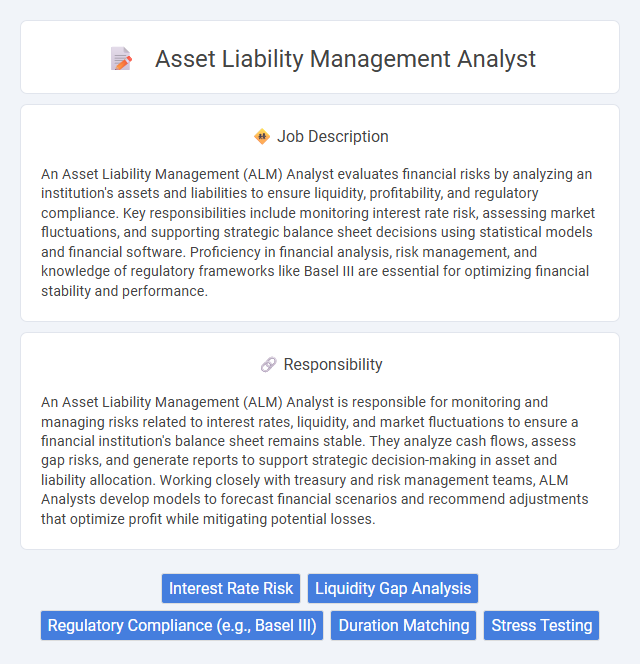

An Asset Liability Management (ALM) Analyst evaluates financial risks by analyzing an institution's assets and liabilities to ensure liquidity, profitability, and regulatory compliance. Key responsibilities include monitoring interest rate risk, assessing market fluctuations, and supporting strategic balance sheet decisions using statistical models and financial software. Proficiency in financial analysis, risk management, and knowledge of regulatory frameworks like Basel III are essential for optimizing financial stability and performance.

Candidates with strong analytical skills and a keen attention to detail are likely to be well-suited for an Asset Liability Management (ALM) analyst role, given the job's demand for precise financial forecasting and risk assessment. Individuals who thrive in structured environments and are comfortable working with complex data models and financial regulations may find this position aligns with their strengths. Conversely, those who prefer creative or highly social roles might find the analytical and repetitive nature of ALM tasks less compatible with their preferences.

Qualification

An Asset Liability Management (ALM) Analyst typically requires a strong background in finance, economics, or accounting, often supported by a bachelor's degree in one of these fields. Proficiency in financial modeling, risk assessment techniques, and statistical analysis tools such as Excel, SAS, or Python is essential for evaluating interest rate risk and liquidity management. Advanced certifications like CFA, FRM, or CPA enhance job prospects and demonstrate expertise in asset-liability management and regulatory compliance.

Responsibility

An Asset Liability Management (ALM) Analyst is responsible for monitoring and managing risks related to interest rates, liquidity, and market fluctuations to ensure a financial institution's balance sheet remains stable. They analyze cash flows, assess gap risks, and generate reports to support strategic decision-making in asset and liability allocation. Working closely with treasury and risk management teams, ALM Analysts develop models to forecast financial scenarios and recommend adjustments that optimize profit while mitigating potential losses.

Benefit

An Asset Liability Management (ALM) Analyst likely enhances financial stability by carefully balancing assets and liabilities to minimize risk and optimize returns. This role probably supports better decision-making through detailed analysis and forecasting of interest rate trends and market conditions. Employers may benefit from reduced exposure to liquidity and interest rate risks, improving overall financial performance.

Challenge

An Asset Liability Management (ALM) analyst likely faces the challenge of accurately forecasting market risks and interest rate fluctuations to maintain a balance between assets and liabilities. Managing the volatility in financial instruments and ensuring regulatory compliance may require advanced analytical skills and timely decision-making. The role probably demands continuous adaptation to changing economic conditions and complex financial models.

Career Advancement

Asset Liability Management (ALM) Analysts play a critical role in financial institutions by balancing risks related to assets and liabilities to maximize profitability and ensure regulatory compliance. Career advancement for ALM Analysts typically involves progressing to senior analyst roles, portfolio management, risk management leadership, or specialized positions such as ALM strategist or financial controller. Mastery of quantitative modeling, regulatory frameworks, and experience with market risk analytics significantly enhances promotion opportunities and career growth in this field.

Key Terms

Interest Rate Risk

An Asset Liability Management (ALM) Analyst specializing in Interest Rate Risk assesses and monitors the impact of fluctuating interest rates on a financial institution's balance sheet. This role involves analyzing gaps between asset and liability maturities to optimize interest income and minimize exposure to rate volatility. Proficiency in financial modeling, stress testing, and regulatory compliance such as Basel III guidelines is essential for effective interest rate risk management.

Liquidity Gap Analysis

An Asset Liability Management (ALM) Analyst specializing in Liquidity Gap Analysis plays a crucial role in identifying and managing the timing mismatches between assets and liabilities to ensure an institution's liquidity position remains stable. This involves analyzing cash flow projections, assessing liquidity risks, and recommending strategies to bridge gaps that could impact the organization's ability to meet short-term obligations. The role requires expertise in financial modeling, regulatory compliance, and market risk assessment to optimize asset-liability structures and maintain operational resilience.

Regulatory Compliance (e.g., Basel III)

An Asset Liability Management (ALM) Analyst ensures regulatory compliance by monitoring and managing risks in accordance with Basel III standards, including capital adequacy, liquidity coverage ratio, and leverage ratio requirements. They analyze balance sheet dynamics to optimize asset-liability structures, mitigate interest rate risks, and maintain adequate capital buffers. Proficiency in regulatory reporting and stress testing under Basel III frameworks is critical to support financial stability and regulatory adherence.

Duration Matching

An Asset Liability Management (ALM) analyst specializing in duration matching evaluates the sensitivity of assets and liabilities to interest rate changes by aligning their weighted average durations. This approach minimizes interest rate risk and ensures a balanced financial position, enhancing the stability of an institution's net interest margin. Proficiency in duration gap analysis, financial modeling, and regulatory compliance is essential for effective duration matching in ALM roles.

Stress Testing

Asset liability management analysts specializing in stress testing rigorously evaluate financial institutions' resilience by simulating adverse economic scenarios to identify potential liquidity and interest rate risks. They utilize quantitative models and regulatory frameworks such as Basel III to analyze balance sheet vulnerabilities and ensure compliance with risk management standards. Effective stress testing supports strategic decision-making aimed at maintaining optimal capital adequacy and financial stability under fluctuating market conditions.

kuljobs.com

kuljobs.com