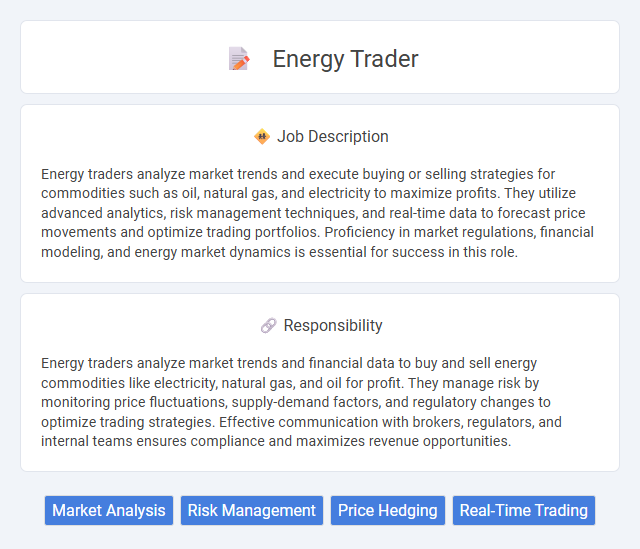

Energy traders analyze market trends and execute buying or selling strategies for commodities such as oil, natural gas, and electricity to maximize profits. They utilize advanced analytics, risk management techniques, and real-time data to forecast price movements and optimize trading portfolios. Proficiency in market regulations, financial modeling, and energy market dynamics is essential for success in this role.

Energy Trader roles likely suit individuals with strong analytical skills and the ability to remain calm under pressure. People who thrive in fast-paced, high-stakes environments and possess a keen understanding of market dynamics may find this job aligns well with their strengths. Those who prefer routine or low-stress conditions might find energy trading challenging or unsuitable.

Qualification

Energy traders require a strong foundation in finance, economics, or engineering, often holding degrees in these fields. Proficiency in market analysis, risk management, and trading software is essential to navigate volatile energy markets effectively. Certifications such as CFA or energy-specific trading licenses enhance credibility and career advancement opportunities.

Responsibility

Energy traders analyze market trends and financial data to buy and sell energy commodities like electricity, natural gas, and oil for profit. They manage risk by monitoring price fluctuations, supply-demand factors, and regulatory changes to optimize trading strategies. Effective communication with brokers, regulators, and internal teams ensures compliance and maximizes revenue opportunities.

Benefit

Energy Trader jobs likely offer significant financial benefits through performance-based bonuses and commissions, reflecting the dynamic nature of energy markets. Opportunities for professional growth and skill development in risk management and market analysis may enhance long-term career prospects. The role might also provide exposure to global energy markets, potentially increasing earning potential and job satisfaction.

Challenge

An Energy Trader likely faces a highly dynamic environment requiring quick decision-making amid fluctuating market conditions and geopolitical uncertainties. The challenge probably lies in managing risk while maximizing profit through strategic buying and selling of energy commodities. Success may depend on strong analytical skills and the ability to anticipate market trends under pressure.

Career Advancement

Energy traders develop expertise in market analysis, risk management, and commodity pricing, positioning themselves for advancement into senior trading roles or portfolio management. Mastery of financial instruments and regulatory frameworks enables progression to leadership positions such as head of trading or energy risk manager. Continuous skill enhancement and networking within energy markets accelerate career growth and profitability opportunities.

Key Terms

Market Analysis

Energy traders specialize in analyzing complex market data, including supply-demand dynamics, price trends, and geopolitical factors, to make informed trading decisions. They utilize advanced statistical models and real-time analytics platforms to forecast energy prices in markets such as oil, natural gas, and electricity. Expertise in regulatory frameworks and risk assessment methodologies is critical to optimizing portfolio performance and maximizing profitability.

Risk Management

Energy traders specialize in buying and selling energy commodities such as oil, natural gas, and electricity, continuously analyzing market trends to optimize profits while minimizing losses. Risk management in energy trading involves developing strategies to hedge against price volatility, counterparty risk, and regulatory changes, ensuring the financial stability of trading operations. Effective use of quantitative models and real-time data analytics enables energy traders to identify potential risks early and implement mitigation measures promptly.

Price Hedging

Energy Traders specializing in price hedging manage risk by utilizing financial instruments such as futures, options, and swaps to stabilize energy costs and protect profit margins. They analyze market trends, supply-demand dynamics, and geopolitical factors to forecast price movements and execute hedging strategies. Effective price hedging minimizes exposure to price volatility in commodities like oil, natural gas, and electricity, ensuring stable financial performance in the energy sector.

Real-Time Trading

Energy traders specializing in real-time trading manage short-term energy market transactions to balance supply and demand fluctuations. They analyze live market data, price signals, and grid conditions using advanced software platforms to optimize trading decisions instantaneously. Expertise in electricity markets, renewable energy integration, and risk management is crucial for maximizing profitability and maintaining grid stability.

kuljobs.com

kuljobs.com