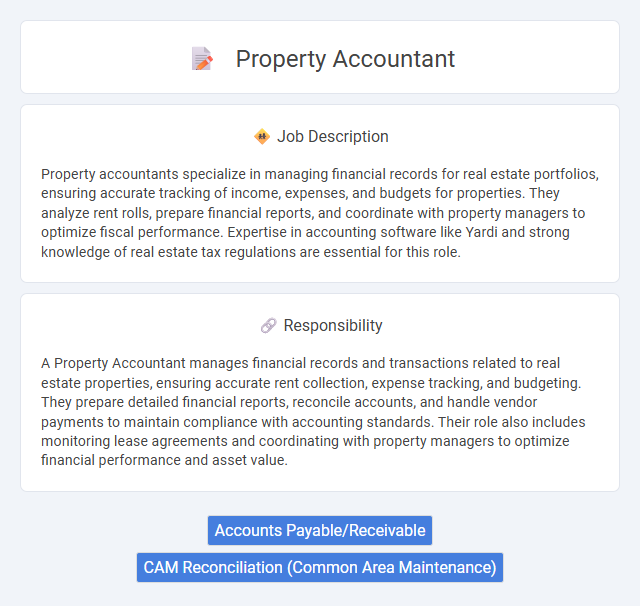

Property accountants specialize in managing financial records for real estate portfolios, ensuring accurate tracking of income, expenses, and budgets for properties. They analyze rent rolls, prepare financial reports, and coordinate with property managers to optimize fiscal performance. Expertise in accounting software like Yardi and strong knowledge of real estate tax regulations are essential for this role.

Individuals with strong numerical skills and attention to detail are likely to be well-suited for a Property Accountant role, as the job requires managing financial records and analyzing property-related transactions. Candidates who are comfortable working independently and maintaining accuracy in a fast-paced environment may find this position a good fit. Those who struggle with organization or lack interest in finance could face challenges adapting to the responsibilities of this job.

Qualification

A Property Accountant must possess a strong foundation in accounting principles, typically demonstrated by a bachelor's degree in accounting, finance, or a related field, alongside proficiency in property management software and financial reporting tools. Professional certifications such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant) are highly valued, enhancing credibility and expertise in handling complex property financial transactions. Expertise in budgeting, tax regulations, and lease accounting further qualifies candidates to manage accurate financial records and ensure compliance within real estate organizations.

Responsibility

A Property Accountant manages financial records and transactions related to real estate properties, ensuring accurate rent collection, expense tracking, and budgeting. They prepare detailed financial reports, reconcile accounts, and handle vendor payments to maintain compliance with accounting standards. Their role also includes monitoring lease agreements and coordinating with property managers to optimize financial performance and asset value.

Benefit

Property accountant roles likely offer financial benefits such as competitive salaries and potential bonuses tied to property performance. Candidates might enjoy opportunities for career growth within real estate firms and access to professional development resources. There is a probability of securing stable employment due to consistent demand in property management and accounting sectors.

Challenge

The role of a Property Accountant likely involves navigating complex financial regulations and managing diverse property portfolios, presenting significant challenges. Accuracy in recording transactions and reconciling accounts is probably critical to avoid discrepancies that could impact financial reporting. Adapting to evolving real estate market trends and software tools may also pose ongoing obstacles requiring continual learning.

Career Advancement

A Property Accountant role offers substantial career advancement opportunities through gaining expertise in financial reporting, budgeting, and property management software. Mastery of complex real estate accounting principles and regulatory compliance enhances prospects for promotion to senior accountant or financial controller positions. Continuous professional development and certifications, such as CPA or CMA, significantly improve upward mobility within real estate finance teams.

Key Terms

Accounts Payable/Receivable

Property Accountants specializing in Accounts Payable and Receivable manage the timely processing of vendor invoices, tenant payments, and lease-related financial transactions to ensure accurate cash flow tracking. They reconcile accounts, verify expense allocations, and maintain detailed records to support financial reporting and budget compliance. Proficiency in property management software and strong attention to detail are essential to optimize payment cycles and minimize discrepancies.

CAM Reconciliation (Common Area Maintenance)

A Property Accountant specializing in CAM Reconciliation manages detailed analysis of Common Area Maintenance charges, ensuring accurate allocation and billing to tenants based on lease agreements. They review service contracts, vendor invoices, and expense reports to verify that CAM charges are compliant with budget projections and contractual terms. Expertise in financial reporting and variance analysis supports timely reconciliations, reducing discrepancies and safeguarding property revenue streams.

kuljobs.com

kuljobs.com