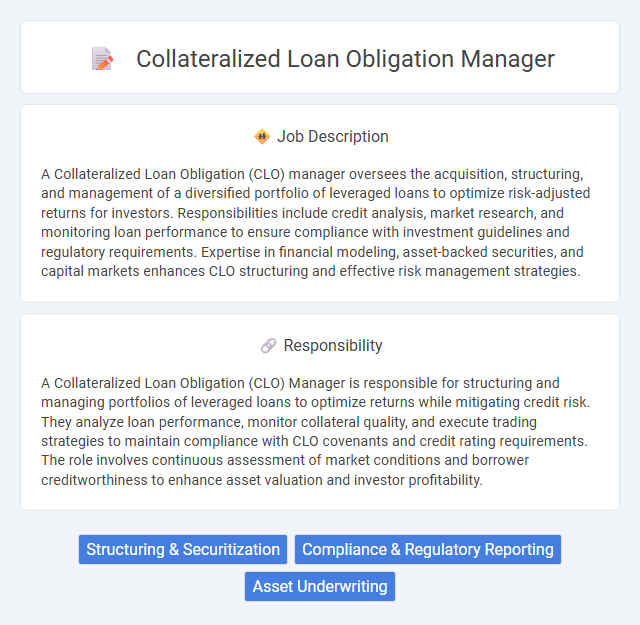

A Collateralized Loan Obligation (CLO) manager oversees the acquisition, structuring, and management of a diversified portfolio of leveraged loans to optimize risk-adjusted returns for investors. Responsibilities include credit analysis, market research, and monitoring loan performance to ensure compliance with investment guidelines and regulatory requirements. Expertise in financial modeling, asset-backed securities, and capital markets enhances CLO structuring and effective risk management strategies.

Individuals with strong analytical skills, resilience under pressure, and a thorough understanding of credit markets are more likely to succeed as Collateralized Loan Obligation (CLO) managers. Those who thrive in highly dynamic, fast-paced environments and can make informed decisions based on complex financial data may find this role suitable. Conversely, people who prefer routine tasks or struggle with high-stakes, stress-inducing settings might be less well-suited for this demanding position.

Qualification

A Collateralized Loan Obligation (CLO) manager must possess strong financial analysis skills and deep expertise in credit markets, particularly leveraged loans and debt securities. Advanced knowledge of structuring CLOs, portfolio management, and risk assessment is essential, often supported by certifications such as CFA or FRM. Proficiency in financial modeling, regulatory compliance, and strategic decision-making underpins effectiveness in optimizing CLO performance and investor returns.

Responsibility

A Collateralized Loan Obligation (CLO) Manager is responsible for structuring and managing portfolios of leveraged loans to optimize returns while mitigating credit risk. They analyze loan performance, monitor collateral quality, and execute trading strategies to maintain compliance with CLO covenants and credit rating requirements. The role involves continuous assessment of market conditions and borrower creditworthiness to enhance asset valuation and investor profitability.

Benefit

A Collateralized Loan Obligation (CLO) manager likely benefits from significant financial incentives, including performance-based bonuses tied to successful asset management and portfolio returns. The role may offer opportunities to develop specialized expertise in credit markets and structured finance, increasing career advancement potential. Job stability is probable due to the high demand for skilled CLO managers in managing complex debt instruments within investment firms.

Challenge

Collateralized loan obligation (CLO) managers face the challenge of balancing risk and return in a highly complex and dynamic credit market environment. They must probabilistically assess portfolio performance while navigating regulatory changes and market volatility to optimize asset allocations. The likelihood of successfully managing default risks and maintaining investor confidence requires constant vigilance and sophisticated financial modeling.

Career Advancement

A Collateralized Loan Obligation (CLO) manager oversees the structuring, management, and performance optimization of CLO portfolios, requiring strong analytical skills in credit analysis and risk management. Career advancement in this field often progresses from analyst roles to senior portfolio manager positions, with opportunities to lead investment strategy teams or transition into executive roles within asset management firms. Expertise in CLO markets, regulatory compliance, and investor relations significantly enhances prospects for leadership and higher compensation.

Key Terms

Structuring & Securitization

A Collateralized Loan Obligation (CLO) manager specializes in structuring and securitization by creating diversified portfolios of leveraged loans and transforming them into tradable securities. This role involves analyzing credit risk, designing tranche structures to optimize returns and manage risk, and coordinating with rating agencies to achieve desired credit ratings. Mastery of cash flow modeling and regulatory compliance is essential to ensure efficient CLO issuance and ongoing asset management.

Compliance & Regulatory Reporting

A Collateralized Loan Obligation (CLO) manager ensures strict adherence to compliance standards and regulatory reporting requirements established by governing bodies such as the SEC and European regulators. The role involves accurate monitoring of CLO portfolio transactions, maintaining transparency through detailed reporting, and ensuring all activities meet risk management and legal frameworks. Expertise in financial regulations like Dodd-Frank and Basel III is crucial for mitigating compliance risks and ensuring audit readiness.

Asset Underwriting

A Collateralized Loan Obligation (CLO) manager specializing in asset underwriting rigorously evaluates leveraged loans and other debt instruments to ensure portfolio quality and risk mitigation. This role involves comprehensive credit analysis, cash flow modeling, and stress testing to assess collateral performance and optimize tranche structuring. Expertise in market trends, borrower financial health, and regulatory compliance is crucial for maximizing returns while maintaining asset stability.

kuljobs.com

kuljobs.com