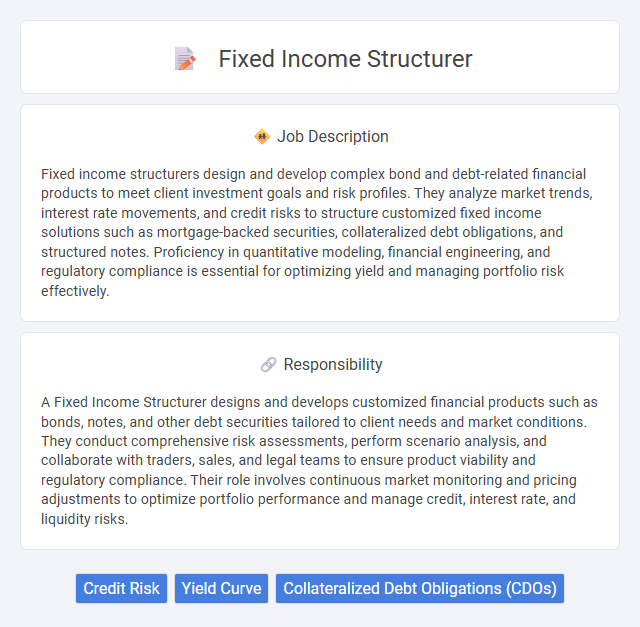

Fixed income structurers design and develop complex bond and debt-related financial products to meet client investment goals and risk profiles. They analyze market trends, interest rate movements, and credit risks to structure customized fixed income solutions such as mortgage-backed securities, collateralized debt obligations, and structured notes. Proficiency in quantitative modeling, financial engineering, and regulatory compliance is essential for optimizing yield and managing portfolio risk effectively.

Individuals with strong analytical skills and a keen attention to detail are likely to be well-suited for a fixed income structurer role, as it involves complex financial modeling and risk assessment. The job may appeal to those who enjoy working with quantitative data and have a solid understanding of bond markets, interest rates, and credit risk. Candidates who prefer fast-paced, dynamic environments and can manage high-pressure situations might find this position both challenging and rewarding.

Qualification

A Fixed Income Structurer typically requires a strong background in finance, mathematics, and quantitative analysis, often supported by a degree in economics, finance, engineering, or related fields. Proficiency in financial modeling, derivatives, risk management, and programming languages such as Python or MATLAB is essential for structuring complex fixed income products. Advanced certifications like CFA or FRM enhance expertise in credit analysis, fixed income markets, and regulatory compliance, which are critical for success in this role.

Responsibility

A Fixed Income Structurer designs and develops customized financial products such as bonds, notes, and other debt securities tailored to client needs and market conditions. They conduct comprehensive risk assessments, perform scenario analysis, and collaborate with traders, sales, and legal teams to ensure product viability and regulatory compliance. Their role involves continuous market monitoring and pricing adjustments to optimize portfolio performance and manage credit, interest rate, and liquidity risks.

Benefit

A Fixed Income Structurer role likely offers substantial benefits such as competitive compensation packages and performance-based bonuses due to the specialized financial expertise required. Professionals in this position may gain enhanced career growth opportunities by developing complex debt instruments and working closely with trading and risk management teams. Exposure to diverse market conditions and innovative financial solutions could also contribute to valuable skills that increase long-term employability in finance.

Challenge

A Fixed Income Structurer role likely involves complex quantitative modeling and market risk assessment, requiring strong analytical skills and attention to detail. The challenge may stem from rapidly changing interest rates and credit conditions, which demand constant adaptation of product designs and pricing strategies. Navigating regulatory constraints while creating innovative fixed income products could also pose significant obstacles in this position.

Career Advancement

A Fixed Income Structurer designs and tailors debt products such as bonds, notes, and structured securities to meet client needs, requiring strong quantitative skills and market insight. Career advancement in this field often leads to senior structurer roles, portfolio management, or executive positions within investment banks or asset management firms. Expertise in financial modeling, risk assessment, and regulatory knowledge enhances opportunities for leadership and strategic decision-making positions.

Key Terms

Credit Risk

A Fixed Income Structurer specializing in Credit Risk designs and tailors debt securities and derivatives to optimize risk-adjusted returns while managing potential credit exposure. They perform thorough credit risk analysis, including default probability assessment and loss given default modeling, to mitigate borrower insolvency impacts on structured products. Expertise in market conditions, credit spread dynamics, and regulatory frameworks ensures effective structuring of collateralized debt obligations, credit default swaps, and other fixed income instruments.

Yield Curve

A Fixed Income Structurer specializes in creating customized debt instruments by analyzing and leveraging yield curve dynamics to optimize investment returns and risk profiles. The role requires deep expertise in yield curve modeling, interest rate derivatives, and market trends to design products that meet client-specific cash flow and duration objectives. Mastery of yield curve shifts, steepening, and flattening scenarios is essential for structuring strategies that enhance portfolio performance and hedge interest rate risk.

Collateralized Debt Obligations (CDOs)

A Fixed Income Structurer specializing in Collateralized Debt Obligations (CDOs) designs and assembles complex financial products by pooling various debt instruments to create tranches with distinct risk and return profiles. They analyze underlying asset cash flows, model credit risk, and optimize capital structure to meet investor demand and regulatory requirements. Expertise in structuring synthetic CDOs, managing collateral pools, and navigating securitization markets is essential for maximizing profitability and mitigating default risks.

kuljobs.com

kuljobs.com