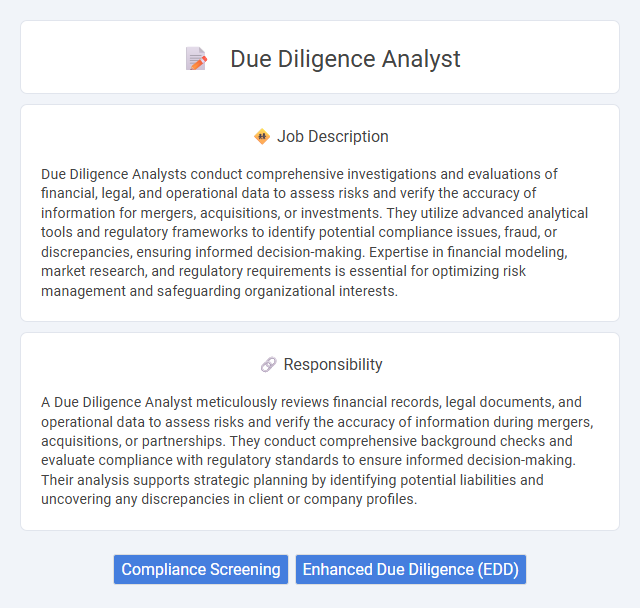

Due Diligence Analysts conduct comprehensive investigations and evaluations of financial, legal, and operational data to assess risks and verify the accuracy of information for mergers, acquisitions, or investments. They utilize advanced analytical tools and regulatory frameworks to identify potential compliance issues, fraud, or discrepancies, ensuring informed decision-making. Expertise in financial modeling, market research, and regulatory requirements is essential for optimizing risk management and safeguarding organizational interests.

Individuals with strong analytical skills and attention to detail are likely to be well-suited for the Due Diligence Analyst role, as the job demands thorough examination of financial and legal documents. Those who are comfortable working independently and can handle high-pressure situations may find this position aligns with their capabilities. Candidates who struggle with complex data interpretation or have difficulty maintaining focus over extended periods might face challenges in meeting the job's requirements.

Qualification

A Due Diligence Analyst requires strong analytical skills, proficiency in financial modeling, and expertise in risk assessment. Candidates typically hold a bachelor's degree in finance, economics, or business administration, often complemented by certifications such as CFA or CPA. Experience with regulatory compliance, data analysis tools, and effective communication skills are essential to evaluate investment opportunities and ensure adherence to legal standards.

Responsibility

A Due Diligence Analyst meticulously reviews financial records, legal documents, and operational data to assess risks and verify the accuracy of information during mergers, acquisitions, or partnerships. They conduct comprehensive background checks and evaluate compliance with regulatory standards to ensure informed decision-making. Their analysis supports strategic planning by identifying potential liabilities and uncovering any discrepancies in client or company profiles.

Benefit

Due Diligence Analyst roles likely provide significant professional growth opportunities by enhancing skills in risk assessment and compliance evaluation. Employees probably benefit from increased job security due to their expertise in identifying potential financial and legal issues. This position may also offer exposure to diverse industries, improving career versatility and marketability.

Challenge

The Due Diligence Analyst role likely involves navigating complex financial data and regulatory requirements, presenting significant analytical and investigative challenges. Understanding multifaceted business operations and assessing potential risks with precision may require sharp attention to detail and critical thinking skills. The ongoing need to adapt to evolving compliance standards probably adds further difficulty to maintaining thorough and accurate due diligence processes.

Career Advancement

Due Diligence Analysts enhance their expertise in regulatory compliance, financial analysis, and risk assessment to position themselves for senior roles in compliance management or financial consulting. Mastery of advanced data analytics tools and thorough understanding of anti-money laundering (AML) regulations significantly improve career progression opportunities. Networking within legal and financial sectors helps secure promotions to leadership positions such as Compliance Manager or Risk Officer.

Key Terms

Compliance Screening

Due diligence analysts specializing in compliance screening conduct comprehensive investigations to verify the legitimacy and regulatory adherence of clients, partners, and vendors, minimizing risks and preventing financial crimes. They utilize advanced software and databases to analyze transaction histories, legal records, and sanction lists, ensuring alignment with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These professionals play a critical role in maintaining organizational integrity by identifying potential red flags and facilitating regulatory compliance audits.

Enhanced Due Diligence (EDD)

Due Diligence Analysts specializing in Enhanced Due Diligence (EDD) conduct in-depth investigations to mitigate risks associated with high-risk clients, complex transactions, and politically exposed persons (PEPs). They utilize advanced analytical tools and regulatory frameworks such as AML (Anti-Money Laundering) and KYC (Know Your Customer) to identify potential fraud, money laundering, and compliance breaches. Their expertise ensures financial institutions align with global compliance standards, minimizing operational risk and safeguarding reputational integrity.

kuljobs.com

kuljobs.com