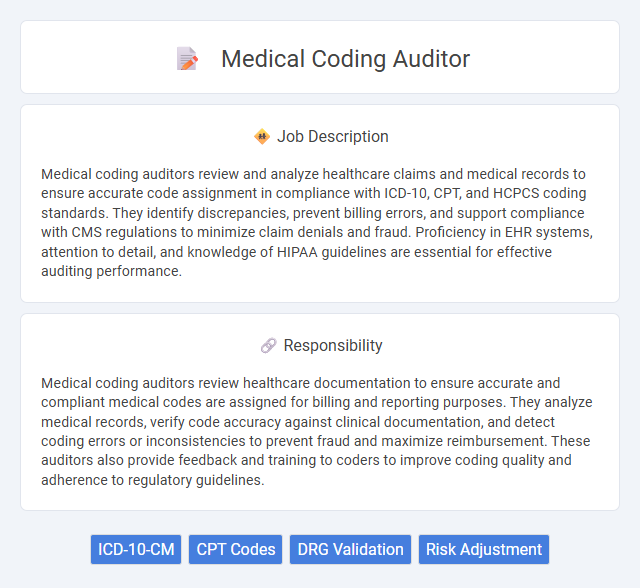

Medical coding auditors review and analyze healthcare claims and medical records to ensure accurate code assignment in compliance with ICD-10, CPT, and HCPCS coding standards. They identify discrepancies, prevent billing errors, and support compliance with CMS regulations to minimize claim denials and fraud. Proficiency in EHR systems, attention to detail, and knowledge of HIPAA guidelines are essential for effective auditing performance.

Individuals with strong attention to detail and a solid understanding of medical terminology and healthcare regulations are likely suitable for a medical coding auditor position. Those who struggle with repetitive tasks or have limited knowledge of coding systems may find the role challenging. The job might be better suited for people who enjoy analytical thinking and maintaining accuracy in complex data environments.

Qualification

Medical coding auditors require a thorough understanding of ICD-10, CPT, and HCPCS coding systems and must possess certifications such as Certified Professional Coder (CPC) or Certified Coding Specialist (CCS). Strong analytical skills and attention to detail are essential to accurately review medical records for compliance and reimbursement accuracy. Experience in healthcare documentation, coding software proficiency, and knowledge of HIPAA regulations further enhance qualifications for this role.

Responsibility

Medical coding auditors review healthcare documentation to ensure accurate and compliant medical codes are assigned for billing and reporting purposes. They analyze medical records, verify code accuracy against clinical documentation, and detect coding errors or inconsistencies to prevent fraud and maximize reimbursement. These auditors also provide feedback and training to coders to improve coding quality and adherence to regulatory guidelines.

Benefit

A Medical Coding Auditor role likely offers substantial benefits including the potential for increased accuracy in healthcare billing and compliance, reducing costly errors and improving reimbursements. This position may provide opportunities to enhance knowledge of medical coding standards and healthcare regulations, which can lead to career advancement. Employees might also experience improved job security and satisfaction by contributing to the integrity of healthcare documentation and financial processes.

Challenge

A Medical Coding Auditor role likely presents significant challenges due to the need for meticulous attention to detail and in-depth knowledge of medical terminology and coding standards. The high probability of encountering complex billing documentation and constantly evolving healthcare regulations demands continuous learning and adaptability. Navigating discrepancies in coding accuracy could pose frequent obstacles requiring critical thinking and problem-solving skills.

Career Advancement

Medical coding auditors play a critical role in ensuring accuracy and compliance in healthcare documentation, which directly impacts reimbursement and regulatory standards. Career advancement in this field often leads to senior auditor positions, coding management roles, or healthcare compliance consulting. Expertise in ICD-10, CPT, and HCPCS coding systems combined with certifications like CRC or CPC significantly enhances promotion opportunities and salary potential.

Key Terms

ICD-10-CM

Medical coding auditors specializing in ICD-10-CM ensure the accuracy and compliance of clinical data coding within healthcare records by meticulously reviewing and validating diagnostic codes. Their expertise in ICD-10-CM classifications supports healthcare organizations in minimizing coding errors, optimizing reimbursement, and adhering to regulatory standards. Proficient auditors utilize coding guidelines and medical documentation to identify discrepancies, improve coding quality, and enhance overall healthcare data integrity.

CPT Codes

A Medical Coding Auditor specializes in reviewing and validating CPT (Current Procedural Terminology) codes to ensure accurate documentation and compliance with healthcare regulations. Expertise in CPT coding guidelines and healthcare billing practices is essential for identifying coding errors, preventing claim denials, and optimizing reimbursement processes. Proficiency in auditing software and electronic health records enhances the accuracy and efficiency of medical coding audits.

DRG Validation

Medical coding auditors specializing in DRG validation ensure the accuracy and compliance of diagnosis-related group assignments, which directly impact hospital reimbursement and quality reporting. By reviewing clinical documentation and coding compliance, they identify discrepancies, support billing integrity, and reduce financial risks for healthcare providers. Expertise in ICD-10-CM, CPT coding, and CMS guidelines is essential for precise DRG validation and audit processes.

Risk Adjustment

A Medical Coding Auditor specializing in Risk Adjustment ensures accurate documentation and coding alignment with clinical guidelines to optimize reimbursement and compliance. They analyze patient records to identify potential gaps in coding that affect risk score accuracy under CMS regulations and the Hierarchical Condition Categories (HCC) model. Proficiency in ICD-10-CM, CPT coding, and familiarity with healthcare quality measures are essential for mitigating financial risks and improving data integrity in value-based care programs.

kuljobs.com

kuljobs.com