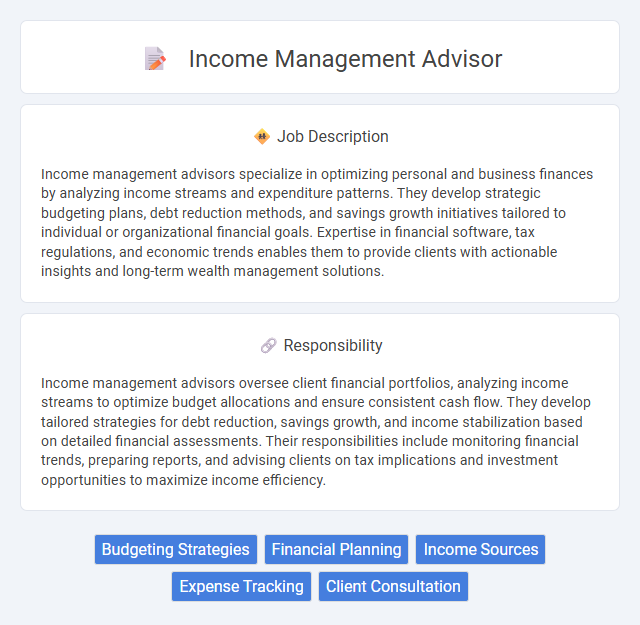

Income management advisors specialize in optimizing personal and business finances by analyzing income streams and expenditure patterns. They develop strategic budgeting plans, debt reduction methods, and savings growth initiatives tailored to individual or organizational financial goals. Expertise in financial software, tax regulations, and economic trends enables them to provide clients with actionable insights and long-term wealth management solutions.

Income management advisor roles may suit individuals who are detail-oriented and possess strong analytical skills, as these tasks often require careful budgeting and financial planning. Candidates with a background in finance or counseling might have a higher likelihood of success due to the need for understanding complex financial situations. Those who prefer routine tasks or lack patience for interpersonal communication may find this role less compatible with their strengths.

Qualification

An Income Management Advisor typically requires a bachelor's degree in finance, accounting, or a related field, along with certifications such as CPA or CFA for enhanced credibility. Proven experience in financial analysis, budgeting, and income forecasting is critical to effectively advise clients or organizations on revenue optimization. Strong analytical skills, attention to detail, and proficiency in financial software tools are essential qualifications for success in this role.

Responsibility

Income management advisors oversee client financial portfolios, analyzing income streams to optimize budget allocations and ensure consistent cash flow. They develop tailored strategies for debt reduction, savings growth, and income stabilization based on detailed financial assessments. Their responsibilities include monitoring financial trends, preparing reports, and advising clients on tax implications and investment opportunities to maximize income efficiency.

Benefit

Income management advisors likely help clients optimize cash flow and budgeting strategies, which could result in improved financial stability and reduced debt risk. Their expertise might enable individuals or businesses to better allocate resources, potentially increasing savings and investment opportunities. The role may also provide valuable insights into tax planning, enhancing overall financial efficiency and long-term wealth growth.

Challenge

Income management advisor roles likely demand navigating complex financial landscapes and addressing diverse client needs with accuracy. Challenges probably include balancing regulatory compliance with personalized financial strategies to optimize client outcomes. Effective communication and problem-solving skills may be essential to manage unexpected financial discrepancies and maintain client trust.

Career Advancement

Income management advisors play a crucial role in helping clients optimize their financial resources and manage debts effectively, providing opportunities for career growth within financial planning and wealth management sectors. Mastery in budgeting, debt counseling, and financial assessment drives professional development toward senior advisory roles or specialized financial consultancy. Advancing in this career often involves acquiring certifications such as CFP (Certified Financial Planner) or FSM (Financial Services Manager) to enhance credibility and unlock higher-level positions.

Key Terms

Budgeting Strategies

Income management advisors specialize in developing personalized budgeting strategies to optimize clients' financial health and ensure sustainable cash flow. They analyze income sources, expenses, and financial goals to craft tailored plans that enhance savings, reduce debt, and improve overall fiscal discipline. Utilizing tools like zero-based budgeting and expense tracking, these advisors help clients achieve long-term financial stability and meet their monetary objectives.

Financial Planning

Income management advisors specialize in developing comprehensive financial plans that optimize cash flow, budgeting, and investment strategies tailored to individual client needs. Their expertise includes analyzing income sources, expenses, tax implications, and long-term financial goals to ensure sustainable wealth growth and retirement readiness. Proficiency in financial software, tax regulations, and market trends is essential for delivering personalized income management solutions and maximizing client financial stability.

Income Sources

Income management advisors specialize in analyzing diverse income sources including salaries, business revenues, investments, and government benefits to create tailored financial strategies. They assess income stability, frequency, and growth potential to optimize budgeting, tax planning, and debt management. Their expertise helps clients maximize cash flow and secure long-term financial health through strategic income allocation and diversification.

Expense Tracking

Income management advisors specialize in expense tracking by accurately monitoring and categorizing client expenditures to ensure financial stability and budgeting accuracy. They utilize advanced financial software and data analysis techniques to identify spending patterns and recommend adjustments that optimize cash flow. Their expertise supports effective income allocation, minimizing unnecessary expenses, and enhancing overall financial health.

Client Consultation

Income management advisors specialize in client consultation by analyzing individual financial situations to develop tailored income strategies. They assess cash flow, identify potential tax advantages, and recommend budgeting plans to enhance financial stability. Effective client communication ensures personalized advice aligns with long-term income goals and risk tolerance.

kuljobs.com

kuljobs.com