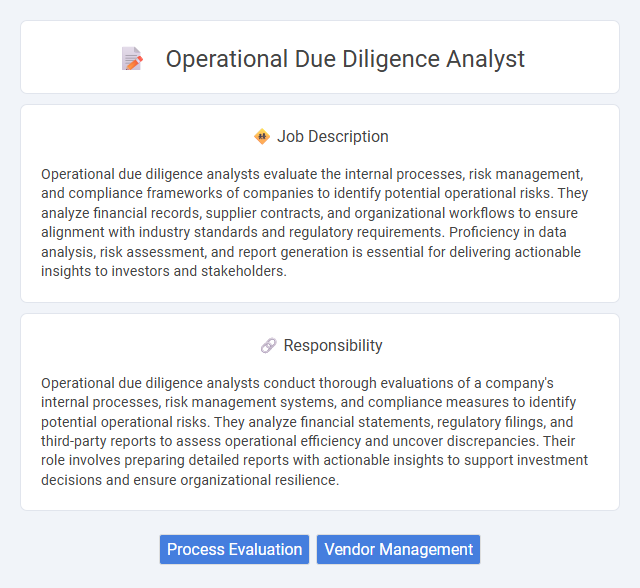

Operational due diligence analysts evaluate the internal processes, risk management, and compliance frameworks of companies to identify potential operational risks. They analyze financial records, supplier contracts, and organizational workflows to ensure alignment with industry standards and regulatory requirements. Proficiency in data analysis, risk assessment, and report generation is essential for delivering actionable insights to investors and stakeholders.

Candidates with strong analytical skills and attention to detail are likely to thrive in an operational due diligence analyst role, as they must scrutinize complex data and identify potential risks. Individuals who demonstrate resilience and effective communication could be more suitable, given the need to interact with various stakeholders and manage high-pressure situations. Those lacking curiosity or the capacity to work independently may find the demands of this position challenging to meet.

Qualification

An Operational Due Diligence Analyst requires strong analytical skills, financial acumen, and expertise in risk assessment to evaluate operational processes and identify potential vulnerabilities in target companies. Proficiency in data analysis tools, knowledge of regulatory compliance, and effective communication skills are essential for presenting findings clearly to stakeholders. A bachelor's degree in finance, business, or related fields, often supplemented by certifications like CFA or CISA, enhances qualifications for this role.

Responsibility

Operational due diligence analysts conduct thorough evaluations of a company's internal processes, risk management systems, and compliance measures to identify potential operational risks. They analyze financial statements, regulatory filings, and third-party reports to assess operational efficiency and uncover discrepancies. Their role involves preparing detailed reports with actionable insights to support investment decisions and ensure organizational resilience.

Benefit

Operational due diligence analysts likely provide crucial insights that help organizations identify potential risks and operational inefficiencies before making investment decisions. Their work probably increases the probability of successful transactions by offering detailed evaluations of operational processes, management quality, and compliance adherence. Companies may benefit from reduced financial exposure and improved strategic planning as a result of their thorough analysis.

Challenge

Operational due diligence analysts likely face the challenge of thoroughly assessing operational risks and inefficiencies within target companies, which can be complex due to incomplete or inconsistent data. They probably encounter difficulties in balancing the need for detailed analysis with tight deadlines, requiring strong prioritization skills. This role may also demand adaptability to rapidly changing business environments and regulatory requirements, increasing the complexity of their evaluations.

Career Advancement

Operational due diligence analysts gain expertise in evaluating business processes, risk management, and compliance, positioning themselves for roles such as risk managers, compliance officers, or investment analysts. Mastery of financial analysis tools, regulatory frameworks, and stakeholder communication enhances career trajectories within private equity, asset management, and consulting firms. Continuous skill development and industry certifications like CFA or CPA significantly increase promotion opportunities and salary growth in this competitive field.

Key Terms

Process Evaluation

An Operational Due Diligence Analyst specializes in process evaluation by systematically assessing internal workflows, risk management procedures, and compliance frameworks to identify operational inefficiencies and potential vulnerabilities. They utilize quantitative data analysis and industry benchmarks to ensure that operational practices align with regulatory standards and investment objectives. Expertise in process evaluation enables these analysts to provide actionable insights that enhance organizational resilience and decision-making accuracy during mergers, acquisitions, or fund investments.

Vendor Management

An Operational Due Diligence Analyst specializing in Vendor Management evaluates third-party suppliers to assess risks related to compliance, performance, and financial stability. They conduct thorough audits, analyze contractual agreements, and monitor vendor compliance to ensure alignment with organizational standards and regulatory requirements. Their role is critical in mitigating operational risks and optimizing vendor relationships to enhance supply chain reliability and cost efficiency.

kuljobs.com

kuljobs.com