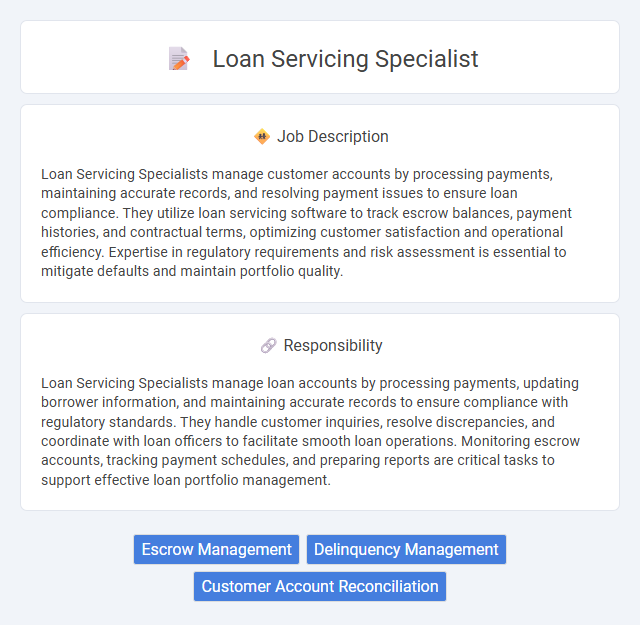

Loan Servicing Specialists manage customer accounts by processing payments, maintaining accurate records, and resolving payment issues to ensure loan compliance. They utilize loan servicing software to track escrow balances, payment histories, and contractual terms, optimizing customer satisfaction and operational efficiency. Expertise in regulatory requirements and risk assessment is essential to mitigate defaults and maintain portfolio quality.

Individuals with strong organizational skills and attention to detail are likely suitable for a Loan Servicing Specialist role. Those who prefer routine tasks and have good communication abilities might find this job fitting. Conversely, people uncomfortable with compliance regulations or high-pressure environments may face challenges in this position.

Qualification

Loan Servicing Specialist positions typically require strong knowledge of loan processing, customer service skills, and proficiency with loan management software such as LoanServ or Fiserv. Candidates benefit from a background in finance, accounting, or related fields, along with experience in handling payment processing, escrow accounts, and regulatory compliance. Attention to detail, effective communication skills, and the ability to resolve borrower inquiries accurately are critical qualifications for success in this role.

Responsibility

Loan Servicing Specialists manage loan accounts by processing payments, updating borrower information, and maintaining accurate records to ensure compliance with regulatory standards. They handle customer inquiries, resolve discrepancies, and coordinate with loan officers to facilitate smooth loan operations. Monitoring escrow accounts, tracking payment schedules, and preparing reports are critical tasks to support effective loan portfolio management.

Benefit

A Loan Servicing Specialist likely enhances customer satisfaction by efficiently managing loan accounts and resolving inquiries, which could lead to higher client retention rates. Proficiency in this role may also improve organizational cash flow through timely payment processing and accurate record-keeping. Expertise gained from handling diverse loan servicing tasks might increase career advancement opportunities within the financial sector.

Challenge

Loan Servicing Specialists probably face the challenge of managing complex loan portfolios while ensuring compliance with ever-evolving regulations. They may need to adeptly resolve payment discrepancies and handle borrower inquiries promptly to maintain customer satisfaction. Efficiency in processing payments, adjustments, and documentation could significantly impact loan performance and risk management.

Career Advancement

Loan Servicing Specialists play a crucial role in managing borrower accounts and ensuring accurate payment processing, which builds a strong foundation for career growth in the financial services industry. Mastery of loan documentation, customer communication, and regulatory compliance can lead to advanced positions such as Loan Manager or Risk Analyst. Continuous skill development in loan portfolio management and financial technology enhances opportunities for specialization and leadership roles within banking institutions.

Key Terms

Escrow Management

A Loan Servicing Specialist oversees escrow management by accurately tracking property taxes, insurance premiums, and other escrow-related expenses to ensure timely payments and compliance with loan agreements. They analyze escrow accounts, calculate escrow shortages or surpluses, and provide detailed statements to borrowers while maintaining clear communication to resolve any discrepancies. Proficiency in loan processing software and strong knowledge of regulatory requirements are essential for effective escrow account administration.

Delinquency Management

Loan Servicing Specialists manage delinquency by monitoring overdue loan accounts and implementing proactive collection strategies to minimize losses. They analyze borrower payment history and coordinate with customers to develop repayment plans that comply with regulatory requirements. Expertise in loan portfolio risk assessment and customer communication enhances recovery rates and ensures compliance with financial policies.

Customer Account Reconciliation

A Loan Servicing Specialist expertly manages customer account reconciliation by verifying accuracy in loan payments, interest calculations, and escrow balances to ensure precise financial records. This role involves resolving discrepancies swiftly through detailed analysis of payment histories and transaction records, enhancing customer satisfaction and regulatory compliance. Proficiency in loan servicing software and comprehensive knowledge of loan policies are essential for maintaining accurate and timely account status updates.

kuljobs.com

kuljobs.com