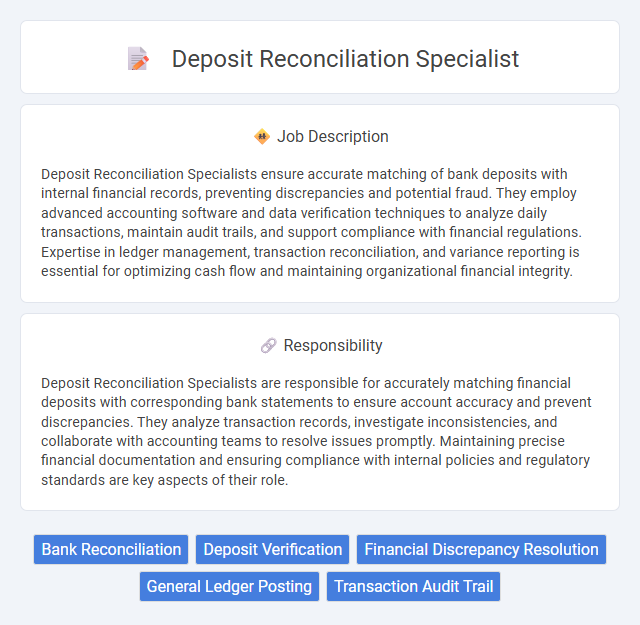

Deposit Reconciliation Specialists ensure accurate matching of bank deposits with internal financial records, preventing discrepancies and potential fraud. They employ advanced accounting software and data verification techniques to analyze daily transactions, maintain audit trails, and support compliance with financial regulations. Expertise in ledger management, transaction reconciliation, and variance reporting is essential for optimizing cash flow and maintaining organizational financial integrity.

Individuals with strong attention to detail and a high level of accuracy are likely to thrive as Deposit Reconciliation Specialists. Those comfortable working with numbers, financial data, and performing repetitive tasks may find this role suitable. People who prefer dynamic environments with constant interpersonal interactions might find the position less fitting due to its focus on meticulous data verification and analysis.

Qualification

A Deposit Reconciliation Specialist must possess strong analytical skills and extensive experience in accounting or finance, typically requiring a Bachelor's degree in Accounting, Finance, or a related field. Proficiency in financial software such as QuickBooks, SAP, or Oracle and advanced Excel capabilities are essential for accurately matching deposits with records and resolving discrepancies. Attention to detail, excellent organizational skills, and a thorough understanding of internal controls and banking procedures are critical qualifications for success in this role.

Responsibility

Deposit Reconciliation Specialists are responsible for accurately matching financial deposits with corresponding bank statements to ensure account accuracy and prevent discrepancies. They analyze transaction records, investigate inconsistencies, and collaborate with accounting teams to resolve issues promptly. Maintaining precise financial documentation and ensuring compliance with internal policies and regulatory standards are key aspects of their role.

Benefit

The role of a Deposit Reconciliation Specialist likely offers the benefit of enhancing financial accuracy and reducing discrepancies in an organization's cash flow management. This position probably improves an employee's attention to detail and analytical skills, which are valuable for career advancement in finance. Working in this role might also provide exposure to advanced accounting software, increasing technical proficiency and marketability in the financial sector.

Challenge

Deposit Reconciliation Specialists likely encounter challenges related to accurately matching large volumes of transactions, which can increase the probability of errors if processes are not thoroughly monitored. The complexity of ensuring timely updates across multiple financial systems may create difficulties in maintaining data integrity and consistency. Navigating discrepancies and resolving inconsistencies efficiently might demand strong analytical skills and attention to detail, making this role potentially demanding but critical for financial accuracy.

Career Advancement

A Deposit Reconciliation Specialist plays a crucial role in verifying and balancing financial transactions to ensure accuracy in corporate accounts. Mastery in this position enhances skills in financial analysis, attention to detail, and regulatory compliance, paving the way for advancement into senior accounting, finance management, or audit roles. Progression often leads to opportunities such as Financial Analyst, Accounting Manager, or Treasury Analyst, reflecting growth in responsibility and strategic financial oversight.

Key Terms

Bank Reconciliation

A Deposit Reconciliation Specialist ensures accurate matching of deposits with bank statements to identify discrepancies and maintain financial integrity. Expertise in bank reconciliation processes involves verifying transaction records, resolving variances, and updating ledger accounts promptly. Proficiency in financial software and attention to detail are critical for seamless deposit tracking and reconciliation in banking operations.

Deposit Verification

Deposit Reconciliation Specialists ensure accuracy in deposit verification by meticulously matching transaction records with bank statements to identify discrepancies. They utilize advanced accounting software and data analysis techniques to validate deposits, reconcile accounts, and prevent financial errors. Expertise in audit trails and regulatory compliance is essential for maintaining the integrity of financial documentation.

Financial Discrepancy Resolution

A Deposit Reconciliation Specialist expertly identifies and resolves financial discrepancies by analyzing deposit records and transaction data to ensure accurate account balances. They utilize reconciliation software and perform detailed audits to detect inconsistencies, preventing potential financial losses and maintaining compliance with company policies. This role demands strong analytical skills and meticulous attention to detail to enhance financial reporting accuracy and streamline cash management processes.

General Ledger Posting

Deposit Reconciliation Specialists ensure accurate General Ledger posting by verifying deposit transactions and matching them with recorded entries to maintain financial integrity. They analyze discrepancies between deposit records and ledger accounts, performing detailed investigations to correct errors promptly. Proficiency in accounting software and strong attention to detail are essential for maintaining updated and compliant financial records.

Transaction Audit Trail

A Deposit Reconciliation Specialist ensures accuracy by meticulously verifying transaction audit trails to identify discrepancies between bank deposits and recorded transactions. This role involves analyzing detailed records to maintain precise financial reporting and support compliance with internal controls. Mastery of audit trail software and banking systems is essential for detecting anomalies and resolving transaction issues efficiently.

kuljobs.com

kuljobs.com