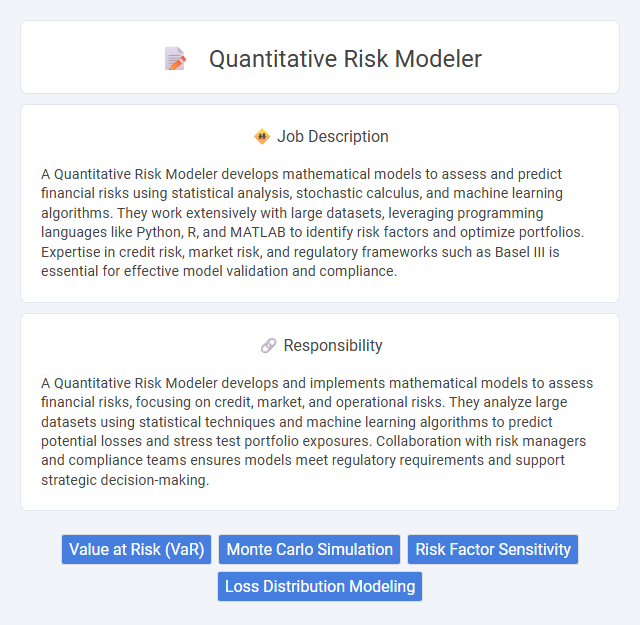

A Quantitative Risk Modeler develops mathematical models to assess and predict financial risks using statistical analysis, stochastic calculus, and machine learning algorithms. They work extensively with large datasets, leveraging programming languages like Python, R, and MATLAB to identify risk factors and optimize portfolios. Expertise in credit risk, market risk, and regulatory frameworks such as Basel III is essential for effective model validation and compliance.

Individuals with strong analytical skills, proficiency in mathematics, and a keen interest in financial markets are likely suitable for a Quantitative Risk Modeler role. Those who thrive in fast-paced, detail-oriented environments and enjoy working with complex data to predict market risks may find this job aligns well with their strengths. However, people who prefer less quantitative or less technical roles might find this position challenging or less engaging.

Qualification

A Quantitative Risk Modeler typically requires advanced proficiency in mathematics, statistics, and computer science, with a strong emphasis on stochastic processes and financial theory. Essential qualifications include a master's or Ph.D. degree in quantitative finance, applied mathematics, statistics, or engineering, combined with experience in programming languages like Python, R, or MATLAB for model development and validation. Expertise in risk metrics such as Value at Risk (VaR), Expected Shortfall, and stress testing frameworks is crucial for accurately assessing and mitigating financial risks.

Responsibility

A Quantitative Risk Modeler develops and implements mathematical models to assess financial risks, focusing on credit, market, and operational risks. They analyze large datasets using statistical techniques and machine learning algorithms to predict potential losses and stress test portfolio exposures. Collaboration with risk managers and compliance teams ensures models meet regulatory requirements and support strategic decision-making.

Benefit

Quantitative risk modeler roles likely offer significant benefits, including enhanced career prospects due to growing demand in finance and insurance sectors. Professionals in this field probably experience improved analytical skills and deeper understanding of market risks, which can lead to higher salary potential. Access to cutting-edge technology and collaborative environments may also contribute to overall job satisfaction and professional growth.

Challenge

Quantitative risk modelers likely encounter complex challenges involving the analysis of large datasets to identify potential financial risks accurately. The role may require advanced statistical and mathematical techniques to develop predictive models that can adapt to rapidly changing market conditions. Navigating the uncertainty and variability inherent in financial markets makes effective risk modeling a constantly evolving challenge.

Career Advancement

Quantitative risk modelers leverage statistical methods and financial theories to develop models that predict market, credit, and operational risks, enhancing decision-making processes in banking and investment firms. Career advancement often involves progressing to senior risk analyst, risk management consultant, or chief risk officer roles, requiring expertise in machine learning, regulatory compliance, and complex derivatives modeling. Mastery of Python, R, and advanced financial software increases opportunities for leadership positions in risk analytics and strategic risk advisory.

Key Terms

Value at Risk (VaR)

A Quantitative Risk Modeler specializing in Value at Risk (VaR) develops and validates statistical models to measure potential losses in investment portfolios under normal market conditions. Expertise in stochastic processes, Monte Carlo simulations, and historical simulation techniques is essential for accurate VaR estimation and risk assessment. Proficiency with programming languages such as Python, R, or MATLAB enables efficient data analysis, model optimization, and regulatory compliance reporting.

Monte Carlo Simulation

Quantitative risk modelers utilize Monte Carlo simulation to assess potential financial losses by generating thousands of random scenarios based on probabilistic inputs. This technique provides a comprehensive risk profile by simulating asset price fluctuations, interest rates, and market volatility, enabling precise valuation of portfolios and derivative instruments. Expertise in programming languages such as Python or R and strong statistical knowledge are essential to build and validate these stochastic models for effective risk management.

Risk Factor Sensitivity

Quantitative risk modelers specialize in developing and implementing models to measure and manage financial risks, with a strong emphasis on risk factor sensitivity analysis. They quantify how changes in market variables such as interest rates, credit spreads, and volatility impact portfolios and financial instruments, enabling precise risk assessment and stress testing. Expertise in statistical methods, programming languages like Python or R, and financial theory supports their ability to enhance risk mitigation strategies and optimize capital allocation.

Loss Distribution Modeling

Quantitative risk modelers specializing in Loss Distribution Modeling (LDM) develop statistical frameworks to estimate the probability and severity of potential financial losses for organizations. They apply advanced techniques such as extreme value theory, copulas, and Monte Carlo simulations to quantify tail risk and operational risk accurately. Expertise in programming languages like Python, R, and SAS, combined with strong knowledge of regulatory frameworks such as Basel III and Solvency II, is essential for effective risk assessment and capital allocation.

kuljobs.com

kuljobs.com