges.

Career Advancement

Customs Entry Writers play a crucial role in ensuring compliance with import-export regulations by accurately documenting shipments and liaising with customs authorities. Mastery of customs laws and efficient software skills can lead to progression into customs brokerage, logistics coordination, or supply chain management positions. Experienced professionals often advance to supervisory roles, developing expertise that drives operational efficiency and regulatory adherence.

Key Terms

Harmonized Tariff Schedule (HTS)

A Customs Entry Writer specializes in preparing accurate documentation for importing and exporting goods, ensuring compliance with customs regulations using the Harmonized Tariff Schedule (HTS). Mastery of HTS codes is essential for correctly classifying products and determining applicable duties, taxes, and regulations. This expertise facilitates efficient customs clearance, minimizes delays, and avoids costly penalties for misclassification.

Customs Broker License

A Customs Entry Writer plays a crucial role in preparing and submitting import documentation to ensure compliance with U.S. Customs and Border Protection regulations. Holding a Customs Broker License is essential, as it authorizes the individual to act as an intermediary between importers and the government, facilitating clearance of goods through customs. Expertise in tariff classification, valuation, and regulatory compliance is necessary to accurately prepare customs entries and avoid delays or penalties.

Importer Security Filing (ISF)

Customs Entry Writers specialize in preparing and submitting Importer Security Filing (ISF) documentation to ensure compliance with U.S. Customs and Border Protection (CBP) regulations. Accurate ISF filing, which involves providing detailed shipment data such as manufacturer, shipper, consignee, and container information, is critical to prevent penalties and avoid shipment delays. Expertise in customs compliance software and knowledge of CBP deadlines enhances the efficiency and accuracy of ISF submissions in the global import process.

Customs and Border Protection (CBP)

Customs Entry Writers play a crucial role in ensuring compliance with Customs and Border Protection (CBP) import regulations by accurately preparing and submitting entry documents. They must possess in-depth knowledge of Harmonized Tariff Schedules, CBP entry procedures, and classification guidelines to facilitate smooth customs clearance and avoid costly delays or penalties. Expertise in CBP Automated Commercial Environment (ACE) software is essential for efficient entry processing and real-time communication with CBP authorities.

Entry Summary (CBP Form 7501)

A Customs Entry Writer specializes in preparing and filing Entry Summary (CBP Form 7501) to ensure accurate declaration of imported goods to U.S. Customs and Border Protection. They meticulously review shipment documents, classify merchandise under the Harmonized Tariff Schedule, and calculate duties, taxes, and fees to guarantee compliance with federal regulations. Expertise in CBP Form 7501 is critical for avoiding delays and penalties during customs clearance and facilitating smooth international trade operations.

kuljobs.com

kuljobs.com