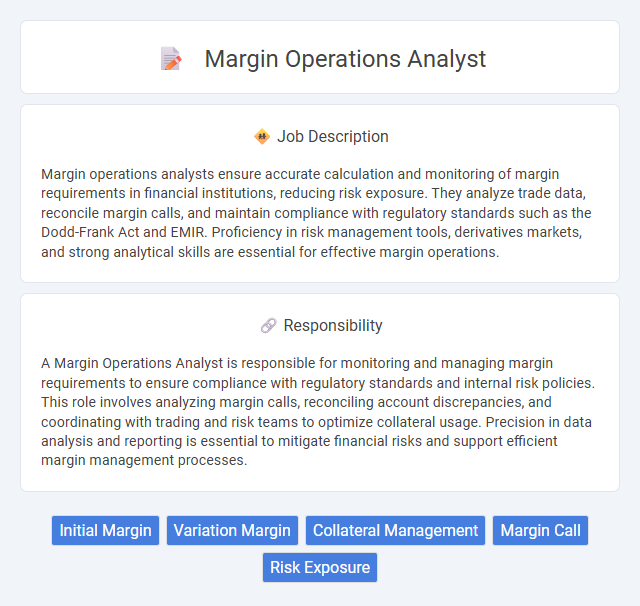

Margin operations analysts ensure accurate calculation and monitoring of margin requirements in financial institutions, reducing risk exposure. They analyze trade data, reconcile margin calls, and maintain compliance with regulatory standards such as the Dodd-Frank Act and EMIR. Proficiency in risk management tools, derivatives markets, and strong analytical skills are essential for effective margin operations.

Individuals with strong analytical skills and a detail-oriented mindset are likely to be suitable for a Margin Operations Analyst role, as the job involves assessing financial risks and ensuring compliance with margin requirements. People who thrive in fast-paced environments and possess excellent communication abilities probably adapt well to the demands of coordinating between trading desks, risk management, and regulatory teams. Candidates who struggle with multitasking or have limited exposure to financial markets might find the responsibilities challenging or less fitting for their skill set.

Qualification

A Margin Operations Analyst must possess strong analytical skills, expertise in financial regulations, and proficiency in risk assessment tools. Experience with margin calculations, trade settlement processes, and exposure monitoring is essential. Advanced knowledge of financial software such as Bloomberg, Excel VBA, and SQL enhances operational efficiency and accuracy.

Responsibility

A Margin Operations Analyst is responsible for monitoring and managing margin requirements to ensure compliance with regulatory standards and internal risk policies. This role involves analyzing margin calls, reconciling account discrepancies, and coordinating with trading and risk teams to optimize collateral usage. Precision in data analysis and reporting is essential to mitigate financial risks and support efficient margin management processes.

Benefit

Margin operations analyst roles likely offer benefits such as enhanced analytical skills and a deeper understanding of risk management processes. Professionals in this position may gain exposure to financial regulations and operational efficiency improvements. Career advancement opportunities might increase due to their critical involvement in maintaining accurate margin calculations.

Challenge

Margin operations analyst roles likely involve navigating complex regulatory environments and ensuring accurate margin calculations under tight deadlines, which may present a significant challenge. Handling large volumes of data and coordinating with multiple departments probably requires strong analytical skills and precise communication. The need to adapt quickly to changing market conditions could also contribute to the demanding nature of this job.

Career Advancement

Margin Operations Analysts play a critical role in monitoring and managing collateral requirements to mitigate financial risks in trading activities. Mastery in margin calculations, regulatory compliance, and exposure analysis positions professionals for advancement into risk management, compliance oversight, or financial control leadership roles. Gaining expertise in advanced risk models, automation tools, and cross-functional collaboration accelerates career growth within investment banks and asset management firms.

Key Terms

Initial Margin

A Margin Operations Analyst specializing in Initial Margin is responsible for calculating and verifying initial margin requirements to mitigate counterparty credit risk in derivative transactions. This role involves monitoring margin calls, reconciling margin accounts, and ensuring compliance with regulatory frameworks such as EMIR, Dodd-Frank, and SIMM methodologies. Expertise in risk management systems and strong analytical skills are essential to optimize collateral efficiency and support trade lifecycle management.

Variation Margin

Margin operations analysts play a critical role in managing Variation Margin processes to ensure accurate daily calculations and timely collateral transfers within trading accounts. They monitor market fluctuations, reconcile margin calls, and collaborate with risk management teams to mitigate counterparty credit risk. Proficiency in regulatory frameworks such as EMIR and Dodd-Frank, along with advanced analytical tools, enhances their ability to optimize margin requirements and maintain compliance.

Collateral Management

Margin operations analysts specialize in collateral management by monitoring, verifying, and optimizing margin requirements to minimize financial risk and ensure compliance with regulatory standards. They manage daily margin calls, reconcile collateral portfolios, and analyze risk exposures to support trading activities and maintain liquidity. Proficiency in risk management tools, regulatory frameworks such as EMIR and Dodd-Frank, and strong analytical skills are essential for effective margin operations analysis.

Margin Call

A Margin Operations Analyst manages and monitors margin calls to ensure compliance with regulatory requirements and internal risk policies. They analyze client portfolios to assess margin deficiencies and coordinate timely notifications, facilitating prompt collateral adjustments. Expertise in margin rules, risk assessment, and financial instruments is crucial for minimizing exposure and maintaining market stability.

Risk Exposure

Margin Operations Analysts specialize in monitoring and managing risk exposure associated with client margin accounts to ensure compliance with regulatory requirements and firm policies. They analyze margin calls, evaluate collateral adequacy, and identify potential threats to financial stability by assessing credit risk and market volatility. Proficiency in risk management software and strong quantitative skills enable them to minimize financial loss and enhance operational efficiency in dynamic trading environments.

kuljobs.com

kuljobs.com