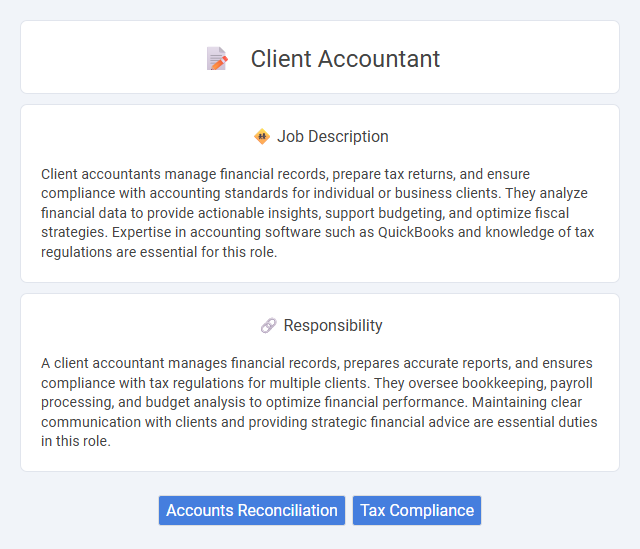

Client accountants manage financial records, prepare tax returns, and ensure compliance with accounting standards for individual or business clients. They analyze financial data to provide actionable insights, support budgeting, and optimize fiscal strategies. Expertise in accounting software such as QuickBooks and knowledge of tax regulations are essential for this role.

Individuals with strong attention to detail and an aptitude for numbers are likely to thrive as client accountants. Those who can manage stress well and communicate effectively with clients may find this role suitable, as it requires meeting deadlines and explaining financial information clearly. People who struggle with multitasking or prefer solitary work environments might find this job less compatible with their strengths.

Qualification

A client accountant typically requires a bachelor's degree in accounting, finance, or a related field, along with professional certifications such as CPA, ACCA, or CMA to demonstrate expertise and credibility. Strong analytical skills, proficiency in accounting software like QuickBooks or Xero, and knowledge of tax regulations and financial reporting standards are essential qualifications. Experience in managing client portfolios, preparing financial statements, and providing strategic financial advice boosts a candidate's effectiveness in this role.

Responsibility

A client accountant manages financial records, prepares accurate reports, and ensures compliance with tax regulations for multiple clients. They oversee bookkeeping, payroll processing, and budget analysis to optimize financial performance. Maintaining clear communication with clients and providing strategic financial advice are essential duties in this role.

Benefit

A client accountant role likely offers significant benefits such as comprehensive exposure to diverse industries, enhancing financial expertise and adaptability. Opportunities for professional growth may be abundant, potentially including certifications and leadership development. The position probably provides a stable income with performance-based incentives fostering long-term career advancement.

Challenge

Client accountant roles likely involve complex challenges related to managing diverse financial portfolios and ensuring accuracy in reporting under tight deadlines. Navigating varying client needs and regulatory requirements may require adaptability and strong analytical skills. Problem-solving in unexpected discrepancies and maintaining client trust could be frequent difficulties faced in this position.

Career Advancement

A client accountant plays a vital role in managing financial records and delivering accurate reports for businesses, enhancing decision-making processes. Mastery of accounting software, tax regulations, and financial analysis opens pathways for career advancement to senior accountant, financial controller, or chief financial officer positions. Pursuing certifications such as CPA or ACCA significantly boosts prospects for leadership roles and specialized financial consulting opportunities.

Key Terms

Accounts Reconciliation

Client accountants specializing in accounts reconciliation meticulously verify and match financial records to ensure accuracy and completeness of client accounts. They identify discrepancies between ledgers, bank statements, and financial reports, implementing corrective actions to maintain balanced books. Proficiency in reconciliation software and strong analytical skills are essential for delivering precise financial summaries that support client decision-making and regulatory compliance.

Tax Compliance

Client accountants specializing in tax compliance ensure accurate preparation and submission of tax returns in adherence to local regulations and deadlines. They analyze financial records to identify tax liabilities, optimize deductions, and minimize risks of audits or penalties. Expertise in VAT, corporate tax, and payroll tax regulations is essential for maintaining clients' fiscal responsibility and regulatory compliance.

kuljobs.com

kuljobs.com