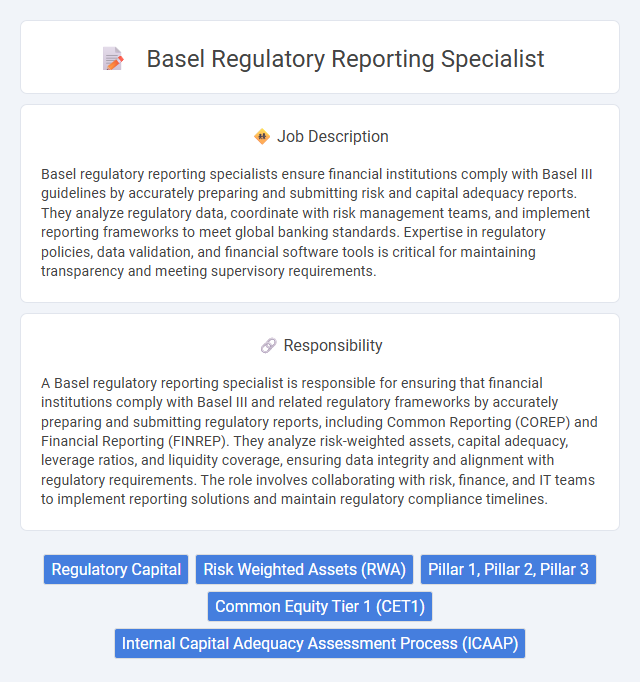

Basel regulatory reporting specialists ensure financial institutions comply with Basel III guidelines by accurately preparing and submitting risk and capital adequacy reports. They analyze regulatory data, coordinate with risk management teams, and implement reporting frameworks to meet global banking standards. Expertise in regulatory policies, data validation, and financial software tools is critical for maintaining transparency and meeting supervisory requirements.

Candidates with strong analytical skills, attention to detail, and a background in finance or regulatory compliance are likely to thrive as Basel regulatory reporting specialists. Those comfortable working with complex regulatory frameworks and producing accurate, timely reports under pressure may find this role suitable. Individuals lacking familiarity with Basel III requirements or struggling with stringent deadlines might face challenges in this position.

Qualification

A Basel regulatory reporting specialist must have in-depth knowledge of Basel III and IV frameworks, including capital adequacy, liquidity, and leverage ratios. Proficiency in regulatory reporting tools such as BCBS 239 compliance and experience with COREP, FINREP, and LCR reporting is essential. Advanced skills in data analysis, risk management, and familiarity with regulatory bodies like the Basel Committee on Banking Supervision significantly enhance job performance.

Responsibility

A Basel regulatory reporting specialist is responsible for ensuring that financial institutions comply with Basel III and related regulatory frameworks by accurately preparing and submitting regulatory reports, including Common Reporting (COREP) and Financial Reporting (FINREP). They analyze risk-weighted assets, capital adequacy, leverage ratios, and liquidity coverage, ensuring data integrity and alignment with regulatory requirements. The role involves collaborating with risk, finance, and IT teams to implement reporting solutions and maintain regulatory compliance timelines.

Benefit

Working as a Basel regulatory reporting specialist likely offers significant benefits such as enhanced expertise in global financial regulations and improved career stability due to high demand in the banking sector. The role probably provides opportunities for professional growth through exposure to complex compliance frameworks and cutting-edge regulatory technologies. Employees in this position may also enjoy competitive compensation packages and the chance to influence critical risk management strategies within their organizations.

Challenge

A Basel regulatory reporting specialist likely faces the challenge of navigating complex and constantly evolving regulatory frameworks set by Basel III and related standards. The role probably demands a deep understanding of risk management metrics, capital requirements, and data accuracy under tight deadlines. Managing cross-departmental coordination and ensuring compliance amidst frequently changing guidelines may also represent significant hurdles.

Career Advancement

A Basel Regulatory Reporting Specialist plays a crucial role in ensuring compliance with Basel III framework requirements, focusing on accurate risk-weighted asset calculations and capital adequacy reporting. Expertise in Basel regulations and regulatory technology tools positions professionals for career advancement into senior risk management or regulatory compliance roles. Mastery in data analytics and regulatory changes enhances opportunities for leadership roles in financial institutions or regulatory bodies.

Key Terms

Regulatory Capital

A Basel regulatory reporting specialist ensures accurate calculation and reporting of regulatory capital to comply with Basel III requirements, including Common Equity Tier 1 (CET1), Tier 1, and Total Capital ratios. They analyze risk-weighted assets (RWA) across credit, market, and operational risk categories to optimize capital adequacy and support regulatory submissions. Expertise in Pillar 1 and Pillar 2 frameworks enables precise interpretation of capital buffers and reporting guidelines for banking institutions.

Risk Weighted Assets (RWA)

A Basel Regulatory Reporting Specialist ensures accurate calculation and reporting of Risk Weighted Assets (RWA) in compliance with Basel III standards, enabling banks to maintain adequate capital buffers. The role involves analyzing risk exposures, validating data inputs, and implementing regulatory guidelines to optimize capital allocation and minimize compliance risks. Expertise in Basel frameworks, risk modeling, and regulatory reporting platforms is essential to support internal and external audit requirements.

Pillar 1, Pillar 2, Pillar 3

A Basel regulatory reporting specialist ensures compliance with international banking standards by managing data and reports related to Pillar 1 minimum capital requirements, assessing risk exposures under Pillar 2 supervisory review processes, and disclosing transparency information in line with Pillar 3 market discipline guidelines. Expertise in Basel III framework, risk-weighted assets (RWAs) calculation, and internal capital adequacy assessment processes (ICAAP) is critical for accurate regulatory submissions. Proficiency in regulatory reporting tools and coordination with risk management and finance teams supports the institution's adherence to Basel Committee mandates.

Common Equity Tier 1 (CET1)

A Basel Regulatory Reporting Specialist plays a crucial role in ensuring accurate calculation and reporting of Common Equity Tier 1 (CET1) capital under Basel III standards. They analyze financial data to verify compliance with regulatory requirements, focusing on risk-weighted assets and capital adequacy ratios to maintain the bank's financial stability. Expertise in Basel regulations and advanced reporting tools is essential to optimize CET1 capital management and support strategic decision-making.

Internal Capital Adequacy Assessment Process (ICAAP)

A Basel regulatory reporting specialist plays a critical role in preparing and analyzing reports related to the Internal Capital Adequacy Assessment Process (ICAAP), ensuring banks comply with Basel III standards. They gather quantitative data on risk exposures, capital requirements, and stress testing outcomes to support senior management in risk management decisions. Expertise in ICAAP documentation, regulatory guidelines, and coordination with risk and finance teams is essential for accurate and timely submission to regulators.

kuljobs.com

kuljobs.com