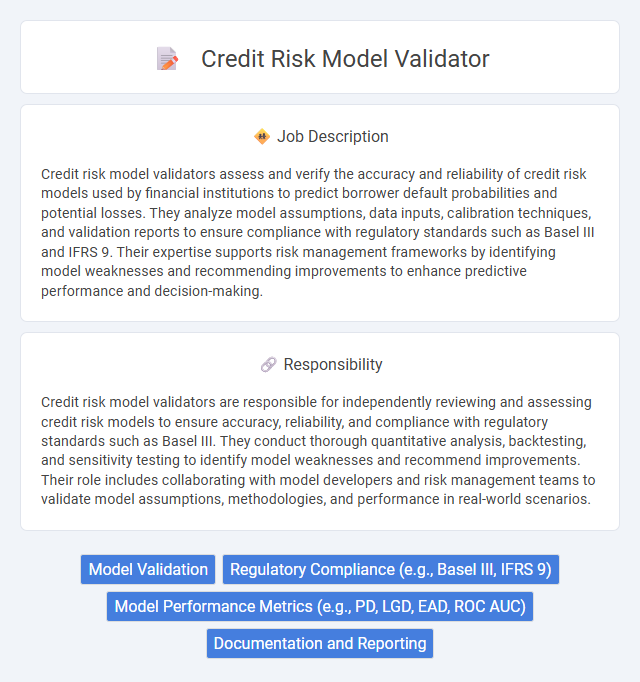

Credit risk model validators assess and verify the accuracy and reliability of credit risk models used by financial institutions to predict borrower default probabilities and potential losses. They analyze model assumptions, data inputs, calibration techniques, and validation reports to ensure compliance with regulatory standards such as Basel III and IFRS 9. Their expertise supports risk management frameworks by identifying model weaknesses and recommending improvements to enhance predictive performance and decision-making.

Candidates with strong analytical skills and attention to detail are likely suitable for a credit risk model validator role, as the job requires rigorous evaluation of financial models. Individuals comfortable with statistical techniques and regulatory frameworks probably adapt well to the responsibilities of identifying model weaknesses and ensuring compliance. Those lacking quantitative expertise or interest in financial risk assessment may find this position challenging.

Qualification

A Credit Risk Model Validator must possess a strong background in quantitative finance, statistics, or econometrics, typically requiring a bachelor's or master's degree in a relevant field such as mathematics, finance, or economics. Proficiency in statistical software like SAS, R, or Python, along with hands-on experience in model validation, credit risk assessment, and regulatory frameworks such as Basel III, is essential. Strong analytical skills, attention to detail, and understanding of credit risk models, including PD, LGD, and EAD calculations, are critical qualifications for this role.

Responsibility

Credit risk model validators are responsible for independently reviewing and assessing credit risk models to ensure accuracy, reliability, and compliance with regulatory standards such as Basel III. They conduct thorough quantitative analysis, backtesting, and sensitivity testing to identify model weaknesses and recommend improvements. Their role includes collaborating with model developers and risk management teams to validate model assumptions, methodologies, and performance in real-world scenarios.

Benefit

A Credit Risk Model Validator role likely offers significant benefits such as enhancing expertise in quantitative analysis and risk management, which can improve career prospects within financial institutions. There is a probable opportunity to work with advanced modeling techniques and regulatory frameworks, providing valuable experience in ensuring model accuracy and compliance. This position may also offer exposure to cross-functional teams, increasing professional networking and strategic decision-making skills.

Challenge

Credit risk model validator roles likely involve the challenge of rigorously assessing complex financial models to ensure their accuracy and reliability under various economic scenarios. They probably face difficulties in interpreting vast datasets and identifying potential model biases or errors that could lead to significant financial losses. Ensuring compliance with evolving regulatory standards may also present ongoing challenges in maintaining model integrity.

Career Advancement

Credit risk model validators play a crucial role in ensuring the accuracy and reliability of credit risk assessment tools used by financial institutions. Mastery in regulatory frameworks like Basel III and proficiency in statistical software such as SAS and Python pave the way for promotions to senior validation roles or risk management leadership positions. Developing expertise in stress testing and model governance significantly enhances career growth opportunities within banking and financial services sectors.

Key Terms

Model Validation

Credit risk model validators rigorously assess the accuracy and reliability of credit risk models used in financial institutions to predict borrower default probabilities and losses. Their work involves verifying model assumptions, backtesting outcomes against historical data, and ensuring compliance with regulatory standards such as Basel III and CECL. Effective model validation mitigates financial risk and supports robust decision-making in credit risk management.

Regulatory Compliance (e.g., Basel III, IFRS 9)

Credit risk model validators ensure that credit risk models comply with key regulatory frameworks such as Basel III and IFRS 9, which mandate rigorous standards for model accuracy, validation, and transparency. They assess model inputs, methodologies, and outputs to verify adherence to regulatory guidelines, mitigating risks of undercapitalization and improving financial institutions' resilience. Expertise in stress testing, Probability of Default (PD), Loss Given Default (LGD), and Exposure at Default (EAD) metrics is essential for aligning credit risk models with evolving compliance requirements.

Model Performance Metrics (e.g., PD, LGD, EAD, ROC AUC)

Credit risk model validators rigorously assess model performance metrics such as Probability of Default (PD), Loss Given Default (LGD), Exposure at Default (EAD), and Receiver Operating Characteristic Area Under Curve (ROC AUC) to ensure predictive accuracy and regulatory compliance. They analyze model outputs against historical data and benchmark standards to identify biases, instability, or overfitting, thereby safeguarding the institution's risk management framework. Expertise in advanced statistical techniques and regulatory guidelines is critical for validating the robustness and reliability of credit risk models.

Documentation and Reporting

Credit risk model validators meticulously document model assumptions, data inputs, and validation methodologies to ensure transparency and regulatory compliance. They produce comprehensive reports detailing model performance, limitations, and risk exposures, facilitating risk management decisions. Accurate and thorough documentation supports audit trails and aligns with Basel III and SR 11-7 supervisory guidelines.

kuljobs.com

kuljobs.com