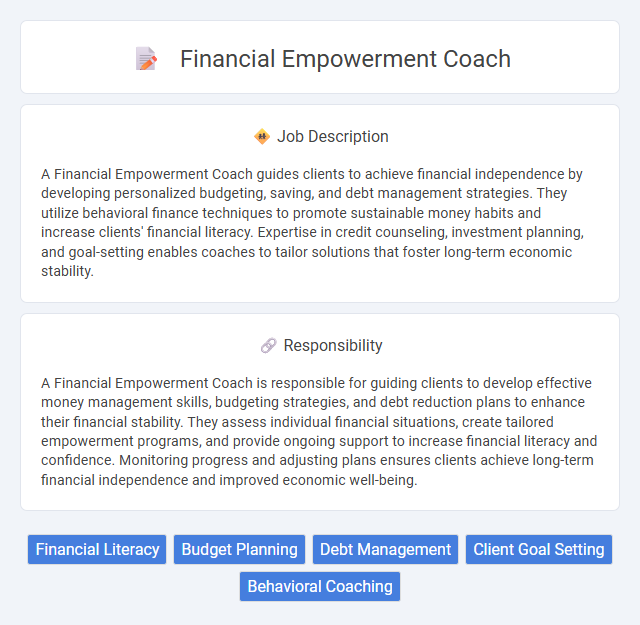

A Financial Empowerment Coach guides clients to achieve financial independence by developing personalized budgeting, saving, and debt management strategies. They utilize behavioral finance techniques to promote sustainable money habits and increase clients' financial literacy. Expertise in credit counseling, investment planning, and goal-setting enables coaches to tailor solutions that foster long-term economic stability.

Individuals facing financial instability or looking to improve money management skills may find a Financial Empowerment Coach role well-suited, as it involves guiding others through budgeting, debt reduction, and financial planning. Those with strong communication skills and a passion for helping others overcome economic challenges are likely to thrive in this position. However, candidates who prefer solitary work or lack patience for ongoing client support might find this role less compatible with their strengths.

Qualification

A Financial Empowerment Coach typically holds a background in finance, accounting, or social work, often supported by certifications such as Certified Financial Planner (CFP) or Accredited Financial Counselor (AFC). Strong knowledge of budgeting, credit management, and debt reduction strategies is essential, along with skills in financial literacy education and behavioral finance. Experience working with diverse populations to develop personalized financial plans and empower clients toward economic self-sufficiency is highly valued.

Responsibility

A Financial Empowerment Coach is responsible for guiding clients to develop effective money management skills, budgeting strategies, and debt reduction plans to enhance their financial stability. They assess individual financial situations, create tailored empowerment programs, and provide ongoing support to increase financial literacy and confidence. Monitoring progress and adjusting plans ensures clients achieve long-term financial independence and improved economic well-being.

Benefit

Financial empowerment coaches likely help clients gain confidence in managing their finances through personalized guidance and education. Clients probably experience improved budgeting skills, reduced debt, and enhanced financial decision-making. This role is expected to provide long-term benefits such as greater financial stability and independence.

Challenge

Financial Empowerment Coaches likely face the challenge of balancing personalized advice with diverse client financial situations, requiring adaptable strategies that resonate across varying economic backgrounds. The complexity of motivating behavioral change around money habits might pose a persistent obstacle, as clients often struggle with ingrained spending patterns. Navigating regulatory compliance and staying updated with evolving financial products could also present ongoing difficulties in delivering effective coaching.

Career Advancement

A Financial Empowerment Coach guides clients toward sustainable financial independence by developing personalized budgeting, debt management, and investment strategies. Mastery in financial literacy, strong communication skills, and experience with diverse economic backgrounds accelerate career progression within nonprofit organizations, financial institutions, and private consulting. Advancement opportunities include senior coaching roles, program management, and specialized certifications such as Certified Financial Planner (CFP) or Accredited Financial Counselor (AFC).

Key Terms

Financial Literacy

A Financial Empowerment Coach specializes in improving clients' financial literacy by teaching essential money management skills, budgeting techniques, and debt reduction strategies. This role involves creating personalized financial plans that empower individuals to make informed decisions about saving, investing, and credit use. By fostering financial confidence, coaches help clients achieve long-term financial stability and independence.

Budget Planning

A Financial Empowerment Coach specializes in budget planning by analyzing clients' income, expenses, and financial goals to create personalized, sustainable budgets. This role involves educating clients on effective money management techniques, prioritizing debt reduction, and maximizing savings to enhance long-term financial stability. Mastery of budgeting tools and software is essential to provide accurate, data-driven guidance that fosters confident financial decision-making.

Debt Management

A Financial Empowerment Coach specializing in Debt Management helps clients create personalized plans to reduce and eliminate debt efficiently while improving credit scores. They analyze financial situations, negotiate with creditors, and educate clients on budgeting strategies to avoid future indebtedness. Expertise in debt consolidation, repayment options, and financial literacy coaching ensures clients achieve long-term financial stability and empowerment.

Client Goal Setting

A Financial Empowerment Coach specializes in helping clients establish clear, achievable financial goals tailored to their individual circumstances. They use data-driven strategies and personalized plans to enhance clients' budgeting, saving, and debt management skills, ensuring measurable progress toward long-term financial stability. Effective client goal setting in this role involves continuous assessment and adjustment to optimize financial outcomes and foster sustainable economic independence.

Behavioral Coaching

Financial empowerment coaches specialize in behavioral coaching techniques to help clients develop healthier money habits and improve financial decision-making skills. By addressing psychological barriers and emotional spending triggers, they guide individuals toward sustainable wealth-building strategies and long-term financial stability. These coaches utilize personalized action plans and mindset shifts to foster accountability and boost clients' confidence in managing their finances effectively.

kuljobs.com

kuljobs.com