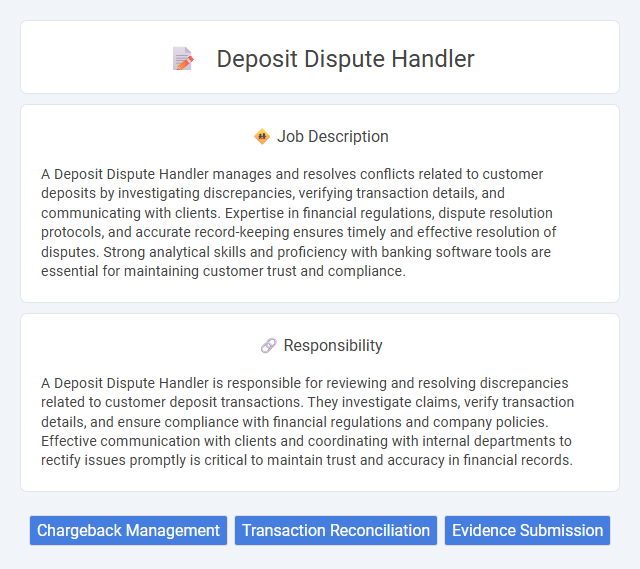

A Deposit Dispute Handler manages and resolves conflicts related to customer deposits by investigating discrepancies, verifying transaction details, and communicating with clients. Expertise in financial regulations, dispute resolution protocols, and accurate record-keeping ensures timely and effective resolution of disputes. Strong analytical skills and proficiency with banking software tools are essential for maintaining customer trust and compliance.

Individuals with strong attention to detail and excellent communication skills are likely to be well-suited for a Deposit Dispute Handler role. Those who can remain calm under pressure and have a problem-solving mindset probably find this job fitting, as it involves resolving financial disputes efficiently. Candidates who prefer structured environments and possess a good understanding of banking policies might be more probable to succeed in this position.

Qualification

A Deposit Dispute Handler requires strong analytical skills and experience in financial dispute resolution, often demonstrated through a background in finance, banking, or customer service. Proficiency in legal and regulatory frameworks related to deposits, along with excellent communication and problem-solving abilities, is essential. Certifications such as Certified Dispute Resolution Professional (CDRP) or relevant financial compliance training enhance qualifications and effectiveness in managing deposit-related conflicts.

Responsibility

A Deposit Dispute Handler is responsible for reviewing and resolving discrepancies related to customer deposit transactions. They investigate claims, verify transaction details, and ensure compliance with financial regulations and company policies. Effective communication with clients and coordinating with internal departments to rectify issues promptly is critical to maintain trust and accuracy in financial records.

Benefit

The role of a Deposit Dispute Handler likely offers strong benefits such as enhanced problem-solving skills and expertise in financial regulations, which can improve career prospects in banking and finance. There is a high probability that individuals in this position gain valuable experience in customer service and conflict resolution, crucial for professional growth. Opportunities for competitive salaries and potential bonuses may also be common, contributing to overall job satisfaction.

Challenge

The role of a deposit dispute handler likely involves navigating complex conflicts between tenants and landlords, requiring strong negotiation and problem-solving skills. It may often be challenging to balance the interests of both parties while adhering to legal regulations and company policies. Handling emotionally charged situations and ensuring timely resolution could further contribute to the difficulty of the job.

Career Advancement

A Deposit Dispute Handler plays a critical role in resolving customer conflicts related to bank deposits, ensuring compliance with financial regulations and maintaining customer trust. Career advancement opportunities include moving into senior dispute resolution roles, compliance management, or risk assessment positions, each offering increased responsibility and specialization. Mastery of dispute resolution techniques and deep knowledge of banking regulations significantly enhance prospects for promotion and salary growth.

Key Terms

Chargeback Management

A Deposit Dispute Handler specializing in chargeback management efficiently investigates and resolves financial transaction discrepancies to safeguard company assets and customer satisfaction. Leveraging advanced dispute resolution techniques and compliance with payment network regulations, they minimize chargeback losses and ensure accurate fund reconciliation. Expertise in analyzing transaction data, communicating with banks and customers, and adhering to industry standards is critical for maintaining operational integrity and reducing fraud risks.

Transaction Reconciliation

A Deposit Dispute Handler specializing in Transaction Reconciliation manages the review and resolution of discrepancies between deposited amounts and recorded transactions, ensuring accuracy in financial records. The role involves analyzing transaction data, identifying errors or fraudulent activities, and collaborating with banks and customers to rectify mistakes promptly. Expertise in financial software, keen attention to detail, and compliance with regulatory standards are critical for effective dispute resolution and maintaining trust in transactional processes.

Evidence Submission

Deposit dispute handlers expertly manage the verification process by collecting and submitting critical evidence such as lease agreements, payment records, and communication logs. Accurate and timely evidence submission ensures disputes are resolved efficiently, minimizing prolonged tenant-landlord conflicts. Mastery of documentation standards and legal requirements is essential to uphold transparency and protect all parties involved.

kuljobs.com

kuljobs.com