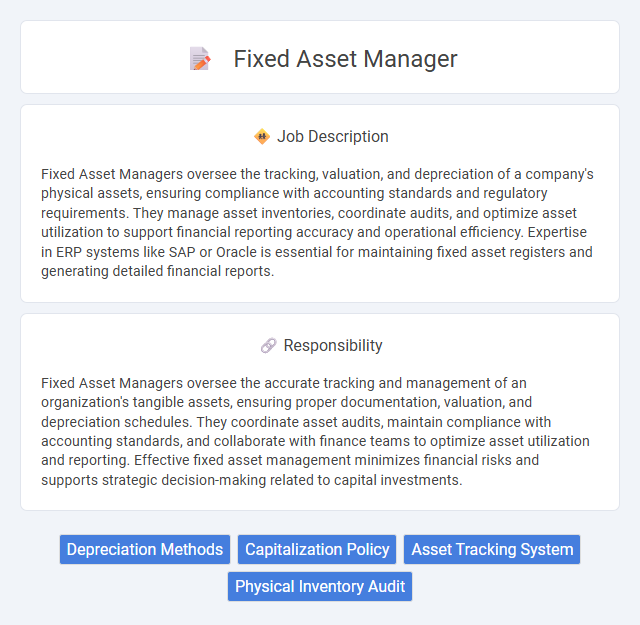

Fixed Asset Managers oversee the tracking, valuation, and depreciation of a company's physical assets, ensuring compliance with accounting standards and regulatory requirements. They manage asset inventories, coordinate audits, and optimize asset utilization to support financial reporting accuracy and operational efficiency. Expertise in ERP systems like SAP or Oracle is essential for maintaining fixed asset registers and generating detailed financial reports.

Individuals with strong attention to detail and organizational skills are likely to excel as Fixed Asset Managers, given the role's requirement to track and manage company assets accurately. Those comfortable with data analysis and financial reporting might find the job well-suited to their abilities, as it involves regular reconciliation and compliance checks. However, candidates who struggle with routine, precise tasks may face challenges adapting to the responsibilities of this position.

Qualification

A Fixed Asset Manager must possess strong expertise in accounting principles, particularly in asset capitalization, depreciation, and impairment processes. Proficiency in asset management software such as SAP, Oracle, or NetSuite is essential for accurate tracking and reporting. A bachelor's degree in finance, accounting, or business administration combined with relevant certifications like CPA or CMA enhances qualification strength.

Responsibility

Fixed Asset Managers oversee the accurate tracking and management of an organization's tangible assets, ensuring proper documentation, valuation, and depreciation schedules. They coordinate asset audits, maintain compliance with accounting standards, and collaborate with finance teams to optimize asset utilization and reporting. Effective fixed asset management minimizes financial risks and supports strategic decision-making related to capital investments.

Benefit

Fixed Asset Managers likely improve organizational efficiency by accurately tracking and managing company assets, which may reduce financial discrepancies and enhance asset utilization. They probably contribute to cost savings through optimized maintenance schedules and timely asset disposal. Their expertise might ensure compliance with accounting standards, minimizing audit risks and supporting informed decision-making.

Challenge

Managing fixed assets likely involves the challenge of maintaining accurate records amid constantly changing asset conditions and valuations. Ensuring compliance with accounting standards and regulatory requirements probably demands meticulous attention to detail. The role may also require problem-solving skills to address discrepancies and optimize asset utilization effectively.

Career Advancement

Fixed Asset Managers play a critical role in tracking and managing an organization's physical assets, ensuring accurate accounting and compliance with financial regulations. Career advancement opportunities include roles such as Senior Asset Manager, Finance Controller, or Chief Financial Officer, with a strong focus on asset optimization and strategic financial planning. Proficiency in asset management software, regulatory knowledge, and analytical skills enhances prospects for leadership positions and industry specialization.

Key Terms

Depreciation Methods

Fixed Asset Managers are responsible for tracking and managing an organization's fixed assets through accurate application of depreciation methods such as straight-line, declining balance, and units of production. Mastery of these depreciation techniques ensures precise asset valuation, compliance with accounting standards like GAAP or IFRS, and optimized financial reporting. Effective depreciation management directly impacts budgeting, tax calculations, and asset lifecycle planning within the fixed asset portfolio.

Capitalization Policy

A Fixed Asset Manager ensures compliance with the Capitalization Policy by accurately tracking and recording all capital expenditures exceeding the company's capitalization threshold. This role involves maintaining detailed asset registers, overseeing asset classification, and ensuring depreciation schedules align with accounting standards. Effective management of the Capitalization Policy minimizes financial discrepancies and supports accurate financial reporting.

Asset Tracking System

A Fixed Asset Manager specializes in overseeing an organization's Asset Tracking System to ensure accurate recording, monitoring, and reporting of physical assets throughout their lifecycle. They implement advanced software solutions and RFID technology to enhance asset visibility and prevent loss, depreciation, or misplacement. Expertise in asset database management and compliance with financial regulations ensures optimized asset utilization and streamlined audit processes.

Physical Inventory Audit

Fixed Asset Managers oversee the accuracy of asset records by conducting thorough Physical Inventory Audits, verifying the presence and condition of company-owned fixed assets. They utilize barcode scanning technology and asset management software to reconcile discrepancies between physical counts and recorded data, ensuring compliance with internal controls and regulatory standards. Detailed audit reports generated by Fixed Asset Managers support financial reporting accuracy and help identify opportunities for asset optimization and loss prevention.

kuljobs.com

kuljobs.com