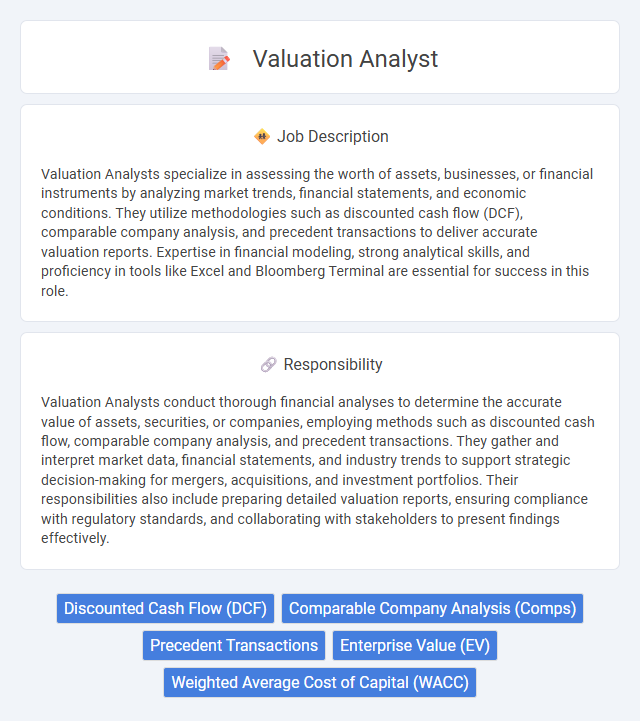

Valuation Analysts specialize in assessing the worth of assets, businesses, or financial instruments by analyzing market trends, financial statements, and economic conditions. They utilize methodologies such as discounted cash flow (DCF), comparable company analysis, and precedent transactions to deliver accurate valuation reports. Expertise in financial modeling, strong analytical skills, and proficiency in tools like Excel and Bloomberg Terminal are essential for success in this role.

Individuals with strong analytical skills and a detail-oriented mindset are likely suitable for a Valuation Analyst role, as the job requires precise financial assessments and data interpretation. People who thrive under pressure and enjoy working with complex financial models may find this position a good fit, while those uncomfortable with repetitive data analysis could face challenges. Candidates possessing effective communication skills might better succeed, given the need to explain valuation outcomes to stakeholders.

Qualification

Valuation Analysts typically require a strong background in finance, accounting, or economics, often demonstrated by a bachelor's degree in these fields. Professional certifications such as CFA (Chartered Financial Analyst) or ASA (Accredited Senior Appraiser) enhance credibility and expertise in asset valuation methodologies. Proficiency in financial modeling, data analysis, and familiarity with valuation software are crucial skills for accurate and comprehensive asset appraisals.

Responsibility

Valuation Analysts conduct thorough financial analyses to determine the accurate value of assets, securities, or companies, employing methods such as discounted cash flow, comparable company analysis, and precedent transactions. They gather and interpret market data, financial statements, and industry trends to support strategic decision-making for mergers, acquisitions, and investment portfolios. Their responsibilities also include preparing detailed valuation reports, ensuring compliance with regulatory standards, and collaborating with stakeholders to present findings effectively.

Benefit

A Valuation Analyst role likely offers significant financial insight that can enhance decision-making and investment strategies. The position probably provides opportunities for exposure to diverse asset classes, improving analytical skills and industry knowledge. It may also lead to career advancement in finance through gaining specialized expertise in valuation methods and market trends.

Challenge

Valuation Analyst roles likely involve complex financial modeling and interpreting market trends, presenting a constant challenge to maintain accuracy amidst fluctuating variables. The probability of encountering intricate asset classes or unconventional financial data may increase the difficulty of delivering precise valuations. Continuous learning and adapting to regulatory changes seem crucial for overcoming these challenges effectively.

Career Advancement

Valuation Analysts specializing in financial modeling and asset appraisal enhance their expertise to unlock senior roles such as Senior Valuation Analyst or Portfolio Manager. Mastery in data analysis, industry regulations, and emerging valuation techniques positions candidates for leadership opportunities in investment firms or corporate finance departments. Continuous learning through certifications like CFA or ASA accelerates career progression and expands professional credibility.

Key Terms

Discounted Cash Flow (DCF)

Valuation Analysts specialize in assessing a company's financial worth using advanced methodologies, with Discounted Cash Flow (DCF) being a primary approach that estimates intrinsic value by projecting future cash flows and discounting them to present value using a risk-adjusted discount rate. Expertise in building detailed financial models, analyzing revenue growth, operating margins, capital expenditure, and working capital trends is essential to generate accurate DCF valuations. These analysts play a critical role in mergers and acquisitions, investment decisions, and financial reporting by providing data-driven insights on asset valuation and business potential.

Comparable Company Analysis (Comps)

A Valuation Analyst specializing in Comparable Company Analysis (Comps) assesses a target company's value by evaluating financial metrics and market multiples of similar publicly traded firms. They meticulously select peer companies, analyze valuation ratios like EV/EBITDA and P/E, and adjust for differences in size, growth, and profitability to ensure accurate relative valuation. Expertise in financial modeling, industry research, and market trends enables them to provide critical insights for investment decisions and corporate finance transactions.

Precedent Transactions

Valuation Analysts specializing in Precedent Transactions meticulously analyze historical M&A deals to determine asset or company value benchmarks, leveraging transaction multiples such as EV/EBITDA, EV/Sales, and P/E ratios. They compile and adjust financial data from comparable sales to provide precise valuation metrics critical for strategic investment decisions. Expertise in interpreting market trends and deal specifics ensures accurate benchmarking and supports effective negotiation and financial reporting processes.

Enterprise Value (EV)

Valuation Analysts specialize in determining Enterprise Value (EV) by analyzing financial statements, market conditions, and comparable company data to assess a business's total worth. They utilize discounted cash flow (DCF) models, precedent transactions, and market multiples to calculate EV, providing crucial insights for mergers, acquisitions, and investment decisions. Accurate EV assessment enables stakeholders to make informed choices regarding capital structure, strategic planning, and shareholder value maximization.

Weighted Average Cost of Capital (WACC)

A Valuation Analyst specializes in assessing company value using financial models, with a core focus on calculating the Weighted Average Cost of Capital (WACC) to determine a firm's cost of financing from equity and debt sources. Precise WACC estimation is crucial for discounting future cash flows, enabling accurate intrinsic valuation and investment appraisal. Expertise in market data analysis, capital structure evaluation, and risk assessment underpins effective WACC computation and overall valuation accuracy.

kuljobs.com

kuljobs.com