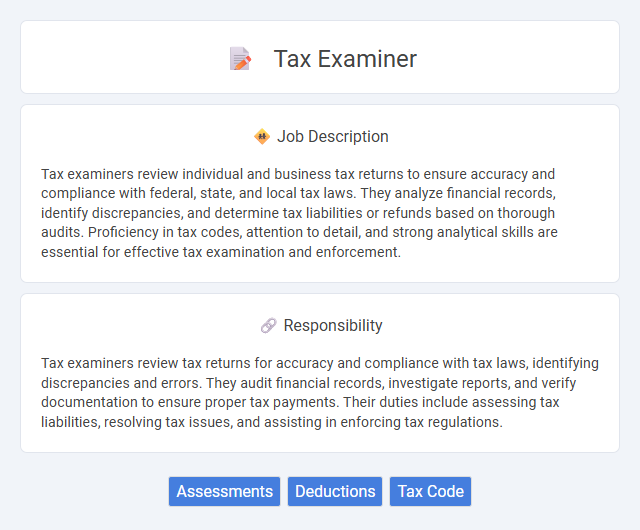

Tax examiners review individual and business tax returns to ensure accuracy and compliance with federal, state, and local tax laws. They analyze financial records, identify discrepancies, and determine tax liabilities or refunds based on thorough audits. Proficiency in tax codes, attention to detail, and strong analytical skills are essential for effective tax examination and enforcement.

People who have strong analytical skills and attention to detail are likely to be suitable for a tax examiner job. Those who feel comfortable working independently and can maintain focus while reviewing complex financial documents may find this role fitting. Individuals who prefer high-pressure environments or dislike routine tasks might struggle in this position.

Qualification

A tax examiner typically requires a bachelor's degree in accounting, finance, or a related field, with strong knowledge of tax codes and regulations. Proficiency in auditing, analytical skills, and attention to detail are essential for reviewing tax returns and identifying discrepancies. Certification such as CPA (Certified Public Accountant) or experience with tax software enhances the qualifications and job effectiveness.

Responsibility

Tax examiners review tax returns for accuracy and compliance with tax laws, identifying discrepancies and errors. They audit financial records, investigate reports, and verify documentation to ensure proper tax payments. Their duties include assessing tax liabilities, resolving tax issues, and assisting in enforcing tax regulations.

Benefit

Tax examiners likely enjoy benefits such as comprehensive health insurance, retirement plans, and paid leave that support work-life balance. The job probably offers opportunities for professional development and career advancement within government agencies. Employees might also gain stability and job security due to the consistent demand for tax regulation enforcement.

Challenge

Tax examiner roles likely present significant challenges due to the complexity of tax laws and the need for meticulous attention to detail. Candidates may frequently encounter discrepancies and contentious cases requiring thorough investigation and interpretation of financial documents. This job could demand strong analytical skills and the ability to remain impartial under pressure.

Career Advancement

Tax examiners analyze tax returns and ensure compliance with tax laws, creating a foundation for career growth in accounting and finance sectors. With experience, they can advance to senior examiner roles, specializing in complex audits or tax law interpretation. Further professional development often leads to management positions, overseeing examination teams or contributing to tax policy development.

Key Terms

Assessments

Tax examiners analyze financial records and tax returns to ensure accuracy and compliance with tax laws. They conduct detailed assessments to identify discrepancies, audit liabilities, and calculate owed taxes, penalties, or refunds. Expertise in federal and state tax codes enables efficient resolution of complex tax assessment cases.

Deductions

Tax examiners specialize in reviewing financial records to verify the accuracy of deductions claimed on tax returns, ensuring compliance with IRS regulations. They analyze expense reports, receipts, and supporting documents related to deductions such as charitable contributions, business expenses, and medical costs. Expert knowledge of tax codes enables them to identify discrepancies and potential fraud, maximizing tax revenue collection while providing taxpayers with accurate refund calculations.

Tax Code

Tax examiners analyze financial records and tax returns to ensure compliance with the Internal Revenue Code, identifying discrepancies and potential tax fraud. They apply detailed knowledge of federal and state tax laws, including specific sections of the Tax Code, to assess tax liabilities accurately. Proficiency in interpreting tax regulations and updating knowledge on amendments to the Tax Code is essential for effective auditing and enforcement.

kuljobs.com

kuljobs.com