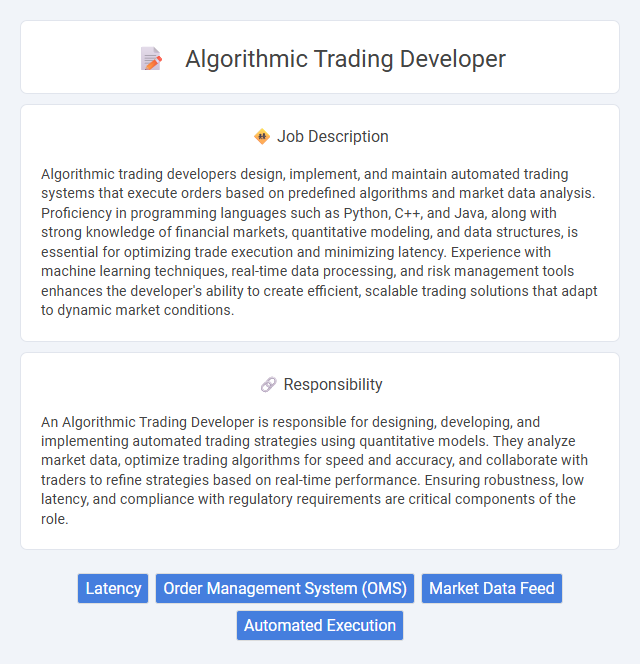

Algorithmic trading developers design, implement, and maintain automated trading systems that execute orders based on predefined algorithms and market data analysis. Proficiency in programming languages such as Python, C++, and Java, along with strong knowledge of financial markets, quantitative modeling, and data structures, is essential for optimizing trade execution and minimizing latency. Experience with machine learning techniques, real-time data processing, and risk management tools enhances the developer's ability to create efficient, scalable trading solutions that adapt to dynamic market conditions.

Individuals with strong analytical skills and a passion for finance are likely to excel as algorithmic trading developers. Those comfortable with coding, quantitative modeling, and working under pressure may find this role well-suited to their abilities. It is probable that candidates who enjoy problem-solving and adapting quickly to market changes will thrive in this fast-paced environment.

Qualification

Algorithmic trading developers require strong proficiency in programming languages such as Python, C++, and Java, coupled with deep knowledge of financial markets and trading strategies. Expertise in quantitative analysis, statistical modeling, and machine learning techniques is essential for designing and optimizing automated trading algorithms. A background in computer science, finance, or mathematics, along with experience in real-time data processing and risk management systems, significantly enhances a candidate's qualifications.

Responsibility

An Algorithmic Trading Developer is responsible for designing, developing, and implementing automated trading strategies using quantitative models. They analyze market data, optimize trading algorithms for speed and accuracy, and collaborate with traders to refine strategies based on real-time performance. Ensuring robustness, low latency, and compliance with regulatory requirements are critical components of the role.

Benefit

Algorithmic trading developer roles likely offer significant financial rewards due to the high demand for specialized skills in automated trading systems. Candidates probably benefit from opportunities to work with cutting-edge technologies and data analytics, enhancing their expertise and career growth. Efficient algorithmic trading strategies developed by experts may increase profitability and reduce market risks for financial institutions.

Challenge

Algorithmic trading developer roles likely involve tackling complex challenges such as designing and optimizing high-frequency trading algorithms that respond to real-time market data with minimal latency. Managing vast datasets and ensuring the robustness of trading strategies against unpredictable market conditions may present ongoing difficulties. Staying updated with evolving financial regulations and integrating advanced machine learning models could further complicate the development process.

Career Advancement

Algorithmic trading developers leverage advanced programming skills and quantitative analysis to design automated trading systems that optimize market performance. Mastery of programming languages such as Python, C++, and expertise in machine learning algorithms significantly enhance opportunities for career progression toward senior quantitative developer or algorithmic trading strategist roles. Continuous learning of financial markets, data structures, and low-latency system design propels professionals into leadership positions within hedge funds, proprietary trading firms, and financial technology companies.

Key Terms

Latency

Algorithmic trading developers specialize in designing high-frequency trading systems that optimize latency to execute orders within microseconds. They utilize low-latency programming languages such as C++ and FPGA technology to minimize delay in market data processing and order routing. Expertise in network optimization, co-location strategies, and real-time data streaming is essential to achieve ultra-low latency performance in competitive trading environments.

Order Management System (OMS)

An Algorithmic Trading Developer specializing in Order Management Systems (OMS) designs and implements robust software to automate trade execution and manage order workflows efficiently. Expertise in integrating OMS with real-time market data feeds, risk management tools, and execution venues ensures optimized trade processing and compliance with regulatory standards. Proficiency in programming languages such as C++, Python, and Java, along with experience in FIX protocol and API development, is essential for creating scalable and low-latency OMS solutions.

Market Data Feed

Algorithmic trading developers specializing in Market Data Feed design and optimize real-time data ingestion systems to ensure low-latency, high-frequency trading strategies operate efficiently. They implement protocols such as FIX, ITCH, and OUCH to process vast streams of financial market data, enabling precise order execution and risk mitigation. Expertise in handling tick-level data, feed handlers, and data normalization is critical for maintaining data integrity and optimizing algorithm performance.

Automated Execution

Algorithmic trading developers specialize in creating automated execution systems that optimize trade timing and order placement to minimize market impact and maximize profitability. These professionals utilize programming languages like Python, C++, and Java to design algorithms that execute trades based on real-time market data and predefined strategies. Expertise in low-latency systems, quantitative finance, and risk management is critical for building efficient, reliable automated execution platforms.

kuljobs.com

kuljobs.com