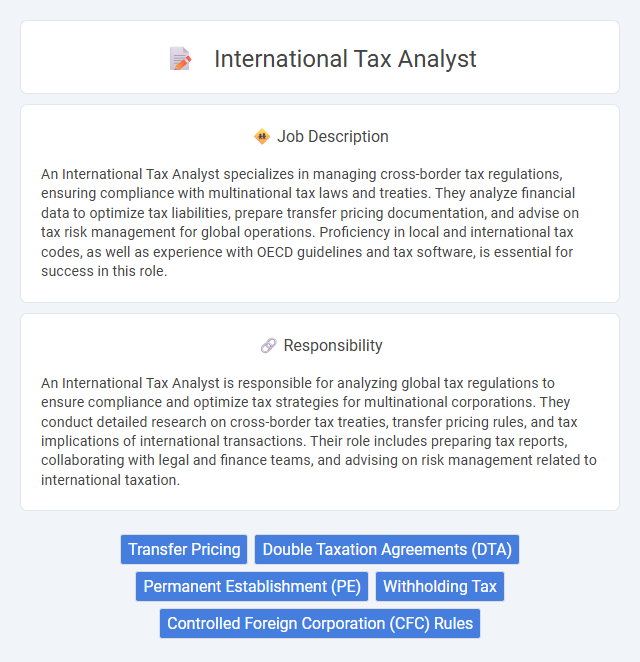

An International Tax Analyst specializes in managing cross-border tax regulations, ensuring compliance with multinational tax laws and treaties. They analyze financial data to optimize tax liabilities, prepare transfer pricing documentation, and advise on tax risk management for global operations. Proficiency in local and international tax codes, as well as experience with OECD guidelines and tax software, is essential for success in this role.

Individuals with strong analytical skills and a keen interest in global finance are likely to thrive as International Tax Analysts. Candidates comfortable working under pressure and adapting to constantly changing tax regulations may find this role well-suited to their abilities. Those who prefer routine tasks with limited complexity might not find this position as compatible with their strengths.

Qualification

International Tax Analyst roles require comprehensive knowledge of global tax regulations, transfer pricing, and cross-border tax compliance. Candidates must possess a bachelor's degree in accounting, finance, or law, often supplemented by certifications such as CPA, CTA, or ACCA. Proficiency in tax software, analytical skills, and experience with multinational tax planning and reporting are critical for ensuring accuracy and minimizing risk in complex international tax environments.

Responsibility

An International Tax Analyst is responsible for analyzing global tax regulations to ensure compliance and optimize tax strategies for multinational corporations. They conduct detailed research on cross-border tax treaties, transfer pricing rules, and tax implications of international transactions. Their role includes preparing tax reports, collaborating with legal and finance teams, and advising on risk management related to international taxation.

Benefit

International Tax Analyst roles likely offer significant benefits including competitive salaries and comprehensive health coverage. There is a strong probability of gaining valuable experience in global tax regulations, which could enhance career growth opportunities. Employees might also enjoy flexible work arrangements and access to continuous professional development programs.

Challenge

The International Tax Analyst role likely involves navigating complex global tax regulations, presenting a constant challenge due to frequently changing laws and cross-border compliance requirements. The position probably demands a high level of analytical skill to interpret diverse tax treaties and mitigate risks in multinational transactions. It may also require staying updated on international tax trends to optimize strategies and ensure regulatory adherence.

Career Advancement

An International Tax Analyst plays a crucial role in navigating complex tax regulations across multiple jurisdictions, enhancing global compliance and optimizing tax strategies for multinational corporations. Mastery of transfer pricing, tax treaties, and cross-border tax regulations significantly boosts career growth opportunities within reputable accounting firms and multinational enterprises. Advancing in this career path often leads to senior advisory roles, tax consultancy leadership, or specialized positions in international tax law and global tax policy development.

Key Terms

Transfer Pricing

An International Tax Analyst specializing in Transfer Pricing conducts comprehensive analysis to ensure compliance with global tax regulations and arm's length principles. This role involves evaluating cross-border transactions, preparing transfer pricing documentation, and supporting risk assessments to prevent double taxation and audits. Expertise in OECD guidelines and BEPS compliance is essential for optimizing tax strategies and mitigating transfer pricing controversies.

Double Taxation Agreements (DTA)

International Tax Analysts specializing in Double Taxation Agreements (DTA) assess cross-border tax regulations to optimize corporate tax obligations and ensure compliance with bilateral treaties. They analyze treaty provisions to prevent double taxation, mitigate withholding taxes, and advise on tax-efficient structures for multinational corporations. Proficiency in international tax law, transfer pricing, and treaty interpretation is essential for accurately navigating complex DTA frameworks and maximizing global tax benefits.

Permanent Establishment (PE)

An International Tax Analyst specializing in Permanent Establishment (PE) assesses cross-border business activities to determine the existence and tax implications of a PE under various tax treaties and domestic laws. They analyze operational structures, contracts, and transactions to ensure compliance with international tax regulations and minimize the risk of double taxation or tax disputes. Expertise in OECD Guidelines, BEPS Action Plans, and local tax authorities' interpretations is crucial for accurately identifying PE status and advising multinational corporations on tax planning strategies.

Withholding Tax

An International Tax Analyst specializing in withholding tax manages cross-border tax obligations to ensure compliance with global tax treaties and regulations, minimizing tax leakage on outbound and inbound payments. Expertise in analyzing withholding tax rates, exemptions, and treaty benefits is essential for optimizing multinational cash flow and reducing tax liabilities. Proficiency in tax software and continuous monitoring of legislative changes enable accurate withholding tax reporting and strategic tax planning for international transactions.

Controlled Foreign Corporation (CFC) Rules

International Tax Analysts specializing in Controlled Foreign Corporation (CFC) rules analyze complex tax regulations to ensure multinational corporations comply with cross-border tax laws and minimize risks associated with income repatriation. They interpret CFC rules to identify passive income streams subject to immediate taxation and assist in structuring foreign entities to optimize global tax liabilities. Proficiency in global tax treaties, transfer pricing, and anti-deferral provisions is critical for advising on strategic tax planning and regulatory reporting for offshore subsidiaries.

kuljobs.com

kuljobs.com