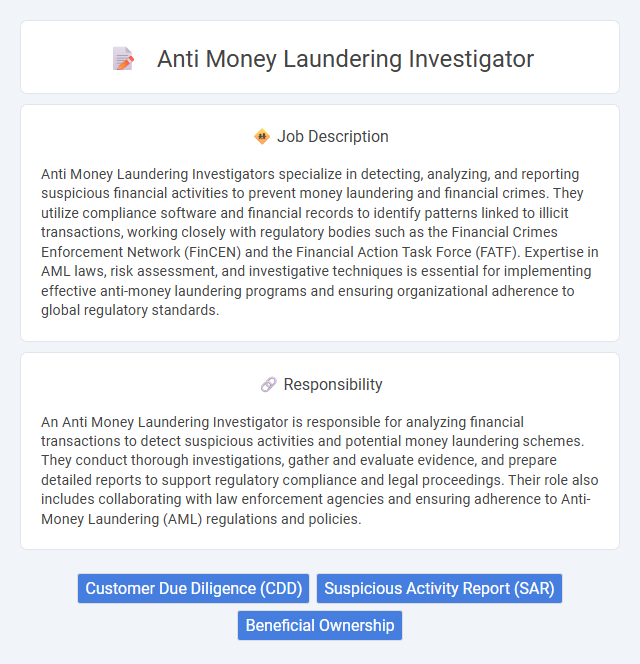

Anti Money Laundering Investigators specialize in detecting, analyzing, and reporting suspicious financial activities to prevent money laundering and financial crimes. They utilize compliance software and financial records to identify patterns linked to illicit transactions, working closely with regulatory bodies such as the Financial Crimes Enforcement Network (FinCEN) and the Financial Action Task Force (FATF). Expertise in AML laws, risk assessment, and investigative techniques is essential for implementing effective anti-money laundering programs and ensuring organizational adherence to global regulatory standards.

Individuals with strong analytical skills and a keen eye for detail are likely suitable for an Anti Money Laundering Investigator role. Those who are comfortable working with complex data and maintaining high ethical standards may find this job aligns well with their capabilities. Candidates who handle pressure effectively and are persistent in uncovering financial irregularities might have a higher probability of success in this field.

Qualification

An Anti Money Laundering (AML) Investigator must possess in-depth knowledge of financial regulations, including the Bank Secrecy Act (BSA) and the USA PATRIOT Act, complemented by experience in transaction monitoring and suspicious activity reporting. Proficiency in data analysis tools such as SQL, SAS, or specialized AML software enhances the ability to detect fraudulent patterns effectively. Strong analytical skills, attention to detail, and certifications like Certified Anti-Money Laundering Specialist (CAMS) are highly valued to ensure comprehensive compliance and risk mitigation.

Responsibility

An Anti Money Laundering Investigator is responsible for analyzing financial transactions to detect suspicious activities and potential money laundering schemes. They conduct thorough investigations, gather and evaluate evidence, and prepare detailed reports to support regulatory compliance and legal proceedings. Their role also includes collaborating with law enforcement agencies and ensuring adherence to Anti-Money Laundering (AML) regulations and policies.

Benefit

An Anti Money Laundering Investigator role likely offers the benefit of contributing to the prevention of financial crimes, which can enhance the security and integrity of financial systems. Employees in this position may experience strong career growth opportunities due to increasing regulatory demands and the global focus on combating money laundering. The job probably provides a chance to develop specialized skills in forensic analysis and compliance, which are highly valuable in the financial sector.

Challenge

The role of an Anti Money Laundering Investigator likely involves navigating complex financial transactions to identify suspicious activities. Challenges may include staying ahead of increasingly sophisticated laundering techniques and ensuring compliance with evolving regulations. This position probably demands sharp analytical skills to interpret large datasets and uncover hidden patterns linked to illicit funds.

Career Advancement

An Anti Money Laundering Investigator gains expertise in financial crime detection, compliance regulations, and forensic analysis, paving the way for career advancement into senior investigator roles or compliance management positions. Mastery of technologies such as transaction monitoring software and data analytics enhances promotion prospects within banks, regulatory agencies, or consulting firms. Continuous professional development, including certifications like CAMS (Certified Anti-Money Laundering Specialist), significantly boosts opportunities for leadership roles in anti-financial crime departments.

Key Terms

Customer Due Diligence (CDD)

An Anti Money Laundering Investigator specializing in Customer Due Diligence (CDD) analyzes client data to identify potential risks and suspicious activities. They meticulously verify customer identities, assess transaction patterns, and ensure compliance with regulatory frameworks like the Bank Secrecy Act and AML laws. Their expertise in CDD processes strengthens financial institutions' defenses against money laundering and terrorist financing.

Suspicious Activity Report (SAR)

Anti Money Laundering Investigators analyze financial transactions and customer behavior to detect patterns indicative of money laundering, focusing heavily on compiling and filing Suspicious Activity Reports (SARs) with regulatory authorities. These specialists employ advanced data analytics and regulatory knowledge to identify unusual activities that violate anti-money laundering laws, ensuring compliance and mitigating financial crime risks. Expertise in drafting detailed SARs is critical, as these reports enable law enforcement agencies to investigate and prevent illicit financial activities effectively.

Beneficial Ownership

An Anti Money Laundering Investigator specializing in Beneficial Ownership analyzes complex ownership structures to identify ultimate beneficial owners (UBOs) and uncover hidden financial risks. They utilize advanced due diligence techniques and regulatory frameworks such as the Financial Action Task Force (FATF) guidelines to ensure compliance and prevent illicit fund flows. Expertise in beneficial ownership databases, Know Your Customer (KYC) protocols, and suspicious activity reporting (SAR) is crucial for mitigating money laundering threats.

kuljobs.com

kuljobs.com