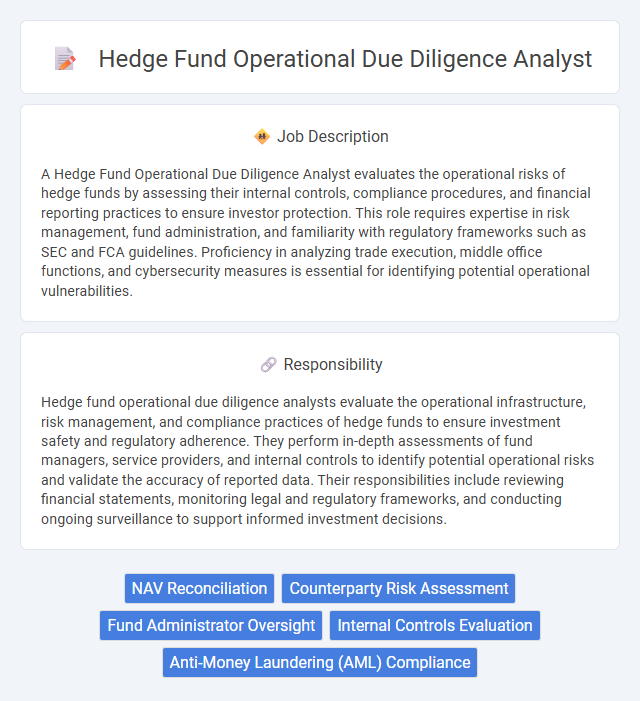

A Hedge Fund Operational Due Diligence Analyst evaluates the operational risks of hedge funds by assessing their internal controls, compliance procedures, and financial reporting practices to ensure investor protection. This role requires expertise in risk management, fund administration, and familiarity with regulatory frameworks such as SEC and FCA guidelines. Proficiency in analyzing trade execution, middle office functions, and cybersecurity measures is essential for identifying potential operational vulnerabilities.

Individuals with strong analytical skills, attention to detail, and a high level of integrity are likely to be suitable for a hedge fund operational due diligence analyst role. Candidates who thrive in fast-paced environments and possess effective communication abilities may adapt well to the demands of evaluating operational risks and compliance issues. Those with limited interest in financial operations or weak investigative instincts might find the role challenging to excel in.

Qualification

A Hedge Fund Operational Due Diligence Analyst must possess a strong background in finance, risk management, and compliance, typically requiring a bachelor's degree in finance, economics, or a related field. Proficiency in analyzing fund operational risks, evaluating internal controls, and understanding regulatory frameworks is essential. Advanced skills in data analysis, financial modeling, and effective communication further strengthen the qualification for this role.

Responsibility

Hedge fund operational due diligence analysts evaluate the operational infrastructure, risk management, and compliance practices of hedge funds to ensure investment safety and regulatory adherence. They perform in-depth assessments of fund managers, service providers, and internal controls to identify potential operational risks and validate the accuracy of reported data. Their responsibilities include reviewing financial statements, monitoring legal and regulatory frameworks, and conducting ongoing surveillance to support informed investment decisions.

Benefit

A Hedge Fund Operational Due Diligence Analyst likely offers significant benefits in risk mitigation by thoroughly assessing operational risks and compliance issues. Their expertise probably enhances investor confidence and aids in identifying potential weaknesses before they impact fund performance. This role might also contribute to improving operational efficiency and transparency within hedge fund management.

Challenge

Working as a Hedge Fund Operational Due Diligence Analyst likely involves navigating complex regulatory environments and ensuring compliance amid constantly evolving industry standards. The challenge may arise from the necessity to thoroughly assess operational risks, verify data accuracy, and detect potential red flags that could impact investment viability. This role probably demands strong analytical skills and resilience to handle high-pressure situations effectively.

Career Advancement

Hedge fund operational due diligence analysts play a critical role in evaluating the risks and operational integrity of investment firms, providing a foundation for robust risk management processes. Career advancement typically involves progressing to senior analyst roles, portfolio management, or compliance leadership positions, leveraging expertise in risk assessment, regulatory frameworks, and financial operations. Mastery of data analytics, regulatory knowledge, and strong communication skills accelerates professional growth within hedge fund operations and investment risk management sectors.

Key Terms

NAV Reconciliation

A Hedge Fund Operational Due Diligence Analyst specializing in NAV Reconciliation plays a critical role in verifying the accuracy and integrity of Net Asset Value calculations, ensuring alignment with fund accounting and custodian records. This position involves detailed analysis of cash flows, trade data, and valuation methodologies to detect discrepancies and mitigate operational risks. Proficiency in financial systems, regulatory requirements, and thorough collateral review ensures reliable NAV reporting essential for investor confidence.

Counterparty Risk Assessment

Hedge fund operational due diligence analysts specializing in counterparty risk assessment evaluate the financial stability, reputation, and operational controls of counterparties to mitigate potential losses. They conduct comprehensive reviews of trading partners, including custodians, brokers, and prime brokers, ensuring compliance with regulatory standards and risk management frameworks. By identifying vulnerabilities in counterparties' creditworthiness and operational processes, analysts support informed investment decisions and safeguard fund assets.

Fund Administrator Oversight

Hedge fund operational due diligence analysts specialize in evaluating fund administrator oversight to ensure accuracy, compliance, and risk management within hedge funds. They assess the administrator's capabilities in trade processing, NAV calculation, and regulatory reporting to verify operational robustness and adherence to industry standards. Rigorous scrutiny of fund administrators helps mitigate potential operational risks and supports investor confidence in fund governance.

Internal Controls Evaluation

Hedge fund operational due diligence analysts specialize in evaluating internal controls to identify operational risks and ensure compliance with regulatory standards. They conduct thorough reviews of a fund's policies, procedures, and systems to detect weaknesses that could impact financial integrity or investor protection. Their expertise in analyzing controls around trade execution, valuation, and risk management supports informed investment decisions and minimizes operational failures.

Anti-Money Laundering (AML) Compliance

A Hedge Fund Operational Due Diligence Analyst specializing in Anti-Money Laundering (AML) Compliance rigorously evaluates fund managers' adherence to AML policies and regulatory frameworks such as the Bank Secrecy Act (BSA) and the USA PATRIOT Act. Key responsibilities include analyzing transaction monitoring systems, assessing Know Your Customer (KYC) processes, and identifying potential risks related to money laundering, terrorist financing, and fraudulent activities. Expertise in conducting detailed audits, reviewing suspicious activity reports (SARs), and ensuring alignment with Financial Action Task Force (FATF) recommendations is crucial for mitigating operational and reputational risks.

kuljobs.com

kuljobs.com