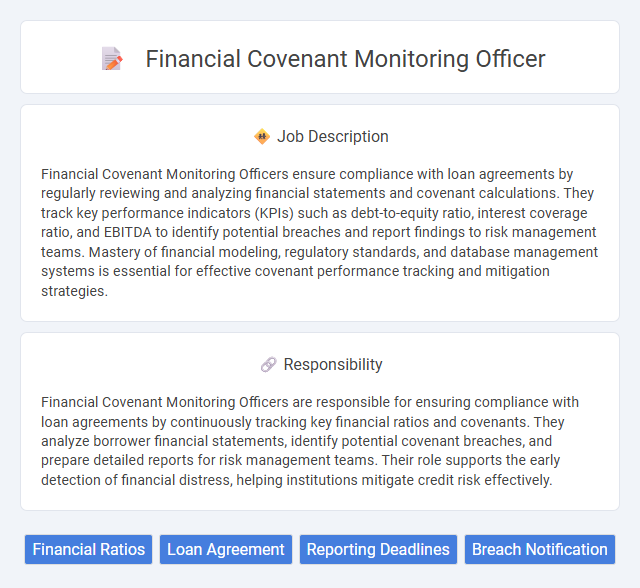

Financial Covenant Monitoring Officers ensure compliance with loan agreements by regularly reviewing and analyzing financial statements and covenant calculations. They track key performance indicators (KPIs) such as debt-to-equity ratio, interest coverage ratio, and EBITDA to identify potential breaches and report findings to risk management teams. Mastery of financial modeling, regulatory standards, and database management systems is essential for effective covenant performance tracking and mitigation strategies.

Candidates with strong analytical skills and attention to detail are likely to be suitable for a Financial Covenant Monitoring Officer role, as the job requires constant vigilance in tracking and evaluating financial conditions. Individuals comfortable working under pressure and with complex financial data probably will perform well in monitoring covenant compliance and identifying potential risks early. Those lacking a proactive mindset or experience in financial analysis might find the demands of this position challenging.

Qualification

A Financial Covenant Monitoring Officer typically requires a strong background in finance, accounting, or business administration, often holding a bachelor's degree in these fields. Proficiency in financial analysis, risk assessment, and knowledge of loan agreements and covenant structures is essential. Experience with financial reporting software and excellent attention to detail enhances the ability to monitor compliance effectively.

Responsibility

Financial Covenant Monitoring Officers are responsible for ensuring compliance with loan agreements by continuously tracking key financial ratios and covenants. They analyze borrower financial statements, identify potential covenant breaches, and prepare detailed reports for risk management teams. Their role supports the early detection of financial distress, helping institutions mitigate credit risk effectively.

Benefit

Financial Covenant Monitoring Officers are likely to provide organizations with early warnings of potential covenant breaches, increasing the probability of timely interventions that protect financial stability. They may enhance risk management processes by ensuring compliance with loan agreements, which could lead to improved lender relationships and favorable financing terms. Their role is probably critical in supporting informed decision-making, reducing financial penalties, and safeguarding corporate reputations.

Challenge

Financial Covenant Monitoring Officers likely face the challenge of accurately interpreting complex financial agreements while ensuring compliance under tight deadlines. The role probably demands a keen eye for detail to detect deviations that may indicate potential risk to the lending institution. Balancing thorough analysis with timely reporting could often be a significant pressure point in managing financial covenants effectively.

Career Advancement

Financial Covenant Monitoring Officers play a crucial role in assessing and ensuring compliance with loan agreements, providing critical risk management data for financial institutions. Mastery in covenant analysis and reporting enhances expertise valuable for senior risk management or credit analysis positions. Career advancement opportunities often include roles such as Senior Financial Analyst, Risk Manager, or Credit Compliance Officer, supported by advanced certifications in finance and risk assessment.

Key Terms

Financial Ratios

A Financial Covenant Monitoring Officer specializes in analyzing key financial ratios such as debt-to-equity, interest coverage, and current ratio to ensure compliance with loan agreements. This role involves continuous tracking and reporting of covenant thresholds to mitigate risk and prevent breaches that could trigger loan defaults. Expertise in financial statement analysis and covenant terms is critical for maintaining lender confidence and safeguarding organizational financial health.

Loan Agreement

A Financial Covenant Monitoring Officer ensures strict compliance with loan agreement terms by regularly reviewing financial statements and key performance indicators stipulated in the contract. This role involves analyzing covenant thresholds, identifying potential breaches, and collaborating with legal and credit teams to mitigate risks associated with loan defaults. Proficiency in financial modeling, risk assessment, and regulatory standards is essential for maintaining the integrity of financial agreements and protecting lender interests.

Reporting Deadlines

Financial Covenant Monitoring Officers ensure timely submission of compliance reports by meticulously tracking covenant deadlines outlined in loan agreements. They utilize automated tracking systems to monitor reporting schedules, preventing breaches and facilitating proactive communication with stakeholders. Accurate adherence to reporting deadlines maintains lender confidence and mitigates financial risk for the organization.

Breach Notification

Financial Covenant Monitoring Officers specialize in tracking compliance with loan agreement terms to prevent breaches. They continuously analyze financial data to identify covenant thresholds and promptly trigger breach notification protocols when limits are exceeded. Timely breach notifications facilitate risk mitigation and ensure adherence to lender requirements, preserving borrower credibility.

kuljobs.com

kuljobs.com