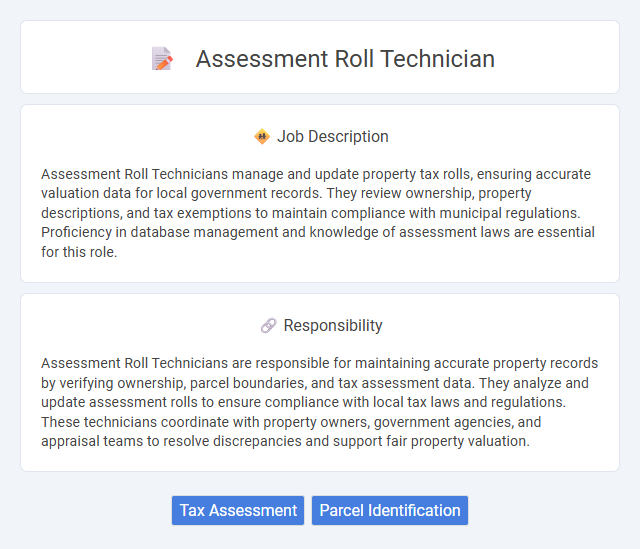

Assessment Roll Technicians manage and update property tax rolls, ensuring accurate valuation data for local government records. They review ownership, property descriptions, and tax exemptions to maintain compliance with municipal regulations. Proficiency in database management and knowledge of assessment laws are essential for this role.

Individuals with strong attention to detail and a methodical approach will likely be well-suited for the role of an Assessment Roll Technician. Those comfortable with handling numerical data, assessing property values, and maintaining accurate records may find this job aligns with their skills. Candidates who prefer structured, routine tasks and have good organizational abilities probably have a higher probability of succeeding in this position.

Qualification

Assessment Roll Technicians require a strong foundation in property assessment principles, often demonstrated by certifications such as the IAAO (International Association of Assessing Officers) designation. Proficiency in data management software and Geographic Information Systems (GIS) is essential for maintaining accurate property records and supporting tax assessments. Candidates typically hold a degree in public administration, real estate, or a related field, combined with experience in local government or property appraisal.

Responsibility

Assessment Roll Technicians are responsible for maintaining accurate property records by verifying ownership, parcel boundaries, and tax assessment data. They analyze and update assessment rolls to ensure compliance with local tax laws and regulations. These technicians coordinate with property owners, government agencies, and appraisal teams to resolve discrepancies and support fair property valuation.

Benefit

Assessment Roll Technicians likely benefit from gaining specialized skills in property valuation and data analysis, which can enhance their career prospects in real estate and municipal government sectors. The role often provides stable employment with opportunities for advancement and involvement in community development. Access to comprehensive training programs may increase the probability of improved job performance and long-term professional growth.

Challenge

Assessment Roll Technician roles likely present challenges related to maintaining accuracy and consistency in property data during dynamic changes in ownership and valuation. The probability of encountering discrepancies in records requires strong attention to detail and problem-solving skills. This job may demand adapting quickly to updated regulations and integrating new data management technologies.

Career Advancement

Assessment Roll Technicians play a crucial role in maintaining accurate property tax records, providing a foundation for career advancement in municipal government or real estate appraisal. Mastery of assessment tools and regulations can lead to promotions such as Senior Technician or Assessor, while experience opens pathways to specialized roles in property valuation and tax consulting. Continuing education and certifications enhance prospects for leadership positions within assessment offices or related public sector agencies.

Key Terms

Tax Assessment

An Assessment Roll Technician specializes in managing and verifying property tax assessment data to ensure accuracy in tax rolls used by local governments. They analyze property information, update ownership records, and calculate assessed values based on current market and regulatory standards. Proficiency in tax assessment software and knowledge of municipal tax regulations are essential for maintaining compliance and supporting equitable property taxation.

Parcel Identification

Assessment Roll Technicians specialize in parcel identification to accurately maintain property records and ensure precise tax assessments. They utilize geographic information systems (GIS) and parcel mapping software to verify boundaries, ownership, and legal descriptions. Expertise in analyzing parcel data supports property valuation and compliance with local tax regulations.

kuljobs.com

kuljobs.com