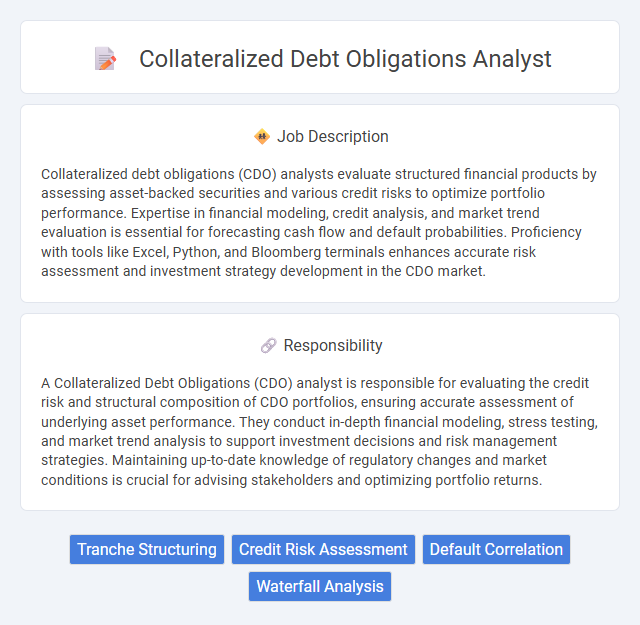

Collateralized debt obligations (CDO) analysts evaluate structured financial products by assessing asset-backed securities and various credit risks to optimize portfolio performance. Expertise in financial modeling, credit analysis, and market trend evaluation is essential for forecasting cash flow and default probabilities. Proficiency with tools like Excel, Python, and Bloomberg terminals enhances accurate risk assessment and investment strategy development in the CDO market.

Individuals with strong analytical skills and attention to detail are likely to be well-suited for a Collateralized Debt Obligations (CDO) analyst role, as the job requires evaluating complex financial instruments. Candidates who can handle pressure and make decisions based on probabilistic risk assessments may find this position aligns with their abilities. However, those uncomfortable with high-stakes environments or lacking a solid understanding of financial modeling might struggle to perform effectively in this field.

Qualification

A Collateralized Debt Obligations (CDO) analyst requires strong quantitative skills, expertise in financial modeling, and proficiency in credit risk assessment. Advanced knowledge of fixed-income securities, derivatives, and regulatory frameworks such as Basel III is essential. A degree in finance, economics, or a related field, along with certifications like CFA or FRM, enhances qualifications and marketability.

Responsibility

A Collateralized Debt Obligations (CDO) analyst is responsible for evaluating the credit risk and structural composition of CDO portfolios, ensuring accurate assessment of underlying asset performance. They conduct in-depth financial modeling, stress testing, and market trend analysis to support investment decisions and risk management strategies. Maintaining up-to-date knowledge of regulatory changes and market conditions is crucial for advising stakeholders and optimizing portfolio returns.

Benefit

A Collateralized Debt Obligations (CDO) analyst likely gains valuable expertise in structured finance and risk assessment, enhancing career growth potential in investment banking and asset management sectors. The role probably offers competitive compensation and opportunities to work on complex financial instruments, which may improve analytical skills and market understanding. Exposure to diverse credit portfolios could also increase a candidate's ability to evaluate investment strategies and contribute to informed decision-making processes.

Challenge

A Collateralized Debt Obligations analyst likely faces the challenge of accurately assessing complex structured finance products involving multiple layers of risk and diverse asset pools. Navigating regulatory changes and market volatility may require continuous adaptation and advanced quantitative skills. There is a probability that balancing detailed financial modeling with real-time decision-making pressures could add to the job's demanding nature.

Career Advancement

A Collateralized Debt Obligations (CDO) analyst evaluates structured credit products, assessing risk and performance to inform investment decisions. Mastery in financial modeling, credit analysis, and market trends enables progression to senior analyst or portfolio manager roles. Experience with regulatory frameworks and strong quantitative skills often lead to leadership positions within asset management firms or investment banks.

Key Terms

Tranche Structuring

A Collateralized Debt Obligations (CDO) analyst specializing in tranche structuring evaluates risk and return profiles to optimize the allocation of debt tranches within a CDO. They analyze underlying asset pools, model cash flow distributions, and use quantitative methods to balance senior, mezzanine, and equity tranches for maximum investor appeal. Expertise in credit risk assessment and financial engineering is essential to design tranches that align with market demand and regulatory requirements.

Credit Risk Assessment

A Collateralized Debt Obligations (CDO) Analyst specializing in credit risk assessment evaluates the creditworthiness of underlying assets within structured finance products to minimize default risk. This role involves analyzing financial statements, credit ratings, and market trends to project cash flow stability and potential loss scenarios across diverse asset pools. Proficiency in quantitative modeling and regulatory frameworks ensures robust risk mitigation strategies and compliance with financial industry standards.

Default Correlation

A Collateralized Debt Obligations (CDO) analyst specializing in default correlation evaluates the likelihood that multiple debt obligations will default simultaneously, impacting the overall risk profile of structured finance products. This role requires advanced quantitative skills to model and predict default dependency using statistical measures such as copulas, correlation matrices, and historical default data. Expertise in default correlation enables precise valuation of tranches and informs risk mitigation strategies within complex credit portfolios.

Waterfall Analysis

A Collateralized Debt Obligations (CDO) analyst specializing in Waterfall Analysis evaluates the distribution of cash flows through the CDO structure to determine payment priorities among tranches. Mastery of modeling tranche paydowns, default scenarios, and credit enhancements is crucial for accurate risk assessment and valuation. Proficiency in Excel, VBA, and structured finance platforms enhances the precision of these complex cash flow allocation models.

kuljobs.com

kuljobs.com