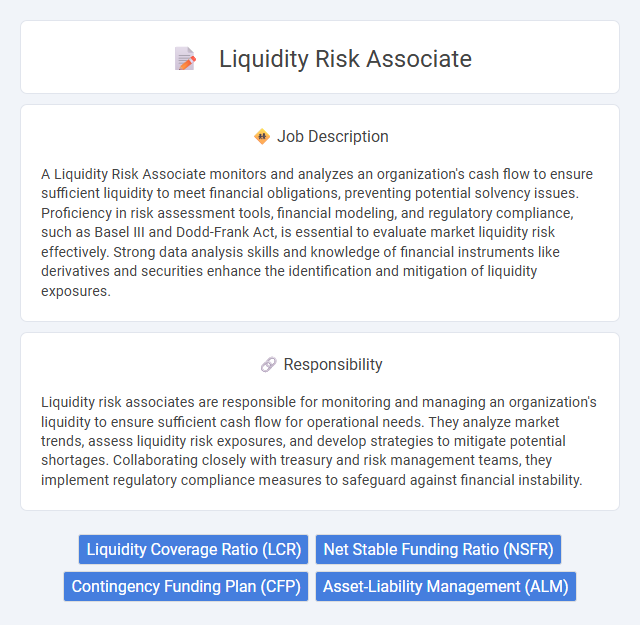

A Liquidity Risk Associate monitors and analyzes an organization's cash flow to ensure sufficient liquidity to meet financial obligations, preventing potential solvency issues. Proficiency in risk assessment tools, financial modeling, and regulatory compliance, such as Basel III and Dodd-Frank Act, is essential to evaluate market liquidity risk effectively. Strong data analysis skills and knowledge of financial instruments like derivatives and securities enhance the identification and mitigation of liquidity exposures.

Individuals with strong analytical skills and attention to detail are likely suitable for a liquidity risk associate role, as the job demands constant monitoring of cash flow and market conditions. Candidates who thrive in fast-paced environments and exhibit effective problem-solving abilities may have a higher probability of succeeding in managing liquidity risks. Those uncomfortable with high-pressure decision-making or lacking financial acumen might find the role challenging and less suitable.

Qualification

A Liquidity Risk Associate must possess a strong foundation in finance, economics, or a related quantitative field, typically requiring a bachelor's degree and knowledge of risk management principles. Proficiency in data analysis tools such as Excel, SQL, and risk modeling software is essential for assessing cash flow and liquidity positions. Exceptional analytical skills, attention to detail, and the ability to interpret financial statements and regulatory requirements are critical for monitoring and mitigating liquidity risks effectively.

Responsibility

Liquidity risk associates are responsible for monitoring and managing an organization's liquidity to ensure sufficient cash flow for operational needs. They analyze market trends, assess liquidity risk exposures, and develop strategies to mitigate potential shortages. Collaborating closely with treasury and risk management teams, they implement regulatory compliance measures to safeguard against financial instability.

Benefit

Liquidity risk associate roles may offer significant benefits such as exposure to dynamic financial markets and the opportunity to develop expertise in risk management and regulatory compliance. The position likely enhances analytical skills and provides experience with advanced financial modeling tools, which can improve career prospects in banking or investment firms. Employees might also benefit from collaborating with cross-functional teams, contributing to professional growth and networking opportunities in the industry.

Challenge

Liquidity risk associate roles likely involve navigating complex market dynamics and assessing potential cash flow shortages under stress scenarios. The challenge may arise from accurately modeling liquidity positions and anticipating sudden shifts in funding availability. Balancing regulatory compliance while managing real-time liquidity risks probably demands sharp analytical skills and proactive decision-making.

Career Advancement

Liquidity risk associates play a critical role in managing and analyzing financial institutions' cash flow and liquidity positions to ensure regulatory compliance and operational stability. Mastery of risk assessment tools and understanding regulatory frameworks like Basel III pave the way for advancement to senior risk management roles or specialized positions in stress testing and capital planning. Continuous professional development through certifications such as FRM or CFA significantly enhances career growth prospects in the competitive financial services sector.

Key Terms

Liquidity Coverage Ratio (LCR)

A Liquidity Risk Associate specializes in monitoring and managing the bank's Liquidity Coverage Ratio (LCR) to ensure compliance with regulatory standards set by Basel III. This role involves analyzing cash flow projections, stress testing liquidity positions, and preparing reports that reflect the adequacy of high-quality liquid assets (HQLA) against net cash outflows. Proficiency in regulatory frameworks and advanced quantitative skills are essential for optimizing liquidity buffers and mitigating potential funding shortfalls.

Net Stable Funding Ratio (NSFR)

A Liquidity Risk Associate specializing in Net Stable Funding Ratio (NSFR) plays a crucial role in monitoring and managing a bank's long-term liquidity position to ensure regulatory compliance with Basel III standards. This position involves analyzing funding sources, assessing the stability and maturity profiles of assets and liabilities, and preparing detailed NSFR reports to inform strategic funding decisions. Expertise in liquidity risk metrics and stress testing scenarios supports maintaining an optimal balance between stable funding and asset liquidity.

Contingency Funding Plan (CFP)

A Liquidity Risk Associate plays a critical role in managing the Contingency Funding Plan (CFP) by identifying potential liquidity shortfalls and ensuring the availability of alternative funding sources during stressed market conditions. The associate analyzes cash flow projections, monitors liquidity buffers, and evaluates the impact of adverse scenarios to enhance the institution's resilience against liquidity disruptions. Expertise in regulatory requirements such as Basel III liquidity coverage ratio (LCR) and internal stress testing methodologies is essential for optimizing the CFP framework and maintaining regulatory compliance.

Asset-Liability Management (ALM)

Liquidity risk associates in Asset-Liability Management (ALM) play a critical role in monitoring and managing an institution's liquidity position to ensure sufficient cash flows meet both short-term obligations and long-term liabilities. They analyze treasury operations, cash flow forecasts, and market variables to identify potential liquidity gaps and recommend strategies to mitigate risk. Expertise in regulatory compliance, liquidity coverage ratio (LCR), and stress testing enhances their ability to maintain optimal asset-liability balance and financial stability.

kuljobs.com

kuljobs.com