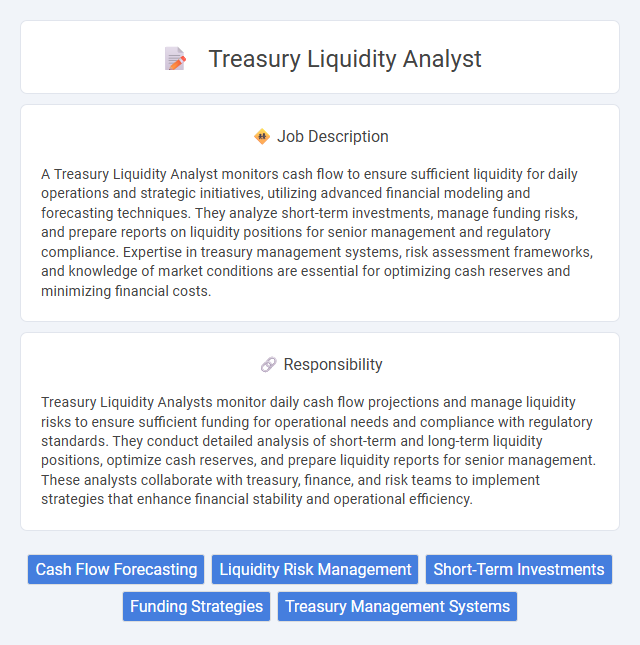

A Treasury Liquidity Analyst monitors cash flow to ensure sufficient liquidity for daily operations and strategic initiatives, utilizing advanced financial modeling and forecasting techniques. They analyze short-term investments, manage funding risks, and prepare reports on liquidity positions for senior management and regulatory compliance. Expertise in treasury management systems, risk assessment frameworks, and knowledge of market conditions are essential for optimizing cash reserves and minimizing financial costs.

Individuals with strong analytical skills, attention to detail, and an aptitude for financial data interpretation will likely find the Treasury Liquidity Analyst role suitable. Those who thrive in fast-paced environments and are comfortable making decisions based on market conditions and cash flow forecasts may be well-suited. However, candidates who struggle with complex financial models or have difficulty managing time-sensitive information might face challenges in this position.

Qualification

A Treasury Liquidity Analyst requires strong proficiency in financial modeling, cash flow analysis, and liquidity risk management to ensure optimal capital allocation and funding strategies. Expertise in treasury systems, banking relationships, and regulatory compliance, such as Basel III and liquidity coverage ratio (LCR), is essential to accurately forecast liquidity positions and stress scenarios. Advanced Excel skills, attention to detail, and experience with ERP systems like SAP Treasury or Kyriba strengthen the ability to monitor daily cash levels and support strategic decision-making.

Responsibility

Treasury Liquidity Analysts monitor daily cash flow projections and manage liquidity risks to ensure sufficient funding for operational needs and compliance with regulatory standards. They conduct detailed analysis of short-term and long-term liquidity positions, optimize cash reserves, and prepare liquidity reports for senior management. These analysts collaborate with treasury, finance, and risk teams to implement strategies that enhance financial stability and operational efficiency.

Benefit

A Treasury Liquidity Analyst role likely offers significant benefits such as competitive compensation packages and opportunities for professional growth within the financial sector. Employees may gain valuable experience working with cash flow forecasting, risk management, and liquidity strategies, enhancing their marketability. Access to advanced financial tools and collaboration with cross-functional teams could further contribute to skill development and career advancement.

Challenge

A Treasury Liquidity Analyst likely faces the challenge of accurately forecasting cash flows under uncertain market conditions, which requires robust analytical skills and attention to detail. Managing liquidity risk probably involves balancing short-term obligations with long-term financial strategies to ensure the organization maintains adequate funds. The role may also demand quick decision-making to respond effectively to sudden changes in market liquidity or unexpected cash demands.

Career Advancement

A Treasury Liquidity Analyst plays a crucial role in managing a company's cash flow and ensuring sufficient liquidity to meet financial obligations, which positions them for advancement into senior treasury or finance roles. Mastery of liquidity risk assessment, cash forecasting, and regulatory compliance enhances career prospects, opening pathways to Treasury Manager, Risk Analyst, or Corporate Finance Director positions. Continuous skill development in financial modeling, SAP Treasury, and strategic decision-making accelerates upward mobility in the competitive financial sector.

Key Terms

Cash Flow Forecasting

A Treasury Liquidity Analyst specializes in cash flow forecasting to ensure optimal liquidity management and financial stability. They analyze historical cash data, market trends, and upcoming financial obligations to predict short-term and long-term cash requirements accurately. Their forecasts enable businesses to maintain sufficient liquidity, minimize borrowing costs, and optimize investment opportunities.

Liquidity Risk Management

A Treasury Liquidity Analyst specializes in monitoring and managing liquidity risk to ensure an organization maintains adequate cash flow for operational and strategic needs. Key responsibilities include analyzing cash positions, forecasting liquidity requirements, and developing risk mitigation strategies to minimize the impact of market fluctuations. Proficiency in financial modeling, regulatory compliance, and real-time data analysis is critical for optimizing liquidity risk management.

Short-Term Investments

A Treasury Liquidity Analyst specializing in short-term investments monitors and manages cash flows to ensure optimal liquidity while maximizing returns. They analyze market trends, evaluate investment options such as money market funds, commercial paper, and Treasury bills, and align portfolios with the company's risk tolerance and cash flow needs. Expertise in liquidity forecasting and adherence to regulatory requirements enables effective short-term asset allocation and risk mitigation.

Funding Strategies

A Treasury Liquidity Analyst develops and implements funding strategies to ensure optimal cash flow management and liquidity reserves. This role involves analyzing market trends, assessing funding sources, and optimizing short-term borrowing to minimize costs and risks. Effective funding strategies directly support the organization's financial stability and regulatory compliance.

Treasury Management Systems

A Treasury Liquidity Analyst specializes in managing cash flow and optimizing liquidity through advanced Treasury Management Systems (TMS) such as Kyriba, GTreasury, and SAP Treasury. They leverage real-time data analytics, cash forecasting models, and automated workflows to enhance financial decision-making and ensure regulatory compliance. Expertise in integrating TMS with ERP platforms streamlines end-to-end treasury operations, improving accuracy and operational efficiency.

kuljobs.com

kuljobs.com