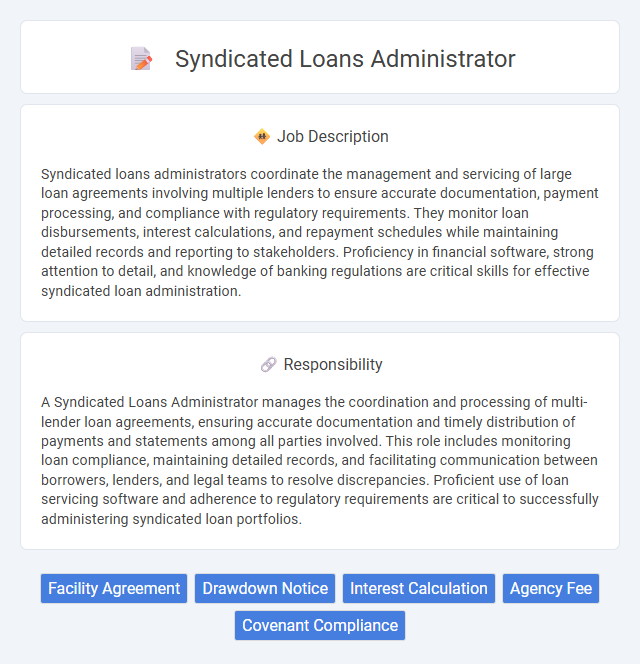

Syndicated loans administrators coordinate the management and servicing of large loan agreements involving multiple lenders to ensure accurate documentation, payment processing, and compliance with regulatory requirements. They monitor loan disbursements, interest calculations, and repayment schedules while maintaining detailed records and reporting to stakeholders. Proficiency in financial software, strong attention to detail, and knowledge of banking regulations are critical skills for effective syndicated loan administration.

Individuals with strong analytical skills, attention to detail, and effective communication abilities are likely suitable for a syndicated loans administrator role. Candidates who thrive in structured environments and can manage multiple tasks accurately under tight deadlines may find this position aligns well with their strengths. Those less comfortable with complex financial data or frequent coordination between parties might face challenges in this job.

Qualification

A Syndicated Loans Administrator requires strong knowledge of loan documentation, financial products, and regulatory compliance to manage complex syndicated credit agreements effectively. Proficiency in financial software, excellent attention to detail, and strong communication skills are essential for coordinating between lenders, borrowers, and legal teams. Typically, a degree in finance, economics, or business administration, along with relevant certifications such as CFA or FRM, enhances qualification for this role.

Responsibility

A Syndicated Loans Administrator manages the coordination and processing of multi-lender loan agreements, ensuring accurate documentation and timely distribution of payments and statements among all parties involved. This role includes monitoring loan compliance, maintaining detailed records, and facilitating communication between borrowers, lenders, and legal teams to resolve discrepancies. Proficient use of loan servicing software and adherence to regulatory requirements are critical to successfully administering syndicated loan portfolios.

Benefit

Syndicated loans administrators likely benefit from gaining deep expertise in managing complex multi-lender loan agreements, which enhances their value in the finance sector. The role often provides opportunities to develop strong analytical skills and attention to detail, crucial for tracking repayments and compliance. This experience may increase job security and open pathways to higher positions in banking or investment management.

Challenge

Syndicated loan administrators likely face the challenge of managing complex communication between multiple lenders and borrowers, requiring precise coordination and attention to detail. Navigating regulatory compliance and ensuring timely loan disbursements might increase the responsibility and pressure involved. The role probably demands strong analytical skills to handle intricate financial documentation and evolving market conditions.

Career Advancement

Syndicated loans administrators manage the coordination and processing of syndicated loan transactions, ensuring accuracy and compliance across multiple lenders. Expertise in financial documentation, credit analysis, and regulatory frameworks enhances opportunities for promotion to senior loan officer, portfolio manager, or credit risk analyst roles. Building strong analytical skills and industry knowledge accelerates career progression within banking and financial services sectors.

Key Terms

Facility Agreement

A Syndicated Loans Administrator manages the full lifecycle of syndicated loan transactions by ensuring strict adherence to the Facility Agreement terms, including disbursements, repayments, and covenant compliance. They coordinate communication among lenders and borrowers, monitor interest calculations, and prepare detailed reports to ensure transparency and risk mitigation. Expertise in interpreting Facility Agreement clauses is crucial to maintaining contractual integrity and facilitating smooth loan operations.

Drawdown Notice

A Syndicated Loans Administrator manages the drawdown process by accurately preparing and distributing the Drawdown Notice to all participating lenders, ensuring compliance with loan agreement terms and timelines. They verify borrower requests, calculate drawdown amounts, and coordinate communication between administrative agents, lenders, and borrowers to facilitate seamless fund disbursement. Maintaining precise records and monitoring repayment schedules are essential to support transparent and efficient loan administration.

Interest Calculation

A syndicated loans administrator is responsible for accurately calculating interest on large multi-lender loan agreements, ensuring compliance with contractual terms and market conventions. This role involves managing complex loan schedules, updating interest rates based on floating benchmarks like LIBOR or SOFR, and applying day count conventions such as Actual/360 or 30/360. Precision in interest calculation supports timely borrower payments and lender disbursements, mitigating financial risk and maintaining transparent loan administration.

Agency Fee

A Syndicated Loans Administrator manages the disbursement and collection of Agency Fees, ensuring accurate calculation based on agreed-upon loan terms within a syndicated facility. This role involves close coordination with lenders and borrowers to track fee schedules, manage invoicing, and oversee the timely payment of Agency Fees. Expertise in loan documentation and compliance is essential to support seamless fee administration across multiple stakeholders.

Covenant Compliance

A Syndicated Loans Administrator ensures strict covenant compliance by monitoring borrower adherence to financial and operational terms outlined in loan agreements. They analyze financial statements, track key performance indicators, and prepare compliance reports to mitigate default risks across multiple lenders. Expertise in regulatory frameworks and proactive communication with stakeholders is critical for maintaining loan integrity and protecting syndicate interests.

kuljobs.com

kuljobs.com