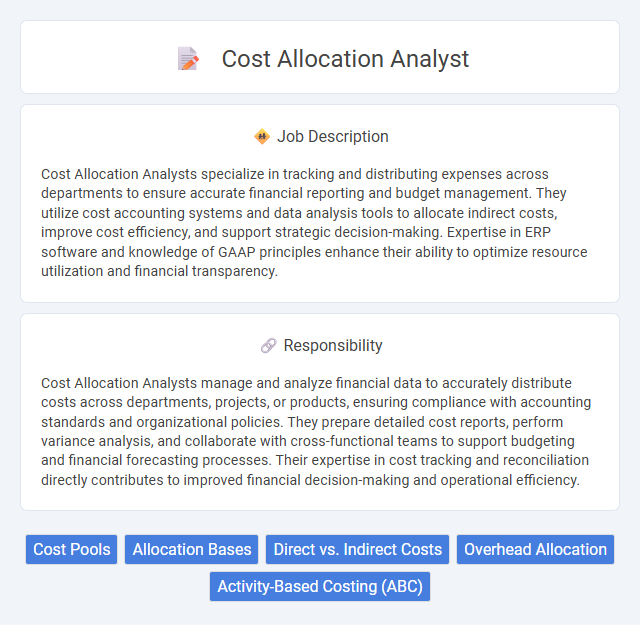

Cost Allocation Analysts specialize in tracking and distributing expenses across departments to ensure accurate financial reporting and budget management. They utilize cost accounting systems and data analysis tools to allocate indirect costs, improve cost efficiency, and support strategic decision-making. Expertise in ERP software and knowledge of GAAP principles enhance their ability to optimize resource utilization and financial transparency.

Individuals with strong analytical skills and attention to detail are likely to be well-suited for a Cost Allocation Analyst role, as the job requires precise data examination and financial assessment. People who thrive in structured environments and enjoy working with numbers may find this position fulfilling, though those uncomfortable with repetitive tasks or complex calculations might struggle. Candidates with strong communication abilities could have an advantage, as explaining cost allocation reports to non-financial stakeholders is often a necessary part of the job.

Qualification

Cost Allocation Analysts require strong analytical skills and proficiency in financial reporting software such as SAP or Oracle. A bachelor's degree in finance, accounting, or economics is typically essential, with advanced knowledge of cost accounting principles and data analysis techniques. Experience in budgeting, variance analysis, and regulatory compliance strengthens a candidate's qualifications in this role.

Responsibility

Cost Allocation Analysts manage and analyze financial data to accurately distribute costs across departments, projects, or products, ensuring compliance with accounting standards and organizational policies. They prepare detailed cost reports, perform variance analysis, and collaborate with cross-functional teams to support budgeting and financial forecasting processes. Their expertise in cost tracking and reconciliation directly contributes to improved financial decision-making and operational efficiency.

Benefit

Cost Allocation Analysts likely improve financial accuracy by ensuring expenses are properly distributed across departments, which may enhance budgeting efficiency. They probably contribute to better decision-making by providing clear insights into cost drivers, potentially reducing waste and optimizing resource use. This role is expected to support organizational profitability through more precise cost control and reporting.

Challenge

Cost Allocation Analyst roles often involve the challenge of accurately distributing expenses across various departments and projects that have complex and overlapping cost structures. The position may require advanced analytical skills to interpret large datasets with varying degrees of completeness and consistency, which can complicate reporting accuracy. Navigating constantly changing financial regulations and compliance requirements might further increase the difficulty and demand adaptive problem-solving abilities.

Career Advancement

Cost Allocation Analysts specializing in budgeting and financial reporting acquire critical skills that pave the way for advanced roles such as Financial Planning Manager or Senior Cost Analyst. Mastery of cost benefit analysis, variance reporting, and ERP systems enhances eligibility for leadership positions in finance departments. Continuous development in data analytics and cross-functional collaboration accelerates career progression within corporate finance and consulting firms.

Key Terms

Cost Pools

Cost Allocation Analysts specialize in identifying and managing cost pools to ensure accurate distribution of indirect expenses across departments or projects. They analyze financial data to categorize costs into relevant pools, enhancing transparency and budget control for organizations. Effective management of cost pools supports strategic decision-making and improves profitability assessment.

Allocation Bases

Cost Allocation Analysts specialize in identifying and applying appropriate allocation bases to distribute expenses accurately across departments or projects. They analyze cost drivers such as labor hours, square footage, or machine usage to ensure fair and consistent cost allocation. Expertise in allocation bases enhances budgeting accuracy, financial reporting, and internal cost control effectiveness.

Direct vs. Indirect Costs

A Cost Allocation Analyst specializes in accurately categorizing expenses into direct and indirect costs to optimize financial reporting and budgeting. Direct costs include expenses directly tied to a specific project or product, such as raw materials and labor, while indirect costs encompass overhead expenses like utilities and administrative salaries that support multiple projects. Precise differentiation enhances cost control, supports compliance with accounting standards, and aids management in strategic decision-making.

Overhead Allocation

Cost Allocation Analysts specialize in distributing overhead costs accurately across various departments and projects to ensure precise financial reporting and budgeting. They utilize activity-based costing and other allocation methodologies to identify indirect costs and assign them proportionally based on usage drivers. Expertise in overhead allocation enhances cost control, profitability analysis, and supports strategic decision-making within organizations.

Activity-Based Costing (ABC)

Cost Allocation Analysts specializing in Activity-Based Costing (ABC) enhance financial accuracy by assigning costs to specific activities based on resource consumption. Their expertise in ABC enables detailed cost tracking, facilitating more precise budgeting and strategic decision-making within organizations. Proficiency in ABC software and data analysis tools is essential to optimize cost allocation processes and improve overall financial performance.

kuljobs.com

kuljobs.com