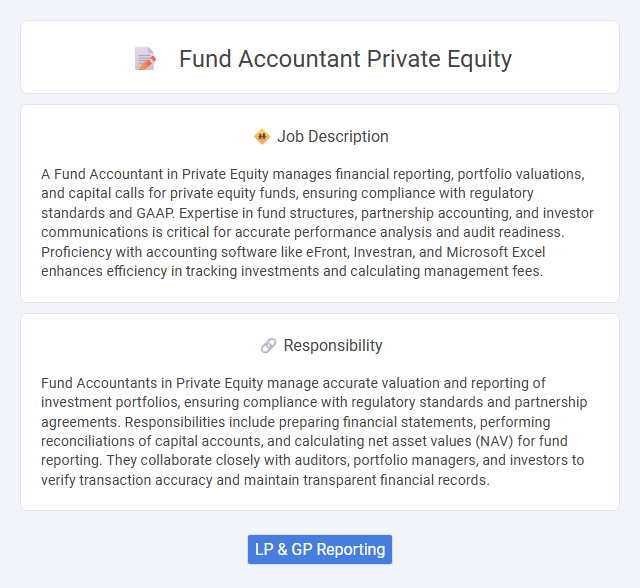

A Fund Accountant in Private Equity manages financial reporting, portfolio valuations, and capital calls for private equity funds, ensuring compliance with regulatory standards and GAAP. Expertise in fund structures, partnership accounting, and investor communications is critical for accurate performance analysis and audit readiness. Proficiency with accounting software like eFront, Investran, and Microsoft Excel enhances efficiency in tracking investments and calculating management fees.

Individuals with strong analytical skills and attention to detail are likely to thrive as Fund Accountants in Private Equity due to the complex financial data and regulatory requirements involved. Those who enjoy working with numbers, possess patience, and can manage tight deadlines may find this role suitable despite its demanding nature. Conversely, candidates who struggle with repetitive tasks or high-pressure environments may encounter challenges in maintaining job satisfaction and performance.

Qualification

A Fund Accountant in Private Equity requires strong proficiency in financial reporting, GAAP, and NAV calculations specific to alternative investments. Expertise in Excel, fund administration software, and experience with investor communications are essential qualifications. A degree in finance or accounting combined with relevant certifications like CPA or CFA enhances employability in this role.

Responsibility

Fund Accountants in Private Equity manage accurate valuation and reporting of investment portfolios, ensuring compliance with regulatory standards and partnership agreements. Responsibilities include preparing financial statements, performing reconciliations of capital accounts, and calculating net asset values (NAV) for fund reporting. They collaborate closely with auditors, portfolio managers, and investors to verify transaction accuracy and maintain transparent financial records.

Benefit

Fund Accountant roles in Private Equity settings are likely to provide competitive compensation packages, including performance bonuses and profit-sharing opportunities. These positions often offer exposure to complex financial instruments and investment structures, which can enhance professional expertise and career growth. Access to cutting-edge financial technology and collaborative work environments may further contribute to job satisfaction and skill development.

Challenge

Fund Accountant Private Equity roles likely involve managing complex financial data and navigating intricate investment structures, presenting constant analytical challenges. The probability of encountering tight deadlines and regulatory compliance demands may require advanced problem-solving skills and meticulous attention to detail. Mastery of specialized accounting software and staying updated on evolving industry standards could be essential to successfully overcoming these challenges.

Career Advancement

Fund Accountant roles in Private Equity offer significant opportunities for career advancement through gaining expertise in portfolio valuation, financial reporting, and compliance. Mastering fund accounting software and regulatory frameworks enhances prospects for promotion to Senior Fund Accountant or Fund Controller positions. Developing strong analytical skills and client communication abilities further accelerates growth into leadership or fund management roles.

Key Terms

LP & GP Reporting

A Fund Accountant specializing in Private Equity is responsible for preparing accurate and timely Limited Partner (LP) and General Partner (GP) reporting, ensuring compliance with fund agreements and regulatory requirements. This role involves tracking capital calls, distributions, and profitability metrics while reconciling fund activity with investor capital accounts. Expertise in financial statement analysis, NAV calculation, and detailed fund performance reporting enhances transparency and supports investor relations.

kuljobs.com

kuljobs.com