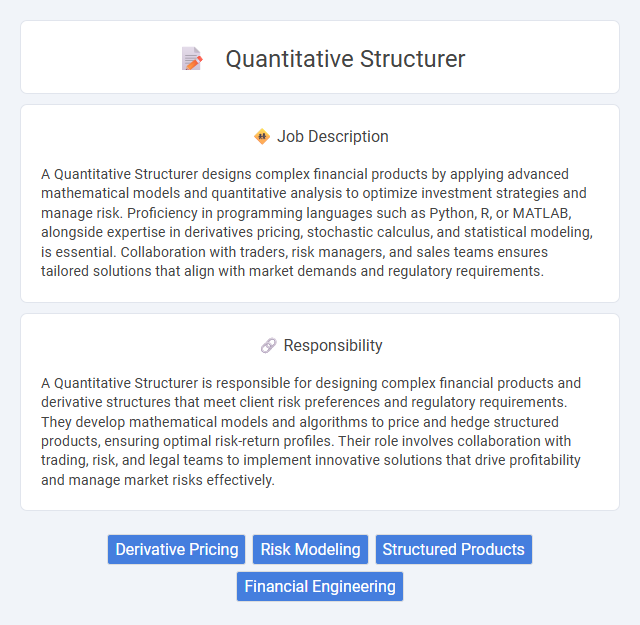

A Quantitative Structurer designs complex financial products by applying advanced mathematical models and quantitative analysis to optimize investment strategies and manage risk. Proficiency in programming languages such as Python, R, or MATLAB, alongside expertise in derivatives pricing, stochastic calculus, and statistical modeling, is essential. Collaboration with traders, risk managers, and sales teams ensures tailored solutions that align with market demands and regulatory requirements.

Individuals with strong analytical skills and a passion for mathematics are likely to thrive in a Quantitative Structurer role. Those comfortable working with complex financial models and data-driven decision-making processes might find this job well-suited to their abilities. People who prefer dynamic, high-pressure environments and continuous problem-solving probably have a higher chance of success as quantitative structurers.

Qualification

A Quantitative Structurer requires advanced expertise in financial mathematics, statistics, and programming languages such as Python, C++, or MATLAB to design complex derivative products and risk models. Strong proficiency in stochastic calculus, numerical methods, and risk management frameworks is essential for creating innovative, tailored financial solutions. A background in quantitative finance, applied mathematics, or engineering, combined with experience in pricing models and regulatory compliance, is highly preferred.

Responsibility

A Quantitative Structurer is responsible for designing complex financial products and derivative structures that meet client risk preferences and regulatory requirements. They develop mathematical models and algorithms to price and hedge structured products, ensuring optimal risk-return profiles. Their role involves collaboration with trading, risk, and legal teams to implement innovative solutions that drive profitability and manage market risks effectively.

Benefit

Quantitative Structurer roles likely offer significant financial benefits due to their critical role in designing complex financial products and managing risk. Employees in this position probably enjoy high earning potential, including bonuses tied to successful trade structuring and market performance. The job may also provide intellectual stimulation and career growth opportunities within quantitative finance.

Challenge

The Quantitative Structurer role likely involves complex modeling challenges that require deep expertise in financial mathematics and programming. It may demand balancing risk management considerations with innovative product design under evolving market conditions. Candidates probably face the pressure of synthesizing large datasets into actionable trading strategies while ensuring regulatory compliance.

Career Advancement

Quantitative Structurers develop complex financial models to design innovative derivative products, leveraging advanced mathematical techniques and programming skills. Mastery in risk management, pricing algorithms, and market data analysis enhances their ability to create tailored solutions for clients, driving portfolio growth and profitability. Career advancement often progresses from junior roles to senior structurer or risk management positions, offering opportunities to lead strategic projects, influence product development, and transition into quantitative research or portfolio management.

Key Terms

Derivative Pricing

Quantitative Structurers specialize in designing and pricing complex derivative products using advanced mathematical models and numerical methods. They leverage stochastic calculus, Monte Carlo simulations, and finite difference methods to evaluate options, swaps, and exotic derivatives accurately. Expertise in market data analysis, risk-neutral valuation, and calibration of pricing models is essential for effective derivative pricing and structuring.

Risk Modeling

Quantitative Structurers specializing in risk modeling develop advanced mathematical models to assess and manage financial risks associated with complex derivatives and structured products. They leverage stochastic processes, statistical analysis, and computational techniques to quantify market, credit, and liquidity risks, ensuring robust pricing and hedging strategies. Proficiency in programming languages such as Python, C++, and MATLAB enhances their ability to create scalable and accurate risk measurement tools for dynamic market environments.

Structured Products

A Quantitative Structurer specializing in Structured Products designs and models complex financial instruments by applying advanced mathematical techniques and quantitative analysis to optimize risk-return profiles. They develop pricing models, conduct scenario analysis, and collaborate with trading desks to create tailored investment solutions that meet specific client objectives and regulatory requirements. Expertise in derivatives, fixed income, and market risk metrics is essential to effectively engineer and manage structured product portfolios.

Financial Engineering

A Quantitative Structurer specializes in designing complex financial products and derivatives by applying advanced mathematical models and programming skills within Financial Engineering. Leveraging expertise in stochastic calculus, risk management, and numerical methods, they create tailored solutions to optimize risk-return profiles for investment banks and hedge funds. Proficiency in tools like Python, C++, and MATLAB is essential for developing pricing models, conducting scenario analysis, and enhancing portfolio strategies.

kuljobs.com

kuljobs.com